Fintech is an abbreviation for Financial Technology. It refers to using technology to improve and automate traditional financial services and processes.

Some of these services include online banking, mobile payments, peer-to-peer lending, digital wallets and financial management tools.

Ghana has, over the past few years, experienced the trend of fast-rising fintech companies in and outside Ghana. It is estimated that there are over 70 fintech companies in Ghana.

It is interesting to note that fintech companies in Ghana go through a series of rigorous screenings from the Bank of Ghana (the regulating authority) before they are accorded their licenses to operate.

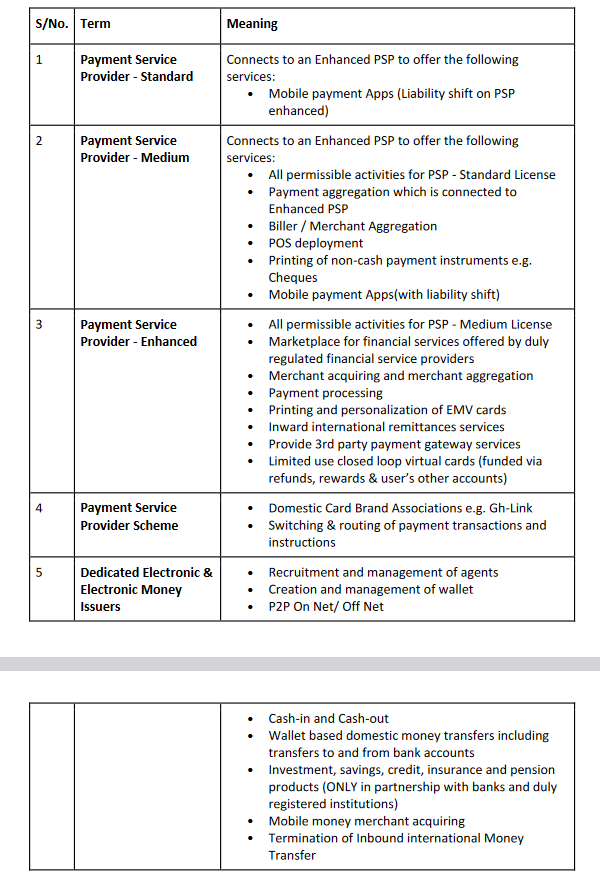

LICENSE CATEGORIES AND PERMISSIBLE ACTIVITIES

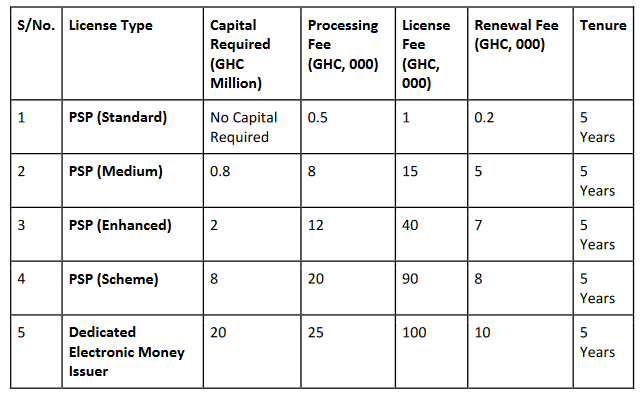

INTEGRITY CAPITAL, PROCESSING AND LICENSING FEES

In addition, the fintech company in question needs to have iron-clad IT security systems and

policies, strong governance structures, and strict risk management policies vetted by the

Fintech and Innovations Office at the Bank of Ghana (BOG).

These are exciting times for the fintech industry in Ghana as the strict regulation of this industry will put fintech companies on their toes and hence pave the way for the most secure and innovative fintech companies to lead the way.

Here are the top 10 fintech companies in Ghana and what makes each unique:

1. MTN Mobile Money – Momo

MTN Mobile Money (popularly called MTN Momo) is an offshoot of MTN, one of Ghana’s largest telecoms networks, is one of Ghana’s foremost fintech platforms, which provides consumers and businesses with a bouquet of digital financial services. Its features include access to payments, e-commerce, insurance, lending, and remittance services. The MTN Momo is the most widely used mobile payment app in Ghana, controlling about 89.3% of the mobile financial services (MFS) revenue in Ghana.

2. Zeepay – trend setter

Zeepay, one of Ghana’s fast-rising fintech companies, specializes in mobile money interoperability and international remittance. Zeepay is the first fintech company in Ghana to be issued with a Dedicated Electronic Money Issuer license by the Bank of Ghana (BOG)- Ghana’s apex financial regulatory institution. Zeepay has been greatly instrumental in facilitating cross-network money transfers and fostering financial

connectivity in Ghana and across parts of Africa. Zeepay is touted as the second largest fintech app in terms of MFS revenue, which they did by unseating Vodafone Cash to claim the second position, thereby pushing Vodafone Cash downwards in rank.

3. Hubtel - the fintech with e-commerce services

Hubtel remains one of Ghana’s most versatile fintech companies. It provides mobile payment, bulk SMS, and e-commerce solutions. Their POS platform allows businesses to accept mobile money, cards, and QR codes. Hubtel empowers numerous small and medium enterprises (SMEs) in Ghana by digitizing their payment processes.

