Banks’ profits will remain under pressure but will fare better than previously expected, Fitch Solutions has revealed.

According to the UK-based firm, banks operating in Ghana recorded strong profits despite the headwinds.

“All of Ghana’s largest banks reported losses in quarter 4, 2022, reflecting the banks participation in the DDEP, which caused shortfalls in the fair values of new bonds against their original carrying amounts. However, the sector still recorded pre-pandemic levels of profitability in 2022”.

It added that although strong net interest income from higher interest rates will continue to support profitability in 2024, rising NPLs and the Domestic Debt Exchange Programme will weigh on banks’ profits.

Also, it expect that the Bank of Ghana (BoG) will embark on a substantial monetary easing cycle in 2024, which will reduce banks’ net interest income compared to 2023.

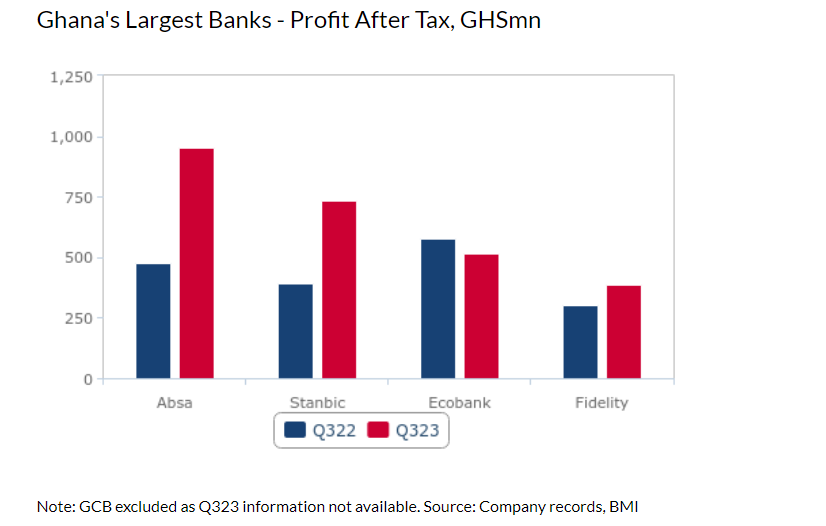

Furthermore, it said, three of the largest banks saw an increase in profit after tax between quarter 2, 2022 and quarter 3, 2023, despite rising Non-Perfroming Loans and losses from the Domestic Debt Exchange Programme (DEP), while all four saw an increase in their net interest income.

In quarter 3, 2023, net interest income for the four largest banks (excluding GCB) increased by an average of 58.1% year-on-year.

The sector’s profit after tax increased by 41.1% year-on-year to ¢5.7 billion in August 2023, as net interest income increased by 37.9% to ¢13.5 billion for the same month, while net fees and commissions increased by 27.3%. However, provisions also increased by 36.4%, reflecting elevated credit risks and mark-to-market losses on investments.

Two regulatory changes to benefit Ghana’s banking sector

Fitch Solutions also said two regulatory changes by the Bank of Ghana will benefit the banking industry

First, in October 2023, the BoG announced it had created a Business Model and Viability Analysis (BMVA) framework to enhance supervisory practices for assessing the sustainability of banks’ business models.

It said the framework will allow supervisors to identify banks’ vulnerabilities early on, following the DDEP’s adverse impact on banks, and align banks’ decisions with their risk appetites.

The BoG also announced an Asset Quality Review, which will evaluate the health of banks’ loans and investment portfolios, and plans to intensify its regulatory reform agenda to roll out Pillar 2 of the Basel II/III capital framework. This, it pointed out will increase financial stability, allowing banks to weather further economic downturns, and improve investor confidence in the domestic banking sector.

Second, in September 2023, the government unveiled plans for an overhaul of its Electronic Transfer Levy (e-levy) as part of its Medium-Term Revenue Strategy.

The rate was reduced to 1.0% in January 2023, but it is unclear what specific changes will be introduced. However, any reforms that do not benefit locals and banks could erode gains made by the digitialisation drive.

Latest Stories

-

I want to focus more on my education – Chidimma Adetshina quits pageantry

2 hours -

Priest replaced after Sabrina Carpenter shoots music video in his church

2 hours -

Duct-taped banana artwork sells for $6.2m in NYC

2 hours -

Arrest warrants issued for Netanyahu, Gallant and Hamas commander over alleged war crimes

2 hours -

Actors Jonathan Majors and Meagan Good are engaged

2 hours -

Expired rice saga: A ‘best before date’ can be extended – Food and Agriculture Engineer

2 hours -

Why I rejected Range Rover gift from a man – Tiwa Savage

2 hours -

KNUST Engineering College honours Telecel Ghana CEO at Alumni Excellence Awards

3 hours -

Postecoglou backs Bentancur appeal after ‘mistake’

3 hours -

#Manifesto debate: NDC to enact and pass National Climate Law – Prof Klutse

3 hours -

‘Everything a manager could wish for’ – Guardiola signs new deal

3 hours -

TEWU suspends strike after NLC directive, urges swift resolution of grievances

3 hours -

Netflix debuts Grain Media’s explosive film

4 hours -

‘Expired’ rice scandal: FDA is complicit; top officials must be fired – Ablakwa

4 hours -

#TheManifestoDebate: We’ll provide potable water, expand water distribution network – NDC

5 hours