The International Monetary Fund (IMF), has revealed details about how Ghana's four collateralized loans from China have exposed the country to the possibility of losing parts of its mineral resource revenue in addition to electricity sales in the future.

For Ghana, Chinese loans have been a reliable funding source for major projects since the year 2000. In two decades, Accra has racked up close to $5 billion from at least 41 Chinese loans.

After several years of near-unbridled borrowing, Ghana is now debt-trapped and wading through its worst economic crisis in a generation, with a current external debt portfolio exceeding $30 billion.

In a lot of debt negotiations taking place within the developing world, China appears to be the most important party at the negotiation table. Although it is the largest bilateral lender in the world, it is opaque about its lending policies and how it renegotiates with distressed customers.

According to the World Bank, the planet’s poorest countries faced $35 billion in debt-service payments to official and private sector creditors in 2022, of which 40% was due to China alone.

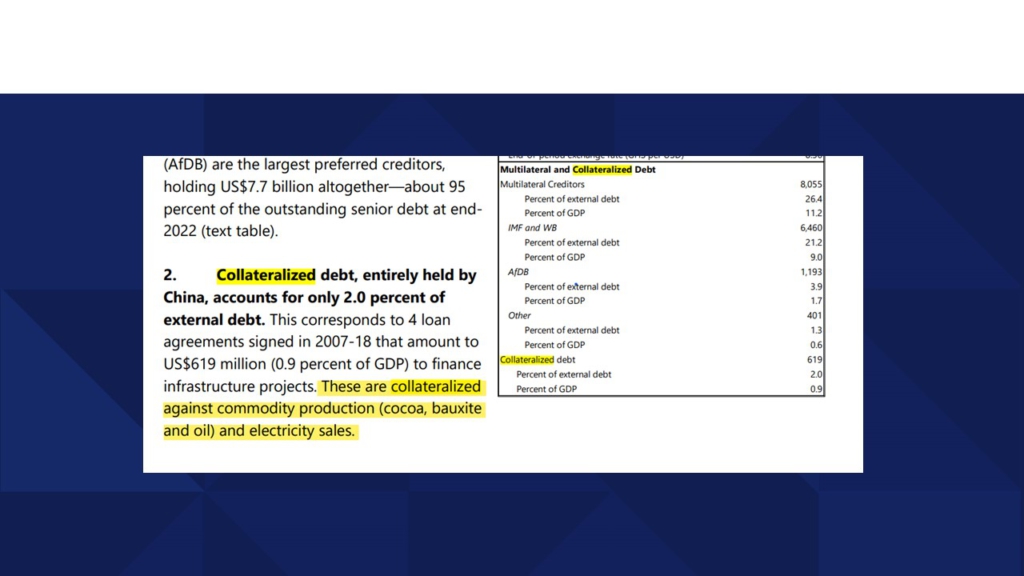

JoyNews’ checks show the West Africa nation has contracted at least 8 collateralized loans from China with different mineral resources as security against default. As at the end of 2022, Ghana owed China $1.9 billion, out of which $619 million were collateralized loans.

According to the Fund, Ghana’s collateralized debt as of the end of 2022, was entirely held by China, this corresponds to four loan agreements signed in 2007-18 that amount to US$619 million to finance infrastructure projects. These loans are collateralized against commodity production (cocoa, bauxite and oil) and electricity sales.

The loan agreement means in the event Ghana defaults on honouring its debt obligation, China has the right to use proceeds from Ghana’s oil, cocoa, bauxite or even the sales from electricity to settle the debt.

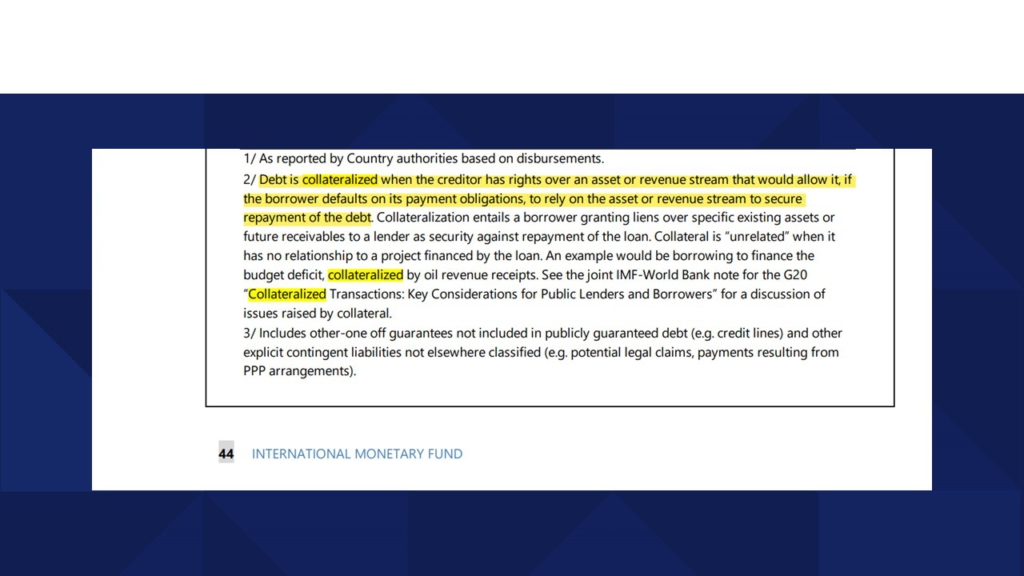

“Collateralized debt is any contracted or guaranteed debt that gives the creditor the rights over an asset or revenue stream that would allow it, if the borrower defaults on its payment obligations, to rely on the asset or revenue stream to secure repayment of the debt” the IMF stated.

The IMF has stressed that “statutory funds will not be allowed to collateralize revenue streams and issue debt. No objection certificates will not be issued to any statutory fund by the governing authority in this regard.”

The Fund has also requested that government provides corresponding loans/ derivatives for all encumbered assets used as collaterals.

Latest Stories

-

Kpando NCCE holds dialogue for Parliamentary Candidates

7 mins -

Bawumia solicits support of CSOs to tackle ‘entrenched interests’ in corruption fight

9 mins -

I’m looking forward to working with CSOs, research institutions; they have a lot to offer – Bawumia

12 mins -

The former illegal miner who became valedictorian: Eliasu Yahaya Bansi’s KNUST journey

24 mins -

Prof Opoku-Agyemang slams gov’t over supply of ‘expired’ rice to Senior High Schools

29 mins -

‘Expired rice’: FDA fines Lamens Investments GH¢100k for regulatory violations

34 mins -

No student has been served unwholesome meals – Nana Boakye

48 mins -

Galamsey has left our river deities powerless – Fetish Priest laments

1 hour -

It was unfair to destroy Leslie’s Fantasy Dome – Okraku-Mantey

1 hour -

Expired rice scandal: We won’t jeopardize people’s health or safety for any reason – FDA

1 hour -

UniMAC to host public forum on democracy and communication

1 hour -

Expired Rice Scandal: Ablakwa slams Lamens Company for “Criminal” acts

2 hours -

Avoid the use of vituperative expressions in your campaigns – NCCE

2 hours -

No petroleum revenue allotment to industrialisation in first half of 2024 – PIAC report

2 hours -

Baba Sadiq motivated me to vie for MP position – Okraku-Mantey

2 hours