Beyond The Numbers on JoyNews with Isaac Kofi Agyei & Winston Tackie

Approximately $12 billion in remittances to Ghana went untracked and unaccounted for by the Bank of Ghana and the Auditor General from 2018 to 2022.

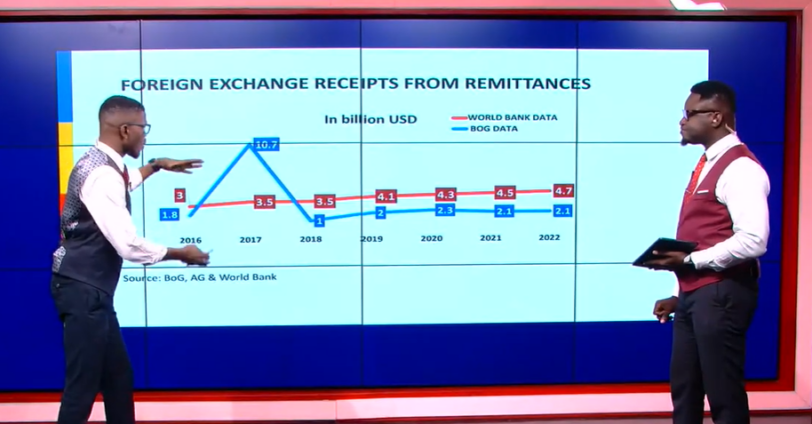

In the space of remittances, available data from the World Bank and the Bank of Ghana have contrasted each other. While the World Bank tracked a total of $21.1 billion as remittances inflow to Ghana from 2018 to 2022, the Auditor General’s reports on the Bank of Ghana’s consolidated statements of foreign exchange receipts and payments within the same period tracked and accounted for only $9.5 billion, leaving a gap of some $11.6 billion.

The Bank of Ghana's 2023 annual financial statement reveals that 11 licensed FinTech companies provided inward remittance services, with remittances totaling GH¢57 billion (US$5 billion) in 2023, up from GH¢18 billion (US$3 billion) in 2022.

Despite this, the Bank of Ghana failed to disclose the actual amounts received in their respective foreign currencies for both years, violating Accounting Standard 21 (IAS 21).

On top of this, the Bank of Ghana’s consolidated statements of foreign exchange receipts and payments report which is responsible for tracking, tracing and accounting for all forex inflows into Ghana has over the years failed to capture remittances held by payment platforms other than the 23 dealer banks.

In fact, existing regulatory frameworks have allowed for significant leakages, enabling payment platforms and some FinTech companies to illegally hold foreign exchange at the state's expense.

Watch this week's Beyond The Numbers with Isaac Kofi Agyei and Winston Tackie for more analysis:

The World Bank estimates that $4 billion worth of remittances flowed into Ghana's economy between 2016 and 2022. This makes forex inflows from remittances the highest compared to cocoa, oil and even gold if receipts are seasonalised to factor in the true amount surrendered.

To test the importance of remittance inflows to the Ghanaian economy, it is essential to consider the Bank of Ghana's statements in its 2023 audited report on inward remittances and their role in economic stability.

First, the bank disclosed that “in the foreign exchange market, the Ghana cedi remained relatively stable against the major trading currencies in 2023. This was due to improved inflows from the first tranche of the IMF ECF, the domestic gold purchase programme, remittances, and FX purchases from mining and oil companies, as well as tight monetary policy.”

Secondly, it stated that Ghana’s income account in 2023 “registered a lower deficit of US$2.08 billion in 2023, down by 53.8 per cent from US$4.51 billion in 2022. Current transfers, largely comprising private remittances, recorded a net inflow of US$3.93 billion in 2023, compared with US$3.57 billion net inflow in 2022.”

Finally, it dropped a bombshell that “in 2023, 11 licensed FinTech companies provided inward remittance service to customers. The total value of remittances received in 2023 was GH¢57 billion, compared to GH¢18 billion in 2022. The remittance space, over the years, has seen licensed FinTechs providing innovative solutions, hence the immense growth witnessed in the review year.”

The reason why this is a bombshell is that the Bank of Ghana failed to disclose the foreign exchange equivalent of these remittances as required by the International Accounting Standard 21 (IAS 21), which outlines how to account for foreign currency transactions and operations in financial statements, and also how to translate financial statements into a presentation currency.

Over the past eight years, available data from the World Bank and the Bank of Ghana have contrasted each other. While the World Bank recorded a total of $27.6 billion as remittances inflow to Ghana from 2016 to 2022, the Auditor General’s reports on the Bank of Ghana’s consolidated statements of foreign exchange receipts and payments within the same period accounted for only $22 billion, leaving a gap of some $5.6 billion. The key question is where did these inflows from remittances go?

Now, with the central bank’s latest admission that FinTechs in 2023 facilitated remittances amounting to GH¢57 billion, compared to GH¢18 billion in 2022, we ask if the previous gap in reporting between the Bank of Ghana and World Bank could be attributed to remittance inflows passing through FinTech and other platforms rather than the 23 dealer banks. This consideration is especially pertinent given that this is the first time within the period under review that the Bank of Ghana is reporting on remittance inflows in its annual audited reports.

Latest Stories

-

I want to focus more on my education – Chidimma Adetshina quits pageantry

1 hour -

Priest replaced after Sabrina Carpenter shoots music video in his church

1 hour -

Duct-taped banana artwork sells for $6.2m in NYC

1 hour -

Arrest warrants issued for Netanyahu, Gallant and Hamas commander over alleged war crimes

1 hour -

Actors Jonathan Majors and Meagan Good are engaged

2 hours -

Expired rice saga: A ‘best before date’ can be extended – Food and Agriculture Engineer

2 hours -

Why I rejected Range Rover gift from a man – Tiwa Savage

2 hours -

KNUST Engineering College honours Telecel Ghana CEO at Alumni Excellence Awards

2 hours -

Postecoglou backs Bentancur appeal after ‘mistake’

2 hours -

#Manifesto debate: NDC to enact and pass National Climate Law – Prof Klutse

3 hours -

‘Everything a manager could wish for’ – Guardiola signs new deal

3 hours -

TEWU suspends strike after NLC directive, urges swift resolution of grievances

3 hours -

Netflix debuts Grain Media’s explosive film

3 hours -

‘Expired’ rice scandal: FDA is complicit; top officials must be fired – Ablakwa

4 hours -

#TheManifestoDebate: We’ll provide potable water, expand water distribution network – NDC

4 hours