In the latter part of 2023, citizens were presented with what could be characterized as the final scandalous exposé of 2023. The Fourth Estate unearthed a worrying alliance between the Ghana Revenue Authority (GRA) and SML (Strategic Mobilisation Ghana Limited), a startup of mysterious origins, wherein the state allocates substantial sums annually to the private contractor under the guise of revenue assurance in the petroleum downstream sector. The revelation didn’t end there. In the course of investigating this strange contract, evidence also emerged that under the express instruction of the finance minister SML will also become the primary auditor of the upstream petroleum and minerals (especially gold) sectors as well, in a deal that could cost the country more than $120 million every year. Over the horizon envisaged in the contract, SML’s total take may well top a billion dollars.

In response to the ensuing Fourth Estate documentary and public outcry, GRA issued a statement justifying its contractual association with SML. However, yesterday saw an unexpected intervention by the President of Ghana, who announced the appointment or engagement of KPMG to investigate the contractual relationship between the GRA and SML.

Upon reflection, it becomes evident that the situation, whilst politically sensitive, is technically straightforward, notwithstanding ongoing efforts to muddy the waters. In this brief note, our intention is to refocus the discussions back to the essentials.

Testing the claims of the Management and Board of the Ghana Revenue Authority (GRA)

In an effort to justify its contract with SML, the Ghana Revenue Authority (GRA) issued a press statement claiming significant revenue improvement attributed to the transaction. According to GRA, figures from the downstream petroleum sector have shown a 33% improvement over the two-year period of 2018/2019 and 2020/2021, resulting in an assumed volume differential of about 100 million litres per month.

We examine these claims by cross-referencing verifiable data from GRA and the National Petroleum Authority (NPA) to determine if GRA's assertions can be substantiated and are necessarily linked to SML interventions.

The GRA's petroleum product data was extracted from its submissions to the Ministry of Finance for statutory reporting under the Energy Sector Recovery Act (ESLA) from 2018 to 2022. The NPA data, a longstanding industry data repository, was sourced from its own website spanning over two decades.

Upon analysis, we observe that the two sets of data are generally similar, with marginal differences. For instance, in the year SML commenced operations (2019/2020), GRA's data indicates a 5% growth in refined petroleum products consumption relative to the previous year (19.38 million litres). In the same period, the NPA reports a 7% growth (24.71 million litres) in product consumption. In the subsequent year (2020/2021), both GRA and NPA data align, indicating an 11% and 10% growth in product consumption, respectively.

| Year | Volumes (NPA) (Million litres) | Volumes (GRA ) (Million litres) | |||||

| Annual | Monthly | monthly differential | Annual | Monthly | monthly differential | ||

| 2018/19 | 4,507.03 | 375.59 | 4,366.80 | 363.9 | |||

| 2019/20 | 4,803.65 | 400.3 | 24.71 (7%) | 4,599.38 | 383.28 | 19.38 (5%) | |

| 2020/21 | 5,262.43 | 438.54 | 38.24 (10%) | 5,088.55 | 424.05 | 40.77 (11%) | |

| 2021/22 | 4,975.12 | 414.59 | -23.95 (-5%) | 4,740.32 | 395.03 | -29.02 (-7%) | |

From the two sets of data, we observe that,

- the claims by GRA that SML’s intervention yielded about 100 million litters monthly consumption increase cannot be supported by their own data.

- The actual growth between 2018/2019 and 2020/2021 was a bout 62.95 million from NPA data and 60.15 million from the GRA Data.

- In the 2021/2022 year, the total consumption of refined products in the country declined by 5% and 7% according to NPA and GRA respectively.

- In the statement issued by GRA, the authority did not hint of the evident consumption decline in 2022. We find this disingenuous and deliberate to sustain the claim that SML’s intervention has yielded significant results. Worse, the stagnation in consumption/demand persists into 2023, the year of the controversy. The least the GRA could have done was to acknowledge this fact.

- We also consider as disingenuous the refusal to acknowledge that growth rates in consumption in the periods before SML’s intervention outstripped the growth rate being attributed to SML.

- The silence of the Minister of finance, the one who instructed the extension into being, is a testament that his action was not informed by data.

Has anything extraordinary happened between 2018 and 2022?

