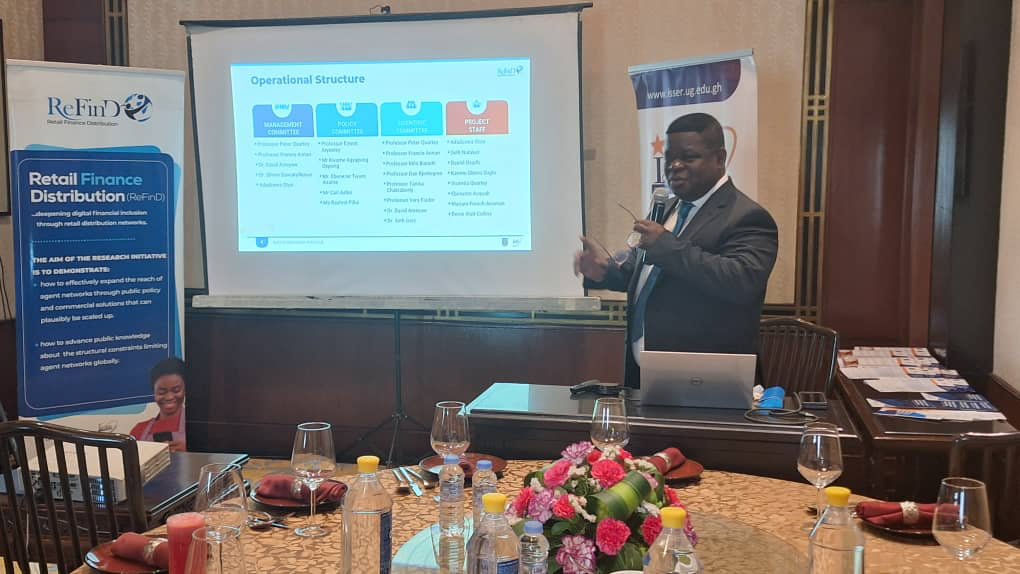

The Retail Finance Distribution (ReFinD) Research Initiative, a program dedicated to improving access to digital financial services in low and middle-income countries, has made significant strides in its efforts to foster financial inclusion.

Funded by the Bill & Melinda Gates Foundation and hosted under the Institute of Statistical Social and Economic Research (ISSER) at the University of Ghana, the initiative has awarded grants to 17 institutions to undertake research and provide commercial solutions that aim to improve access to digital financial services.

Through its rigorous selection process, ReFinD has identified and supported a diverse range of research projects and commercial solutions aimed at expanding agent banking networks and enhancing the reach of digital financial services.

The funded projects encompass a variety of approaches, including proposal development, pilot studies, natural experiments, extensions of ongoing research, and large-scale greenfield evaluations.

The geographic distribution of the funded projects reflects ReFinD's commitment to addressing financial inclusion challenges across different regions.

Of the 17 funded institutions, 76% are undertaking projects in Sub-Saharan Africa, 18% in South Asia, and 6% in Southeast Asia.

Specific countries where these projects will be undertaken include Ghana, Indonesia, Bangladesh, Kenya, Uganda, Nigeria, Sierra Leone, and India.

Notably, the lead researchers and institutions behind these projects represent a diverse array of backgrounds and locations.

While 57% of the lead researchers' institutions are based in Sub-Saharan Africa, others hail from the USA (27%), Europe (12%), Southeast Asia (3%), and Australia (2%).

This global collaboration fosters cross-pollination of ideas and expertise, ultimately enhancing the potential for impactful solutions.

Furthermore, ReFinD has placed a strong emphasis on promoting gender diversity among its lead researchers.

Out of the total 69 researchers involved in the funded projects, 35% are female, reflecting the initiative's commitment to empowering marginalised communities, including women, through improved access to financial services.

The funded institutions will receive grants ranging from $5,000 for proposal development to $450,000 for large-scale greenfield evaluations.

These projects will tackle various aspects of expanding agent banking networks, such as understanding the impact of supply-side interventions, assessing the effects of competition and policy interventions, and addressing constraints to network expansion.

By supporting cutting-edge research and fostering collaborations between academia, policymakers, and commercial providers, ReFinD aims to drive evidence-based solutions that can be scaled to enhance financial inclusion in underserved regions.

As the initiative progresses, stakeholders eagerly anticipate the insights and innovations that will emerge from these 17 funded institutions, ultimately contributing to the broader mission of promoting sustainable economic development through increased access to digital financial services.

Latest Stories

-

Amazon faces US strike threat ahead of Christmas

9 minutes -

Jaguar Land Rover electric car whistleblower sacked

16 minutes -

US makes third interest rate cut despite inflation risk

21 minutes -

Fish processors call for intervention against illegal trawling activities

34 minutes -

Ghana will take time to recover – Akorfa Edjeani

1 hour -

Boakye Agyarko urges reforms to revitalise NPP after election defeat

1 hour -

Finance Minister skips mini-budget presentation for third time

1 hour -

‘ORAL’ team to work gratis – Ablakwa

2 hours -

Affirmative Action Coalition condemns lack of gender quotas in Transition, anti-corruption teams

2 hours -

December 7 election was a battle for the ‘soul of Ghana’ against NPP – Fifi Kwetey

2 hours -

Social media buzzing ahead of Black Sherif’s ‘Zaama Disco’ on December 21

2 hours -

Afenyo-Markin still suffering from the massive defeat – Fifi Kwetey

2 hours -

Retain Afenyo-Markin as NPP leader, he has experience – Deputy Speaker

2 hours -

Kufuor didn’t leave behind a strong economy – Fifi Kwetey

2 hours -

It won’t be business as usual, remain humble – Fifi Kwetey to party members

3 hours