Ghana has secured a US$103 million need-based funding from the African Development Bank (AfDB) to support Small and Medium Enterprises (SMEs), with a focus on agriculture and digitalisation.

The grant, provided by the Bank’s concessional funding body – African Development Fund, would support the implementation of projects as well as the skills development of beneficiary SMEs.

The government and the Bank, have since signed the Indicative Operations Programme, detailing projects to be implemented between 2024 and 2025.

Additionally, the two signed a five-year country strategy document for 2024 and 2029, specifying the sectors and projects that would be supported by the Bank.

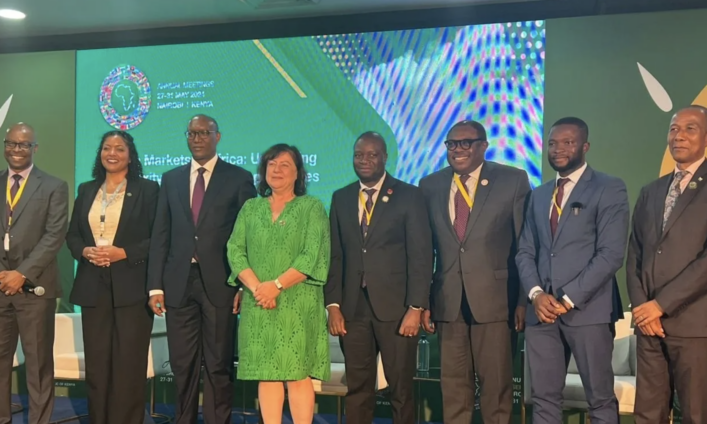

Dr Mohammed Amin Adam, Finance Minister, signed for the government, while Ms Eyerusalem Fasika, Country Manager, AfDB, signed on behalf of the Bank.

This occurred at a short ceremony on the margins of the Bank’s 2024 Annual Meetings in Nairobi, Kenya.

The Minister pledged the government’s commitment to ensure a rigorous monitoring and supervision of projects under the pact for optimal utilisation of the funds through monthly reviews of all project disbursements.

That, Dr Amin Adam, said was to identify and resolve execution challenges promptly, as well as persistent delays in fund disbursement, which sometimes characterised project implementations.

The Minister added that such measure was to properly blend value for money and the government’s oversight responsibilities to avoid any inefficiencies in project implementation.

He expressed appreciation to the AfDB for their continued support to the growth of African countries, including Ghana.

Ms Fasika, AfDB Country Manager, said the pact reflected the people’s aspirations as well as insights of experts to make the interventions well-aligned with Ghana’s development priorities.

She noted that the strategy was developed through extensive consultations with a diverse range of stakeholders, saying, “we aimed for an inclusive and comprehensive strategy.”

They included Civil Society Organizations (CSOs), Ministries, Departments and Agencies (MDAs), the National Development Planning Commission (NDPC), and private sector representatives.

She also said the Bank would be mobilising resources from various sources, to support Ghana’s climate action, citing the construction of some 20 mini grids for the country as an example.

Ghana signed the financing agreement of the 20 mini grid projects two years ago, with the African Development Fund, and the government of Switzerland, which has seen a bidding process for US$28.49 million as of September 2023.

“We’re also looking at cross-cutting areas systematically to mainstream all operations that will be undertaking,” the AfDB Ghana Country Manager said.

“This will be economic and financial governance, climate change and green growth, environmental and social safeguard issues, gender equality, and fragility and resilience consideration, and digitalisation,” Ms Fasika, said.

She noted that those initiatives were aligned with the country’s 40-year national development plan, which aims at building an industrialised, inclusive, and resilient economy to create an equitable, healthy and disciplined society.

They were also aligned with AfBD’s high-five priorities and new 10-year strategy (2024-2033), Sustainable Development Goals (SDGs), and the African Union (AU) Agenda 2063.

Ms Fasika concluded by reiterating the Bank’s continued support to the country, particularly in addressing the country’s economic recovery and development issues.

Latest Stories

-

CSIR Executive Director urges farmers to adopt technology for improved farming

3 mins -

Football Impact Africa’s Ghetto Love Initiative inspires change in Teshie

14 mins -

Peter Toobu calls for tighter border security over uncovered weapons at Tema Port

16 mins -

Gov’t has failed its commitment to IPPs – Ablakwa

20 mins -

Sell Chrome to end search monopoly, Google told

32 mins -

KATH to install seven new dialysis machines by end of November

35 mins -

Walewale: Police confiscate 37 bags of cocoa beans suspected of being smuggled out of Ghana

46 mins -

‘Expired’ Rice Scandal: FDA confirms rice was safe for consumption after rigorous lab tests

52 mins -

Many women have experienced intimate partner violence – Angela Dwamena Aboagye

1 hour -

Power challenges persist due to government’s mismanagement of revenues – Okudzeto Ablakwa

2 hours -

Jordan Ayew injury not as bad as feared – Leicester City boss

2 hours -

Stonebwoy heads to North America for UP & RUNNIN6 tour

2 hours -

FDA explains extension of best-before date for ‘expired’ rice

2 hours -

Rebecca Akufo-Addo, Mahama storm Akuapem North as NPP NDC slugs it out

2 hours -

Fatawu’s injury a big blow for us – Leicester City manager

2 hours