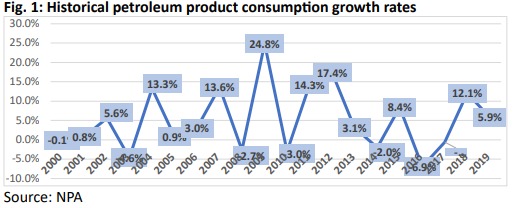

No extraordinary events occurred between 2018 and 2022. NPA’s historical data indicates that the growth in consumption of petroleum products has never been consistent since they began collecting data for the downstream sector. The graph below illustrates that the growth rate of consumed petroleum products has not followed a linear path. Some years saw significant growth rates of 24.8%, 17.4%, and 14.3%, even without the presence of the SML. Conversely, there were years, such as 2022, when consumption declined.

From the examined data we can state clearly that:

- There is no 33% consumption increase that can be attributed to SML. The consumption growth for the two-year period cited by GRA saw actual growth of 16.5% (8.25% average), which is not extraordinary, comparing it with the growth trends.

- The NPA data is more superior for revenue assurance and indeed that is what GRA uses for revenue purposes.

- The GHS 3billion quoted by GRA is inaccurate and cannot be traced to the data sources; GRA and NPA.

- There are powerful exogenous factors that drive petroleum consumption and demand in Ghana. These factors would have to be systematically eliminated before one can isolate the impact of SML’s intervention, if any. Without that being done, the country will continue to lavish funds on SML for no discernible contribution.

Closer look at some data published by SML

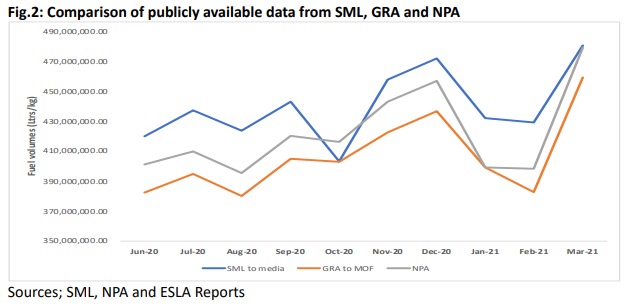

In 2021, SML issued a press release claiming significant savings in the revenue outlay of the state. A meticulous examination of the data purportedly relied upon by SML, however, reveals notable inaccuracies. We conducted a comprehensive comparison of the month-on- month volumes published by SML for three key products (AGO, Petrol, and LPG) with the data presented by GRA to the Ministry of Finance during the same period. The analysis indicates that SML's data was intentionally inflated to validate its contract with GRA, and it bore no correlation with the data employed for revenue accounting. This discrepancy renders the SML data set unsuitable for tax purposes, explaining why GRA could not utilize it in their revenue calculations.

During this timeframe, the data provided by the National Petroleum Authority (NPA) also outperformed that which was used for revenue purposes as shown in figure 2. This discrepancy raises pertinent questions about the substantial payments made to SML, especially considering that their data does not contribute to the informed decision-making process in revenue collection. Despite this, SML has received gross payments between GHS700 million and GHS750 million thus far. The disparity between the purported benefits

and the actual data used for Revenue accounting shows that amounts paid to SML were needless and could have been utilised for other development efforts.

Extension of SML Contract to Upstream Oil and Minerals production

The extension of the SML contract mirrors the design template of the original agreement. The initiation of the contract, orchestrated by the Minister of Finance, is characterized by a flawed analytical foundation and a conspicuous absence of stakeholder consultations.

Notably absent from these consultations are other state actors with similar revenue assurance responsibilities, such as the Petroleum Commission, GNPC, Mineral Commission, PMMC, National Security, and others.

Doubts arise when examining the Minister's approach, especially when there are more cost- effective ways to enhance the performance and accountability of existing state actors tasked with delivering value to the state. It also raises suspicion when the proposed solution lacks distinctiveness from the current methods of production accounting.

In the oil-producing fields, where electronic metering is universally adopted, GRA supplements these measures with physical inspections of volumes in tanks on FPSOs and export vessels to ensure revenue assurance for the State. If the Minister believes that existing agencies are falling short in protecting national interests, the more rational approach would be to strengthen and reform these institutions. The annual fee of $40 million allocated to SML could significantly contribute to the operational efficiency enhancement of numerous institutions.

The perplexing extension of the contract to encompass gold production adds another layer of bewilderment. This move appears to be driven by the finance ministry’s questionable influence. Once again, if PMMC, the Customs division of GRA, and the Mineral’s Commission are perceived as failing in their duty to protect the state's interests, the imperative is to rectify and strengthen these institutions, rather than creating a royalty of 0.75% for SML.

