The opposition party in Ghana's parliament has expressed its objection to the government's plans to dissolve the National Investment Bank (NIB) or merge it with the Agricultural Development Bank (ADB).

The government has been actively pursuing the merger of these two banks, aiming to establish the National Development Bank (NDB) to address their financial challenges.

In 2017, the Governor of the Bank of Ghana, Dr. Ernest Addison, supported the idea of combining ADB and NIB to meet the requirement of recapitalizing both banks to GH¢400 million by December 2018. This proposal came after the Finance Minister, Mr. Ken Ofori-Atta, announced the possibility of merging ADB and NIB to create the NDB.

The NDB, set to commence operations with a stated capital of US$500 million, aims to fill the funding gap for businesses in the agricultural and manufacturing sectors. The bank is expected to attract foreign, long-term, and patient capital to lend to businesses in these sectors.

Dr. Addison viewed this move as a strategic approach to comply with the recapitalization directive issued by the central bank in September, requiring all banks in the country to increase their capital to GH¢400 million, up from the existing GH¢120 million.

In mid-2017, the Bank of Ghana undertook a banking sector cleanup to facilitate the orderly exit of insolvent institutions, safeguard depositors' funds, and ensure the stability of the banking sector. As a result, the number of banks was reduced from 33 in December 2016 to 23 in December 2018.

Despite Dr. Addison's earlier suggestion to merge ADB and NIB, both banks continued to operate independently. However, less than five years later, discussions have resurfaced about merging ADB and NIB to establish the National Development Bank (NDB).

What is IMF’s position?

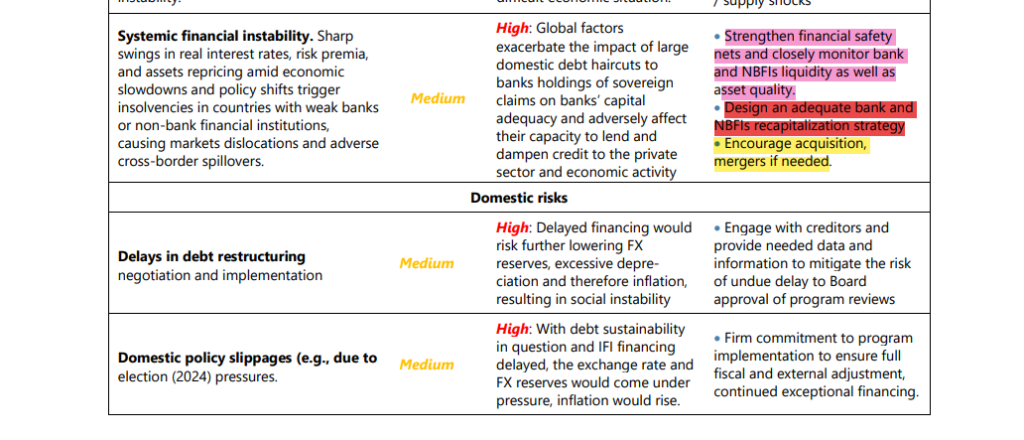

The International Monetary Fund (IMF) has advised the Ghanaian government to encourage the consolidation of banks and Non-Bank Financial Institutions (NBFIs) through acquisitions and mergers, if necessary. These recommendations, outlined in the Risk Assessment Matrix of the latest IMF report on Ghana, consist of three policies aimed at reducing potential systemic financial instability. The goal is to manage risks effectively and uphold the stability of both the banking sector and NBFIs in Ghana.

The first policy suggests strengthening financial safety nets and closely monitoring the liquidity and asset quality of banks and NBFIs.

The second policy involves designing an appropriate strategy to recapitalize banks and NBFIs. Lastly, the IMF encourages acquisitions and mergers as a means to address any necessary consolidation in the financial space.

- “Strengthen financial safety nets and closely monitor bank and NBFIs liquidity as well as asset quality.

- “Design an adequate bank and NBFIs recapitalization strategy

- “Encourage acquisition, mergers if needed”

According to the IMF, countries with weak banks and non-bank financial institutions are at risk of insolvencies when they experience significant fluctuations in real interest rates, risk premia, and asset prices. These fluctuations are often observed during economic slowdowns and policy changes.

The IMF emphasises that such insolvencies can have far-reaching consequences, causing disruptions in markets and unfavourable effects that extend beyond national borders.

“Sharp swings in real interest rates, risk premia, and assets repricing amid economic slowdowns and policy shifts trigger insolvencies in countries with weak banks or non-bank financial institutions, causing markets dislocations and adverse cross-border spillovers” It stressed.

