The founder and leader of the Movement for Change, Alan Kyerematen, assured the Ghana Union of Traders Associations (GUTA) that he would eliminate several import taxes if elected into office.

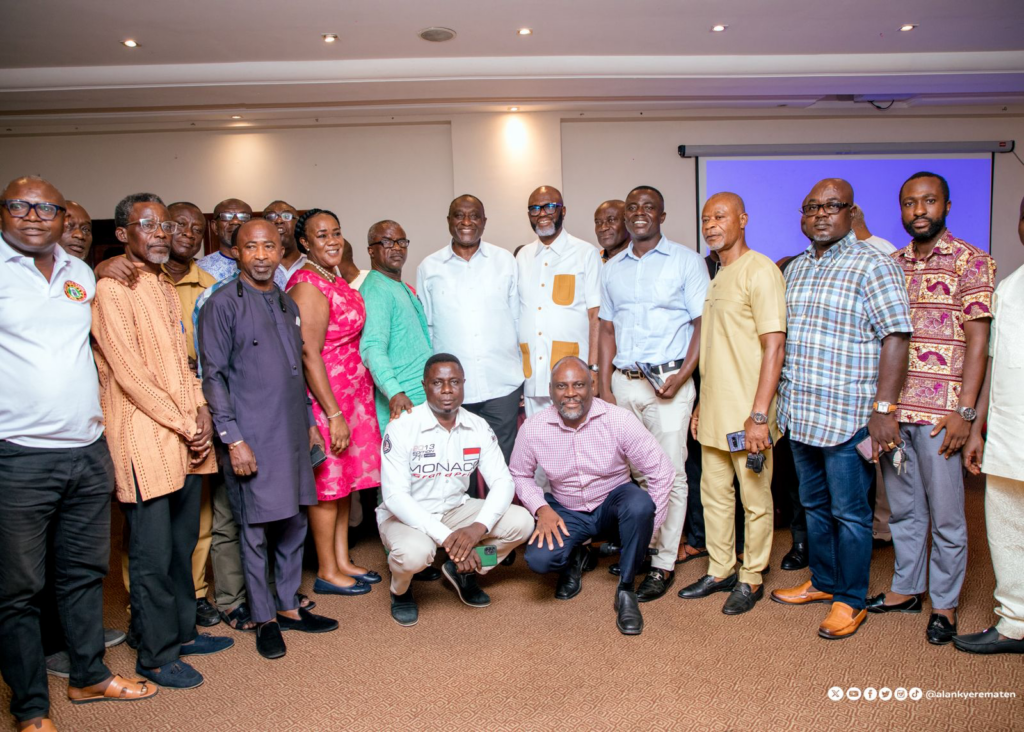

During a meeting with the Association on Wednesday, April 10, 2024, the independent presidential candidate expressed his belief that many of these taxes are unnecessary and impose a heavy burden on the trading community.

"Under my presidency, Ghana will boast the lowest tax rate regime in ECOWAS," he declared.

Kyerematen outlined a series of radical tax reforms aimed at reducing the tax burden on Ghanaians, particularly on imports. Immediate measures would include consolidating the existing NHIL & GETFund levies at the ports into the calculation of a new VAT rate.

He also pledged to abolish the Special Import Levy of 2%, the COVID-19 Health Recovery Levy, and the Ghana Health Service Disinfection Fee.

Within two years of his government's establishment, all taxes and charges on the importation of spare parts would be scrapped.

Moreover, a comprehensive review of all statutory fees on imports imposed by regulatory agencies would be conducted, to consolidate them into a convenient payment system. This system, which would include a new Cash Waterfall mechanism, aims to meet statutory agency requirements while reducing the burden on importers.

Additionally, Kyerematen proposed establishing a fixed exchange rate for the calculation of import duties over a specified period, as well as fixing the exchange rate for specified strategic and essential commodities below the prevailing rate in a 'second window' to mitigate imported inflation.

These proposed tax reforms represent the most extensive and radical review of the import tax regime to date, promising to positively transform the business environment in Ghana.

Dr Obeng, President of GUTA, highlighted the challenges posed by the multitude of taxes in Ghana, noting that apart from VAT, there are 32 additional taxes, totalling nearly 65% of the value of imports.

He also mentioned the presence of over 14 state agencies and various security agencies operating in the port, contributing to the high cost of doing business and encouraging unethical practices.

Kyerematen emphasized the importance of creating an enabling environment for private sector-led growth to improve the livelihoods of ordinary Ghanaians.

Furthermore, he proposed a shift from heavy reliance on indirect taxes to direct taxes to optimize revenue mobilization and make the corporate sector more competitive and profitable.

These plans align with Kyerematen's Great Transformational Plan (GTP), which aims to deliver the vision of Ghanaians for a prosperous, united, and peaceful Ghana that provides equal opportunities for all.

Latest Stories

-

Ebenezer Ahumah Djietror appointed as new Clerk to Parliament

32 minutes -

Actress Benyiwaa of ‘Efiewura’ TV series dead

1 hour -

Ashanti Regional Chief Imam dies at age 74

1 hour -

Africa Arts Network calls for tax reform to save Ghana’s theatre industry

2 hours -

SSTN Ghana Chapter reaffirms commitment to economic growth under new leadership

2 hours -

Inlaks strengthens leadership team with key appointments to drive growth across sub-Saharan Africa

3 hours -

Green Financing: What Ghana’s Eco-startups need to know

3 hours -

CHAN Qualifiers: Amoah confident of beating Nigeria

3 hours -

Governments deprioritising health spending – WHO

3 hours -

Lordina Foundation brings Christmas joy to orphans

3 hours -

Yvonne Chaka Chaka to headline ‘The African Festival’ this December

3 hours -

Nigerian man promised pardon after 10 years on death row for stealing hens

3 hours -

Patrick Atangana Fouda: A Hero in the fight against HIV passes away

3 hours -

MGA Foundation deepens support for Potter’s Village

3 hours -

Galamsey: One dead, 3 injured as pit collapses at Nkonteng

4 hours