Audio By Carbonatix

Commercial banks and the Bank of Ghana are taking extra measures to make it more difficult for persons and businesses with bad credit history to borrow from financial institutions in Ghana.

The banks are working through the Credit Reference Bureau as well as other measures instituted by the Bank of Ghana. The measures will ensure that no loan is granted, without reviewing credit history of borrowers.

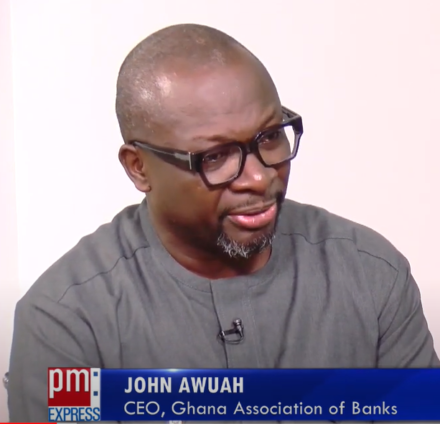

“We have gotten to that stage where, a default, will automatically black list, that borrower”, the Chief Executive of the Ghana Association of Banks, John Awuah told George Wiafe on PM Express Business Edition.

He added that one of the measures will include the refusal to grant loans to persons who cannot pay rent.

“If you cannot pay your rent there is no need banks should lend to that borrower”, he stressed.

He stated that the credit reporting portal for financial institutions are being expanded to cover other areas to assess the obligations of borrowers in other areas.

Mr. Awuah rejected arguments that the high Non Performing Loans in the banking sector was influenced by high target set for credit officers.

“The credit committee that approve these loans are not moved by targets, but rather the quality of loans”.

Rising non-performing loans

Data from the Bank of Ghana puts Non-Performing Loans around 20%..

This could largely mean that, for every gh¢100 given out as loan, there is the likelihood that gh¢20 will not be paid back.

The Governor of the Bank of Ghana, Dr. Ernest Addison, noted that in 2023, bad credit increased due to general repayment challenges on the part of borrowers, reflecting the impact of the general macroeconomic challenges in 2022.

Work with Judiciary to deal with defaulters

Mr. Awuah disclosed that significant progress has been made with the judiciary to help in the recovery of bad loans.

He said the Chief Justice, Gertrude Torkornoo has also committed to help the association.

“We are working with the judges when it comes to training to help them appreciate things like the borrowers and lenders Act and how all these can improve recovery”, he explained.

“It could take you about 4 to 5 years and when before you win a case. The banks also struggle to enforce the ruling”, he disclosed.

Challenging business environment

Mr. Awuah also blamed the challenges facing the banking sector on the current economic condition.

“Some businesses are struggling and that has affected their ability to meet their obligations to the banks”, he sid.

BoG’s directive on conditions and terms for loans

The Bank of Ghana recently reviewed its regulations on credit extension advising, financial institutions to ensure borrowers understand the terms and conditions.

It maintained that failure to strictly observe the regulations could make the loan agreement not binding.

“Most borrowers don’t want to read the terms, even when they have been advised to do so, what they just want to do is sign the facility”, Mr. Awuah said.

Latest Stories

-

Adom FM’s ‘Strictly Highlife’ lights up La Palm with rhythm and nostalgia in unforgettable experience

2 hours -

OMCs slash fuel prices as cedi gains

3 hours -

Around 40 dead in Swiss ski resort bar fire, police say

4 hours -

AFCON 2025: Aubameyang and Nsue make history among oldest goalscorers

5 hours -

Ghana is rising again – Mahama declares

6 hours -

Firefighters subdue blaze at Accra’s Tudu, officials warn of busy fire season ahead

7 hours -

Luv FM’s Family Party In The Park ends in grand style at Rattray park

7 hours -

Mahama targets digital schools, universal healthcare, and food self-sufficiency in 2026

7 hours -

Ghana’s global image boosted by our world-acclaimed reset agenda – Mahama

7 hours -

Full text: Mahama’s New Year message to the nation

7 hours -

The foundation is laid; now we accelerate and expand in 2026 – Mahama

8 hours -

There is no NPP, CPP nor NDC Ghana, only one Ghana – Mahama

8 hours -

Eduwatch praises education financing gains but warns delays, teacher gaps could derail reforms

8 hours -

Kusaal Wikimedians take local language online in 14-day digital campaign

9 hours -

Stop interfering in each other’s roles – Bole-Bamboi MP appeals to traditional rulers for peace

9 hours