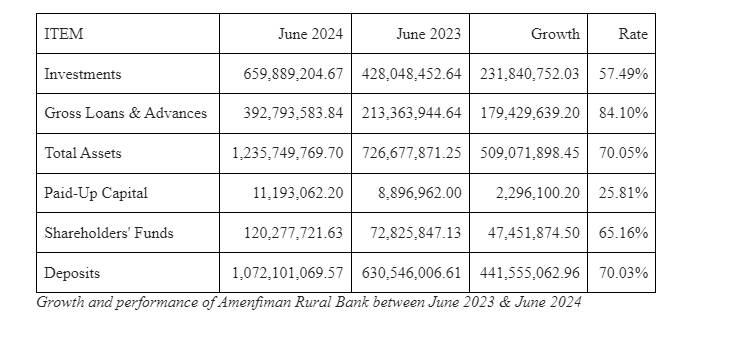

Amenfiman Rural Bank PLC has recorded a total deposit of a little over GH₵1 billion as at the end June 2024.

This represents an impressive growth of 70.03% from the same period in June 2023, from approximately GH₵631 million to a little over GH₵1 billion in June 2024.

Amenfiman Rural Bank as a financial institution recognizes the importance of deposits in growing its books. Basically, fuelled by deposits and shareholders’ funds, the Bank is able to grow its investments, loans, and liquidity which is required to serve clients on a daily basis.

With the growth of investments and loans, the Bank is able to generate income to operate, return to its shareholders, and shore up as retained earnings. In effect, the Bank’s income generating potential is expected to be increased significantly which would influence the Return on Equity and Return on Asset indicators.

The CEO of the Bank, Dr Alex Asmah, told Luv Fm, this achievement is the highest so far recorded in the history of rural banking in Ghana.

According to him, Amenfiman Rural Bank PLC for the last ten years has had a mission to drive financial inclusion in its communities, serving the unbanked and the underbanked population of the market with emphasis on MSME by giving them easy, convenient and cost-effective access to financial products using the appropriate technology and quality staff while creating value for shareholders.

This mission, he emphasised, fed a vision to consolidate and sustain the Bank’s leadership in rural banking in Ghana and to become a point of reference in the industry as well as aspiring to be the most tech savvy and customer-friendly rural bank in Ghana.

With the Board and Management of the Bank drawing references from this vision and mission, the Bank goes the extra mile to ensure that customer needs are met, ensure competitive rates on deposit and loan products with products tailored to meet the needs of customers as well as research and development of existing products and services.

Competitive Strategy

Other areas of competitive strategy adopted by the Board to realise the bank’s mission is collaborating and partnering with other financial service providers, convenience and improved accessibility to the Bank’s products and services and deployment of none traditional banking services such as Bancassurance, Asset-financing among others.

In the last 4 years of the Bank’s operations, the Amenfiman Rural Bank has deployed a network of ATMs to offer 24/7 access to cash by its clients and the general public via the GH-Link switch. The drive to improve customer convenience has continued with the deployment of the GhanaPay service, USSD mobile banking service and the mobile susu service.

The Bank has also deployed multiple life and general insurance products to its clients which has thus far been very beneficial to multiple people and businesses within its catchment.

The CEO, further emphasises that, leadership has been a key factor however in the face of this growth there has been multiple challenges from the macroeconomic front such as the financial sector clean up, the DDEP among other macroeconomic challenges.

In spite of all these challenges, the Board and Management of Amenfiman Rural Bank PLC work closely in ensuring that the Bank is positioned favourable to meet and excel in the midst of operational challenges.

By defying the odds to achieve these remarkable accomplishments, the leadership, especially the Chief Executive officer of the Bank has been recognized on multiple levels for his contribution to the business of the Bank and the industry as a whole.

Local authorities, businesses, regulators, and other stakeholders have also recognised the contributions of Amenfiman Rural Bank PLC and this has also expanded the reach of the Bank’s brand and loyalty.

Expanded financial support

From the Western to the Western North, Central, and Ashanti regions of the country, the brand is basically a house hold name when it comes to dependable and quality financial support services.

With its head office located at Wasa Akropong, in the Wasa Amenfi East Municipality in the Western Region, Amenfiman Rural Bank PLC’s strategy is fundamentally rooted in fostering deep customer loyalty, with an unwavering commitment to delivering unparalleled customer experiences at every interaction.

“Our remarkable growth stems from the unwavering support of our loyal clientele, who not only choose us repeatedly for their banking needs but also passionately share their positive experiences and advocate for our products to potential new clients. This approach is not just effective; it is enduring and consistently yields exceptional results,” Dr Asmah stressed.

He has also emphasised that the Bank continues to invest in its communities and the people, and such CSR activities has also uplifted the goodwill of people for the Bank.

Today, people within the Bank’s operational territories easily refer to Amenfiman Rural Bank as the benchmark for safe deposits, flexible loans, rewarding investments and other financial services such as insurance.

Empowering MSME Sector

Early this year, Amenfiman Rural Bank PLC launched a groundbreaking initiative to offer loans up to GH¢400,000 to micro and small businesses, without the usual stringent collateral requirements and at exceptionally low interest rates.

This bold move aligns seamlessly with the Bank’s vision to empower the MSME sector, driving growth and aiding the recovery of Ghana's national economy.

The CEO in his concluding remarks stated emphatically that the Board, Management and staff have been critical to the growth seen over the period and it is important that the level of quality, commitment and dedication is maintained into the future to ensure the Bank maintains its enviable position within the market.

Customers and their deposits according Dr Asmah would still remain as the life blood of the Bank and the Bank would continue to prioritize customer focus and service improvement in maintaining the trust and confidence of the Amenfiman brand.

The Rural banking industry has improved greatly over the last 10 years and it is envisioned that this would continue into the future, management of the Bank would continue to grow all areas of the business strategically to ensure that the Bank remains competitive and prosperous.

As the Bank has achieved a billion cedis in deposits, this would reflect directly on the volumes that the Bank would deploy towards supports for individuals, businesses and industry in Ghana.

Latest Stories

-

From classrooms to conservation: 280 students embrace sustainability at Joy FM/Safari Valley’s Second Eco Tour

9 mins -

Jordan Ayew’s late goal not enough as Leicester lose at home to Chelsea

17 mins -

Global Crimea Conference 2024: Participants reject Russian claims to Soviet legacy

20 mins -

Jospong Group, Uasin Gishu County sign MoU to boost sanitation services in Kenya

28 mins -

Thomas Partey stunner helps Arsenal overcome Nottingham Forest

40 mins -

Over half of cyber attacks in Ghana, rest of Africa target government and finance, says Positive Technologies

43 mins -

Academic City unveils plastic recycling machine to address plastic pollution

60 mins -

German-based Kanzlsperger makes medical donation to WAFA

3 hours -

It could take over 100 years for Ghana and other African countries to become ‘developed’ – Report

3 hours -

AEC 2024 renews momentum to lift Africa out of poverty despite global shocks

3 hours -

Can RFK Jr make America’s diet healthy again?

3 hours -

Maiden Women in Chemical Sciences conference opens with a call for empowerment

5 hours -

We’ll reclaim all Groupe Nduom stolen assets – Nduom declares

5 hours -

Center for Learning and Childhood Development Director Dr Kwame Sakyi honoured at Ghana Philanthropy Awards

14 hours -

Asantehene receives 28 looted artefacts

15 hours