This seemingly arbitrary addition amounts to an annual giveaway of about $55 million at a minimum.

Ghana's gold production stems from two primary sources: small-scale and large-scale mining, with a split of about 40/60%. However, approximately 95% of the sector's revenue is derived from large-scale mining. A strategic approach would focus on generating revenue from the small-scale sector. Yet, the Minister of Finance chooses to share the large-scale revenue with SML, a decision that raises questions about the priorities and motives behind such a move. Worse, the full span of the contract extends beyond gold to other minerals, some of which are even yet to be commercialised. Massive upside to revenue from multiple unrelated trends will going forward be attributed to SML, a startup with no revenue assurance track record, to justify fees in the tens of millions of dollars.

KPMG in the Mix

The KPMG engagement is simply a case of unnecessary intervention by the President. KPMG is hugely conflicted in the assignment as a contractor of GRA and a service provider occupying multiple adjacent spaces in government and the private sector. Whilst we do not begrudge KPMG’s expertise, we do not believe that in a politically sensitive matter of this nature, their role would be value-enhancing.

The experience of KPMG affiliates in the UK, Australia and South Africa, in similar public sector consulting/auditing contexts raises serious concerns. The aftermath of serious conflict of interest, whitewashing and confidentiality abuse in these episodes has led to whole KPMG divisions being scrapped, mass resignations, and even the outright sale for a song of major business units. Not to talk about regulatory fines, client desertions and loss of public trust. It is in the strong interest of KPMG Ghana to keep in mind at all times, should it choose to accept this assignment, that it will be subjected to the harshest of scrutiny by the general public.

What would definitely be useful is an independent investigation by statutory and constitutionally empowered agencies, as well as Parliament, to establish whether the state has been criminally duped through these schemes for the appropriate sanctions to be prescribed. It is only a state agency that can do that, not KPMG. We do not have an objection to KPMG providing purely technical expertise to address narrow inquiries in support of such state agencies.

A note to the President

The SML situation presents an opportunity to:

- Holistically examine the many revenue assurance gigs that are siphoning revenue from the state across many sectors, particularly the telecoms sector, the ports, at GRA head office etc., to free up revenue for development.

- Note that GRA, Ministry of Finance, National Security and NPA know exactly how the state loses revenue from the downstream sector. It is a heavily coordinated political fodder for making quick money using unapproved routes to bring in products. Fuel tankers crisscross the country with these illicit products on the daily basis.

- Those Oil Marketing Companies (OMCs) who sell petroleum products and pocket tax revenue are known by GRA, NPA and the Ministry of Finance. Yet they continue to lift product from the depots. They have simply operated above the law, even with the presence of SML.

- By law, GRA is entitled to 2.4% of mineral revenue collected for the state. SML cannot be entitled to 0.75% of gross production. That is equivalent to about 25% of the State’s royalty. In the upstream oil sector GRA is entitled to Zero benefits by law. To pay SML $0.75 per barrel will constitute an encumbrance of petroleum revenue, a practice abhorred by the Petroleum Revenue Management Act (PRMA). To the extent that the entire operation of SML is irrelevant, the action constitutes a calculated attempt to dissipate the State’s resources.

We hope that we can count on the conscience of those with power to act in rectifying these atrocities.

Latest Stories

-

National Peace Council assures public of violent free elections

4 seconds -

Agenda 111 to be discontinued if NDC comes to power – Akufo-Addo

9 mins -

Mahama begins 3-day tour of the Western Region today

14 mins -

NCCE holds Parliamentary Candidates’ dialogue at Kumbungu

31 mins -

Akufo-Addo commissions new oil and gas services terminal

32 mins -

Bono East NIB seizes stolen SHS rice, arrests driver

34 mins -

Petroleum Commission gives $3.6bn contracts to indigenous companies

1 hour -

COP29 ends with $300bn annual deal to fight climate change

1 hour -

Texas schools can now teach Bible-based reading lessons

2 hours -

South African anti-apartheid writer Breytenbach dies

2 hours -

One-million-dollar crop insurance premium paid for farmers

2 hours -

Over 30 winners enjoy indulgent rewards in Baileys Treat-Cation promo

2 hours -

Why Indians are risking it all to chase the American Dream

2 hours -

Martin Amidu: Government must account to electorates for the violent conflicts before 2024 election

3 hours -

‘Pregnant’ for 15 months: Inside the ‘miracle’ pregnancy scam

3 hours