4. Expresspay – One of Ghana’s premier Fintechs

Expresspay is one of Ghana’s prominent fintech companies that provides electronic payment solutions. Their platform allows utility payments, internet subscriptions, and airtime top-ups. Expresspay combines a user-friendly interface and an extensive agent network, making it a popular option for Ghanaians and expats seeking efficient payment solutions.

5. Kowri - the All-In-One app

Kowri, one of Ghana’s fastest-rising all-inclusive digital financial apps, is a service from Sevn Ghana Limited (formerly DreamOval Limited). Kowri is a multi-bouquet of financial solutions that includes sending and receiving money payments, buying airtime, paying utility bills, managing your finances, Insuring your businesses, promoting your businesses, and much more.

6. Finance Plus - focused on financial institutions and loans management

Finance Plus is a fintech app by Cube Robotics, one of the licensed fintech companies in Ghana. Finance Plus is a custom software building company with experts who assist credit unions, rural banks, and microfinance institutions in growing. Finance Plus assists these financial entities with specialized software that enables them to reach out and provide financial services to their teeming number of customers.

7. Ghanapay - the giant in the room

Ghanapay is a payment app rolled out by Ghana Interbank Payment Settlement Systems Limited (GhIPSS). GhIPSS is a wholly-owned subsidiary of the Bank of Ghana mandated to implement and manage interoperable payment system infrastructures for banks and nonbank financial institutions in Ghana.

It is a mobile money service provided for universal banks, rural banks and savings and loans companies. It is like any mobile money service in Ghana, but with additional banking services designed for client’s

financial freedom. Ghanapay is touted as being the first bank-wide solution in Ghana providing the opportunity for users to have access to banking services in addition to existing mobile money services. Ghanapay gives customers the opportunity to have a direct relationship with all of the banks and non-bank financial institutions in Ghana, as well as the ARB Apex bank.

8. Chango - towards crowdfunding

Chango is a crowdfunding platform rolled out by IT Consortium (ITC) one of Ghana’s largest B2B fintech companies. Chango is a mobile application made up of both private and public groups which brings people together based on agreed terms and conditions to raise funds. The Chango app is to donate to a cause or project by creating groups and raising funds. IT Consortium ITC, is establishing itself as one of Africa’s leading financial services technology solutions providers.

9. Slydepay - one of the many firsts from Banks

Slydepay was created by Dreamoval Limited and is powered by Stanbic Bank Ghana. Slydepay (formerly iWallet) is an all-in-one mobile application making mobile payments, airtime and internet data purchase easy in Ghana. It is essentially a mobile wallet in Ghana that allows customers to pay bills, top up mobile phones, make money transfers and pay in-store via QR codes as well as online via emails. One feature that puts slydepay ahead of some of the fintech apps in Ghana is its option that allows customers to make payments at retails shops via the app.

10. Payswitch - enabling financial inclusion for SMEs

Payswitch is one of the few fintech companies that allows businesses to accept payments via multiple channels, such as mobile money, cards (VISA and Mastercard), and other online platforms. Payswitch combines cards management and issuing, digital banking, automated fare collections, eCommerce, agency banking and a host of other tailor-made solutions to suit the needs of the Ghanaian middle class and business community.

Payswitch prides itself as an enabler for a wide spectrum of users from startups to large organizations. A unique feature of payswitch is that it caters to the circulation of money and value between individuals (C2Cs), individuals and organizations (C2Bs), organizations and individuals (B2Cs) and between organizations (B2Bs).

Fintechs in Ghana have come to stay as they make payments and financial transactions easier and more convenient for Ghana’s residents. However, the fintechs who will lead are those who can position more financial solutions and services in their apps at the disposal of their customers as well as anticipate solutions to clients’ requests and needs.

Getting a fintech license in Ghana can be challenging, however, it can also be rewarding. Fintechs will be able to tap into the large market opportunity and the high demand for digital financial services.

Latest Stories

-

Brazilian Supreme Court justice threatens to arrest Bolsonaro

3 hours -

Queen Elizabeth II’s fashion to feature in exhibition

4 hours -

North Macedonia backs Morocco’s autonomy plan as sole basis for resolving Sahara dispute

4 hours -

Coach Lars Björkegren “proud” of Black Queens after penalty defeat to Morocco

4 hours -

Hosts Morocco to take on Nigeria in African women’s final

4 hours -

We were the better team – Queens coach Bjorkegren reflects on WAFCON 2024 semi-final loss

4 hours -

Mali court rejects appeal to release four Barrick employees, judge says

4 hours -

Kenyan man on death row in Saudi Arabia freed

5 hours -

Euro 2025: England beat Italy to reach finals

5 hours -

Ho Technical University partners with GhIE Branch 6 For Engineering and Innovation Week

5 hours -

The voices in the cockpit fuelling controversy over Air India crash

5 hours -

Mike Lynch estate and business partner owe HP Enterprise £700m, court rules

5 hours -

Trump administration pulls US out of UNESCO again

5 hours -

WAFCON 2024: Ghana’s Black Queens miss out on final after penalty loss to Morocco

5 hours -

Coca-Cola will roll out cane sugar Coke in US after Trump push

5 hours