The International Monetary Fund has stated that Ghana breached the Debt Sustainability Analysis (DSA) thresholds, a situation that led the country into debt distress.

In a statement titled “Request for an arrangement under the Extended Credit Facility Programme”, the Fund said Ghana is in debt distress. It added that the country's debt level is also unsustainable.

“Given the ongoing debt restructuring and large and protracted breaches to the Debt Sustainability Analysis (DSA) thresholds, Ghana is in debt distress, and debt is assessed as unsustainable”.

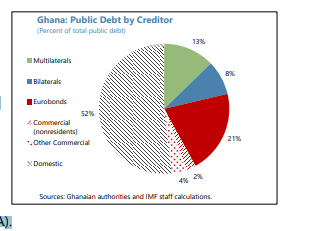

It pointed out that public debt increased to 88.1% of Gross Domestic Product by end-2022, almost evenly split between external (42.4% of GDP) and domestic (45.7% of GDP).

Again, the Fund mentioned that gross financing needs have reached about 19% of GDP.

“Under the proposed programmes baseline projections, which do not consider the possible outcome of the ongoing debt restructuring, the ratios of present value of public and external debt to GDP, and the ratios of external debt service to revenues and exports are and would remain above their LIC-DSF thresholds over the medium and long term”, it added.

Outlook subject to significant downside risks

The Fund further said that the outlook is subject to significant downside risks.

It explained that the baseline projections are predicated on successful programme execution and swift progress in implementing the authorities’ comprehensive debt restructuring and plans to address the large stock of domestic arrears, including to independent power producers (IPPs).

Notwithstanding mitigation strategies, it said that the domestic debt exchange presents significant risks to domestic financial sector stability, adding “exchange rate, credit, and liquidity risks further add to the vulnerabilities”.

“The authorities’ debt restructuring plans still leave a substantial need for T-bill [Treasury bills] issuance in the near term and expose Ghana to the uncertainty in domestic market conditions, though programme implementation and outreach may help mitigate financing risks. Domestic policy slippages represent a significant downside risk to the projections, further compounded by risks associated to the end-2024 general elections.”

Latest Stories

-

The Conscience of Leadership: A call to President Akufo-Addo on Ghana’s environmental devastation

29 mins -

Ghanaian youth unaware of their right to hold politicians accountable – Youth Bridge Foundation

1 hour -

Judge delays Trump sentencing for a third time

2 hours -

2024 WAFCON: Ghana drawn against defending champions South Africa in Group C

2 hours -

Photos from DW-JoyNews street debate on ‘galamsey’

3 hours -

Mimmy Yeboah: Blending heritage with global sophistication, confidence redefined through couture

3 hours -

100 Most Influential People Awards 2024: Brain Hill International School’s Director Mary Anane Awuku honoured

3 hours -

Akufo-Addo commissions 97-km Tema-Mpakadan railway line

4 hours -

Majority requests recall of Parliament

4 hours -

Kanzlsperger and Professor Quartey support WAFA with medical Donation

4 hours -

Gideon Boako donates 10 industrial sewing machines to Yamfo Technical Institute

4 hours -

‘Golden Boy’ Abdul Karim Razak honored at WAFU-B general assembly

4 hours -

Buipewura Jinapor secures Vice Presidential position in National House of Chiefs with record votes

5 hours -

2024 election: I want results to come out like ‘milk and honey’ – Toobu

5 hours -

Ghana’s Henry Bukari hands over chairmanship of ECOWAS Brown Card Council of Bureaux

5 hours