Audio By Carbonatix

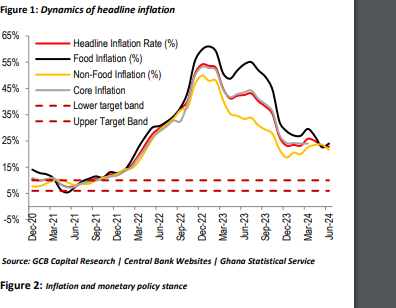

The near-term outlook of inflation is uncertain despite the disinflation trend, GCB Capital has disclosed.

It pointed out that while it expects the disinflation trend to continue in the second half of 2024, the inflation profile remains elevated.

“These prevailing upside pressures will continue to moderate the decline in inflation and we envisage possible reversals in the inflation trend in August and later in Q4 [quarter 4] 2024. While the cedi appears to have stabilized broadly against the major trading currencies following the raft of positive news since June, the lagged impact and the second-round effects of the prevailing inflationary pressures could linger, moderating the pace of disinflation”, it said.

“Accounting for the prevalent upside risks to inflation in the near term, our revised model shows that inflation could struggle to close sub-20% even if the exchange rate pressures remain muted in 2H2024 [second half 2024]. Potential election-related expenditure in the lead-up to the December 2024 general elections could also increase GHS [Ghana cedi] liquidity in the economy and fuel demand-side inflationary pressures if not adequately mopped up”, it added.

Inflation slowed down in June 2024 printing at 22.8%.

However, GCB Capital said it expects increased cedi liquidity in the system as the election pulse heats up in the second half of 2024, which could further fuel inflationary pressures.

Therefore, it maintains a remote possibility of a marginal rate cut in July 2024 but more firmly in the September 2024 and November 2024 policy windows.

It concluded expecting nominal interest rates to be sticky downwards on the outlook.

Latest Stories

-

Ghana is rising again – Mahama declares

4 hours -

Firefighters subdue blaze at Accra’s Tudu, officials warn of busy fire season ahead

5 hours -

New Year’s Luv FM Family Party in the park ends in grand style at Rattray park

5 hours -

Mahama targets digital schools, universal healthcare, and food self-sufficiency in 2026

5 hours -

Ghana’s global image boosted by our world-acclaimed reset agenda – Mahama

5 hours -

Full text: Mahama’s New Year message to the nation

5 hours -

The foundation is laid; now we accelerate and expand in 2026 – Mahama

6 hours -

There is no NPP, CPP nor NDC Ghana, only one Ghana – Mahama

6 hours -

Eduwatch praises education financing gains but warns delays, teacher gaps could derail reforms

6 hours -

Kusaal Wikimedians take local language online in 14-day digital campaign

7 hours -

Stop interfering in each other’s roles – Bole-Bamboi MP appeals to traditional rulers for peace

7 hours -

Playback: President Mahama addresses the nation in New Year message

8 hours -

Industrial and Commercial Workers’ Union call for strong work ethics, economic participation in 2026 new year message

10 hours -

Crossover Joy: Churches in Ghana welcome 2026 with fire and faith

10 hours -

Traffic chaos on Accra–Kumasi Highway leaves hundreds stranded as diversions gridlock

10 hours