Vice President of IMANI Africa, Bright Simons, has expressed worry about the excessive taxes banks and other financial institutions are being asked to pay in 2023, despite the impact of the Domestic Debt Exchange Programme (DDEP) on their operations.

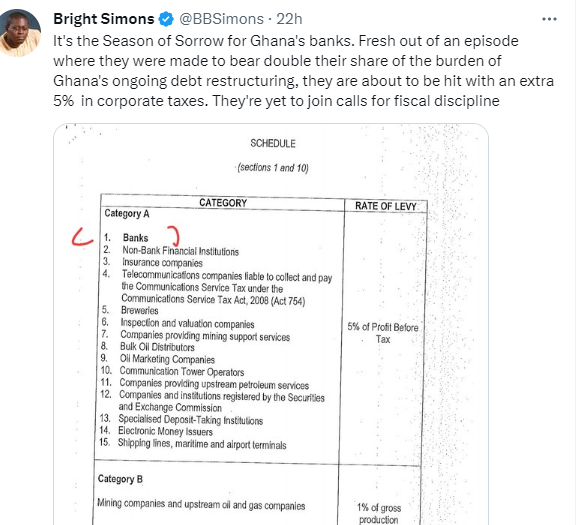

According to him, banks in Ghana will pay 5% taxes on their profit-before-tax this year.

Non-bank financial institutions, insurance companies, telecommunication firms, Oil Marketing Companies, Bulk Oil Distribution Companies (BDCs) are among 15 firms that are also to expected to pay 5% tax on their profits in 2022.

In a tweet, Mr. Simons said “It’s the Season of Sorrow for Ghana’s banks”.

Describing the ordeal as burden, he stated that it is unfortunate that government is growing a strong appetite to take from the private sector even when they are struggling to breakeven.

He stated for example that a reasonable policy will be for government to advocate fiscal policies that will encourage the private sector to reinvest the little profit that would be made in their businesses for expansion.

“Fresh out of an episode where they were made to bear double their share of the burden of Ghana’s ongoing debt restructuring, they are about to be hit with an extra 5% in corporate taxes. They’re to join calls for fiscal discipline”, he added.

How the DDEP ended

The Ministry of Finance on February 14, 2023 announced that approximately 85% of bondholders participated in the Domestic Debt Exchange Programme (DDEP).

This amounted to ¢82,994,510,128 (¢82.99 billion)

“The Government is pleased with the results, as a substantial majority of the Eligible Holders have tendered,” a statement from the ministry said.

It added that the result is a significant achievement for the government to implement fully the economic strategies in the post-COVID-19 Programme for Economic Growth (PC-PEG) during the current economic crisis.

To provide sufficient time to settle the New Bonds in an efficient manner, the statement explained that government is extending the Settlement Date of the Exchange from the previously announced February 14, 2023 to February 21, 2023.

Latest Stories

-

Gold Fields Ghana Foundation challenges graduates to maximize benefits of community apprenticeship programme

14 mins -

GBC accuses Deputy Information Minister Sylvester Tetteh of demolishing its bungalow illegally

25 mins -

Boost for education as government commissions 80 projects

36 mins -

NAPO commissions library to honour Atta-Mills’ memory

47 mins -

OmniBSIC Bank champions health and wellness with thriving community walk

49 mins -

Kora Wearables unveils Neo: The Ultimate Smartwatch for Ghana’s tech-savvy and health-conscious users

53 mins -

NDC supports Dampare’s ‘no guns at polling stations’ directive

56 mins -

Police officer interdicted after video of assault goes viral

1 hour -

KNUST’s Prof. Reginald Annan named first African recipient of World Cancer Research Fund

1 hour -

George Twum-Barimah-Adu pledges inclusive cabinet with Minority and Majority leaders

2 hours -

Labourer jailed 5 years for inflicting cutlass wounds on businessman

2 hours -

Parliament urged to fast-track passage of Road Traffic Amendment Bill

2 hours -

Mr Daniel Kofi Asante aka Electrician

2 hours -

Minerals Commission, Solidaridad unveils forum to tackle child labour in mining sector

2 hours -

Election 2024: Engagement with security services productive – NDC

2 hours