Although the likelihood of this happing is tagged as MEDIUM, the Fund, however, indicated that global factors have intensified the consequences of substantial reductions in domestic debt on banks' capital adequacy. These haircuts directly impact the banks' holdings of sovereign claims and have adverse effects on their ability to lend. As a result, this situation hampers credit availability for the private sector and ultimately dampens economic activity – the potential impact on Ghana’s financial sector could be HIGH.

The IMF also revealed the recent Domestic Debt Exchange Programme (DDEP) in Ghana which exchanged old sovereign bonds for new ones has affected the health of the country's financial sector. Banks and other financial institutions had invested a significant amount of money in government bonds, but now the government has reduced the interest rates and extended the time they have to be paid back. As a result, the value of these bonds has decreased, causing financial institutions to face a significant financial challenge.

“Domestic bonds were widely distributed across the financial sector in Ghana, representing the most important asset class held by commercial banks, pension funds, asset management companies, and insurance companies. Banks held 30 to 50 per cent of their total assets in government securities before the DDEP—with especially high exposures in the state-owned banks—and relied significantly on income from these securities.

The coupon reductions and maturity extensions in the recently completed DDE mean that the value of these assets will decline to about 70 per cent of the par value. This revaluation represents a significant shock to the balance sheets of these financial institutions” the report indicated.

In announcing the success of the DDEP, government indicated it was putting plans in place to establish a GH¢15 billion ($1.5 billion) Ghana Financial Stability Fund (GFSF) which will be supervised by the Bank of Ghana. The GFSF is to provide liquidity to banks that participated in the DDEP. The World Bank has committed $250 million to support the racialization plan with the remaining amount expected to be funded by government.

On NIB, government of Ghana disclosed to the IMF that it is "committed to completing the remaining tasks from the financial sector cleanup and to implement reforms to support credit to the private sector" and that "those tasks include addressing the insolvency of NIB as well the long-standing

under-capitalization of several special deposit taking institutions (SDIs)". Government also said that it's "strategy will include an assessment of these institutions’ operational strategies and corrective actions to

prevent the accumulation of further losses."

According to the IMF country report, government solvency support will also be "designed to minimize costs and moral hazard, incentivise private capital injections, foster structural reforms improving operational efficiency, and allow for an orderly, early government exit.

"When acting in its capacity as shareholder, i.e., for state-owned banks, the government will front-load any necessary recapitalizations of state-owned banks, which will be underpinned by credible plans to ensure the future viability and a level-playing field with private banks.”

Ghana’s financial sector has already gone through a lot of turmoil during the 2017 banking sector clean-up which saw a reduction in the number of banks operating in Ghana from 34 to 23, whilst 347 micro-finance institutions, 15 savings and loans, and eight finance houses had their licenses revoked. This exercise cost the state about GH¢25 billion and takes a pivotal position in Ghana’s sustainable debt portfolio.

The IMF country report on Ghana has disclosed that “the fiscal cost of the financial sector recapitalization (estimated to have reached 7.1 per cent of GDP over 2017-21) has led to an increase in the government deficit and debt. Additional recapitalization costs are expected in the coming years resulting from the domestic debt restructuring envisaged in 2023—some 2.6 per cent of GDP are included in the DSA’s baseline.”

Banks operating in Ghana have up to September 2023 to provide their respective recapitalisation plans to the Bank of Ghana.

Latest Stories

-

Alan promises to amend the Constitution to limit presidential powers

15 mins -

Ghana to face liquidity pressures in 2025, 2026 despite restructuring most of its debt – Fitch

18 mins -

NPP’s record of delivering on promises is unmatched – Bawumia

19 mins -

Mahama: It’s time to dismiss the incompetent NPP government

22 mins -

Today’s front pages: Monday, November 25, 2024

35 mins -

T-bill auction: Government misses target again; interest rates continue to rise

38 mins -

We have a bad technical team; Otto Addo and his team should go – Ernest Thompson

2 hours -

Hindsight: Why Accra Lions’ present problems do not define them

2 hours -

10-year-old Lisa Laryea arrives at Wits Donald Gordon Hospital in South Africa for bone marrow transplant

3 hours -

23 ambassadors inducted to take on 2025 GSTEP Challenge in three regions

3 hours -

Ghana Shea Workers Union inaugurated

3 hours -

Microsoft 365 under attack – how to bulletproof your business against cyber threats

4 hours -

I trust Bawumia; he has never lied to me – Akufo-Addo

4 hours -

Bawumia is hardworking; offers the youth platform to share ideas – Kow Essuman

4 hours -

IGP, Police commanders worship with churches in Ghana as part of security arrangements for 2024 elections

4 hours