Audio By Carbonatix

Mobile money stands out as the predominant channel in Ghana’s payment landscape, with 66% of respondents reporting weekly usage, the 2023 KPMG West Africa Banking Industry Customer Survey has disclosed.

Despite a substantial move towards digital channels, the country remains predominantly a cash-based economy.

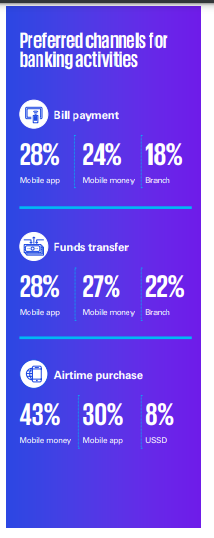

The ease of transferring money between accounts and mobile wallets, the report said, emerged as the most important experience metric for retail customers.

Notably, certain banks refrain from imposing fees on their customers for transferring funds between their mobile money wallet and bank account, fostering convenience. Additionally, there was an uptick in customers utilising financial technology platforms.

Sixteen percent of respondents indicated using fintech platforms weekly, up from 10.0% in 2022.

Fifty three percent of respondents reported using their bank’s mobile app at least once a week, a 3-percentage point increase from last year.

The USSD platform’s penetration also continued its upward trajectory, evidenced by a growth in weekly customer usage. Presently, 28% of respondents use their bank’s USSD platform weekly.

Despite a substantial move towards digital channels, Ghana remains predominantly a cash-based economy.

A significant 32.0% of respondents indicated weekly Automated Teller Machine (ATM) usage, emphasising the importance of 24/7 cash availability at these machines which ranks as the second most crucial metric for retail respondents.

The report also stated that with 36% of respondents favouring the ATM for cash withdrawals and 22% preferring mobile money, the cultural preference for cash persists due to its perceived security and widespread acceptance, particularly in traditional markets and informal sectors.

“Despite advancements in digital security, there persists a prevailing mistrust and reluctance toward the security of digital platforms”, it added.

In summary, the report said the ongoing journey of digital adoption is gaining momentum, albeit moderately. Thus, the Ghanaian payment sphere presents a fertile ground, ripe with opportunities for substantial disruption and transformative change.

Latest Stories

-

Life begins at 40: A reflection on experience and leadership

17 minutes -

Maresca leaves Chelsea after turbulent end to 2025

41 minutes -

NPP still hurting after 2024 loss – Justin Kodua

51 minutes -

Ghana declares war on illegal streaming of pay-TV content

54 minutes -

Vice President leads 44th anniversary commemoration of 31st December Revolution

55 minutes -

Valencia coach Fernando Martin dies in Indonesia boat accident

1 hour -

Nigeria AG’s intervention brings relief to River Park estate investors – JonahCapital

1 hour -

High number of youth behind bars is a national loss – Ashanti regional prisons commander

2 hours -

Nhyira Aboodoo shifts to monumental projects, injects GH₵270,000 into Ashanti orphanages

2 hours -

Police restores calm after swoop operation at Aboso

2 hours -

Through thick and thin in 2025: KGL Group makes national, global impact

2 hours -

Clean Air Fund sets 2026 targets, pushing gov’t toward funding, tougher laws and real health gains on air pollution

2 hours -

New Year begins with 15.92% water and 9.86% electricity tariff hikes

3 hours -

TUC, PURC call for calm amid power tariff concerns, assure public of stakeholder engagement

3 hours -

New VAT is a game changer for Ghana’s revenue collection – GRA Boss

3 hours