Finance Minister, Ken Ofori-Atta, during the presentation of the 2024 budget statement described the Domestic Debt Exchange Programme as done and dusted.

According to him, "we have successfully concluded the Domestic Debt Operations and are making steady progress on external debt restructuring”.

This is after the nation had undergone five exchanges under the DDEP with an overall exchange of GH₵203.4 billion which resulted in a breathing space of GH₵61 billion over 2023.

The Finance Ministry in their investor presentation in October 2023 indicated that “no further exchanges are being considered” as far as the completion of the DDEP is concerned.

This has further been strengthened by the indication in the 2024 budget that the domestic debt exchange has been concluded successfully.

The five big sacrifices made

As a necessity to get the $3 billion IMF bailout, Ghana was required to undertake a comprehensive debt rework which comprised both domestic and external debts.

The nation has undergone five series of exchanges under the Domestic debt operations including; the first leg of the DDEP, pension funds, USD-denominated local bonds, Cocobills and the Bank of Ghana non-marketable debt.

These exchanges, according to the Ministry of Finance, illustrate the commitment of the Ghanaian people to contribute to the Government’s effort to restore debt sustainability.

The details of the exchanges show that the first leg of the DDEP which was executed in two phases (December 5, 2022, and September 13, 2023) had a GHS96 billion target, and saw a 90.7% participation rate at GHS 87 billion.

The next exchange was the pensions funds (July 31, 2023) which had a target of GH₵31 billion but saw an exchange amounting to GH₵29.7 billion representing 95.3% participation. The restructuring of USD-denominated local bonds of $809 million followed this.

The exchange saw a participation rate of 91.7% translating to $742 million (GHS8.23 billion).

The rework on the Cocobills also has a participation rate of 97.4% amounting to GH₵7.7 billion (the target was GH₵7.9 billion).

The last of the exchanges was the Bank of Ghana’s GH₵70.9 billion. This exchange saw a 100% participation rate with a 50% haircut with 15 years maturity date.

In all the nation has exchanged GH₵203.4 billion in the domestic debt operation translating to a debt service relief of GH₵61 billion.

Where are we with the external debt restructuring?

The external debt restructuring parameters involve bilateral debt and commercial debt (Eurobonds). The external restructuring is to complement the DDEP as part of efforts to achieve a sustainable debt level.

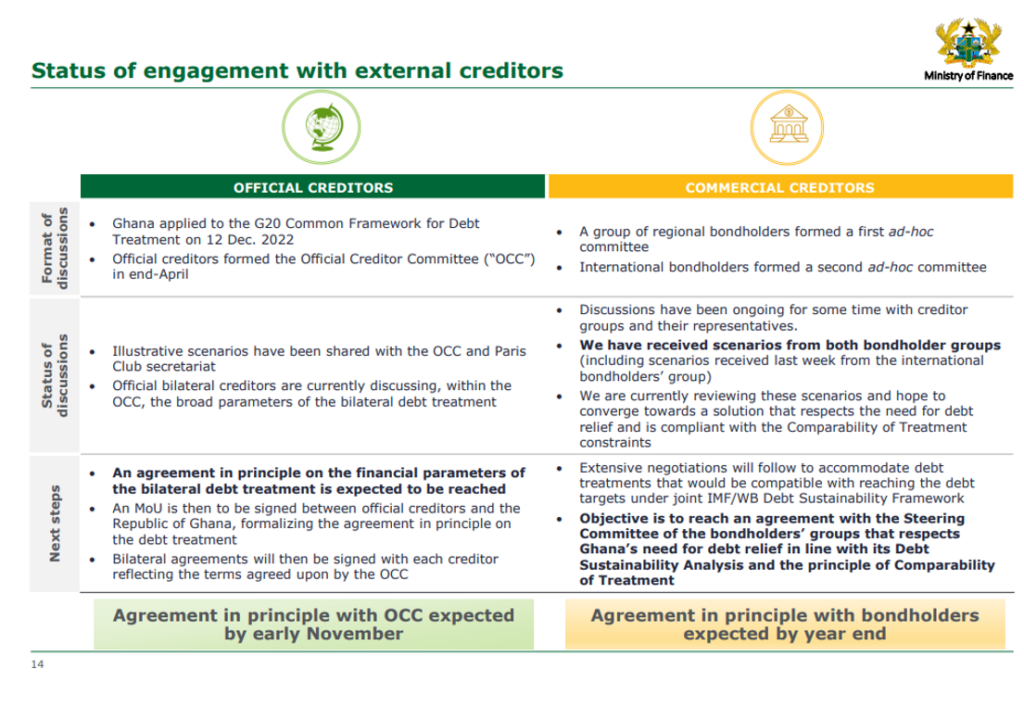

On December 13, 2022, Ghana formally requested debt treatment under the G20 Common Framework for Debt Treatment beyond the Debt Service Suspension Initiative (CF-DSSI).

Ghana’s bilateral creditors subsequently established the Official Creditor Committee (OCC) on 12th May 2023, under the auspices of the Paris Club to restructure the bilateral debt. Ghana was able to get financing assurance from both creditors which enabled the securing of the $3 billion IMF deal.

The deal came with an initial disbursement of $600 million to Ghana as the first tranche of the bailout. The second tranche is yet to be disbursed upon approval of the first review by the IMF board and the attainment of specific debt restructuring terms with the external creditors.

The minister for finance during the presentation of the 2024 budget indicated that “An agreement in principle on the restructuring parameters is expected to be reached by end November 2023”.

This is in relation to the Official Creditors.

Meanwhile, the ministry in their October 2023 investors’ presentation outlined that, “Agreement in principle with OCC was expected by early November”.

The commercial debt (Eurobonds) according to the Finance Minister has received counterproposals on the debt treatment scenarios from the two bondholder groups.

However, the counterproposals are under review to converge towards a solution in compliance with the comparability of the treatment principle.

The Minister emphasized that in the coming weeks, the Government will start extensive negotiations with both groups to ensure that the targets set under the IMF/World Bank Debt Sustainability Framework.

Latest Stories

-

Ghanaian community in Côte d’Ivoire pushes for Chamber of Commerce to boost cross-border trade

19 minutes -

The Joshua of Our Time: Why Dr Bryan Acheampong is the right leader to guide the NPP into its promised future

34 minutes -

Public Financial Management Act must be enforced – Yaw Appiah Lartey on damning Auditor‑General’s findings

36 minutes -

Absa Bank Ghana hosts Youth Festival to empower young entrepreneurs

38 minutes -

WPRD Festival 2025 closes with PR fireside chat on leadership

46 minutes -

Afrofuture and WatsUp TV launch nationwide Rising Star Challenge on university campuses

56 minutes -

Auditor-General report: Heads must roll among technical officers, not just politicians – Dr. Eric Oduro Osae

1 hour -

Ghana must rethink internal audit to defeat corruption

1 hour -

CIMG engages BoG to deepen collaborations

1 hour -

Hey big spenders – Liverpool lead top-four domination of £1bn deals

1 hour -

UK-Ghana industrial ties celebrated as British High Commissioner visits Springs and Bolts factory

1 hour -

Discontinuation of UniBank case: Adongo calls for national discourse

1 hour -

uniBank case: The decision creates avenue to loot – Kwadwo Poku criticises AG’s move to drop Duffuor case

2 hours -

US diplomats asked if non-whites qualify for Trump refugee program for South Africans

2 hours -

Medikal set to headline WatsUp On Campus this Saturday at Cape Coast Technical University

2 hours