Cash is king in Nigeria - electronic banking it still in its infancy. In fact very few people keep their money in banks - and it is often joked that most put any savings they have under their mattresses.

According to the Central Bank of Nigeria (CBN), less than 20% of the local currency in circulation is held by the banks.

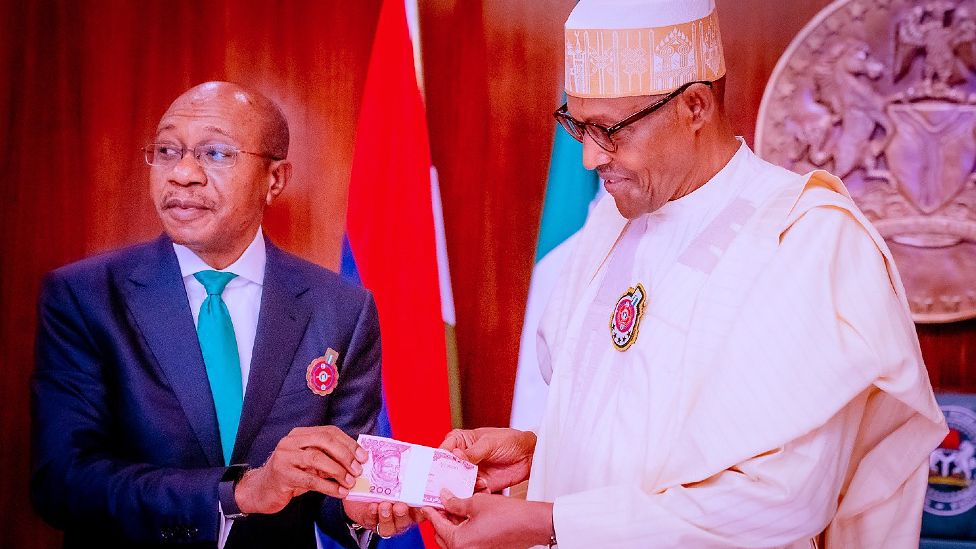

CBN Governor Godwin Emefiele explained that of the 3.2 trillion naira ($7bn; £5.8bn) in circulation, up to 2.7 trillion was outside the vaults of commercial banks.

This is one of the reasons why he made a shock announcement in October that three of the country's higher denominations were going to be replaced.

The main design change appears to be the colour of the banknotes. The 1,000 naira note has changed from brown to blue; the 500 from purple to green and the 200 from brown and blue to pink.

Gold dust

The problem for a country where things rarely go according to plan, is that the switch has to happen in a six-week window - and after the end of January the old notes will no longer be legal tender.

Midway through this window, the new notes are like gold dust and it is very difficult to get hold of them.

I have only handled 10 of the crisp new notes, which I managed to get hold of when I went to a bank in the capital, Abuja, last week.

I had tried to withdraw new notes from an ATM, but they are all still dispensing old notes.

The bank teller who handed over to me the 10 banknotes, worth just over $20, said this was the maximum anyone could get.

He even asked me to fill out my details in a notebook by his counter - a way to ensure that only genuine bank customers are getting the new notes and not those diverting them to money changers who are charging a premium for the new cash.

Even the rich and powerful are facing problems getting hold of them.

On the day the new notes became legal tender, just before Christmas, I overheard a senior member of the ruling party complaining that though he personally went to his local bank, the manager there said he could only provide him with a small amount because the banks have only a very limited supply of the new notes.

These anecdotes underline the challenge of completing the currency switch. If in the major cities of Abuja, Lagos, Port Harcourt and Kano most people are yet to have sight of the new notes, it is inconceivable that they will be in circulation in sufficient numbers nationwide by the end of the month.

Cash ransoms unaffected

If the exercise is to succeed there is also an urgent need to mount a publicity campaign.

Already social media is awash with instances of market women turning down the new currency, which they consider to be a poor imitation of the old one - in addition to being fearful of being conned by fraudsters.

And changing the colour of the naira is unlikely to deter kidnapping for ransom, which is prevalent in many parts of the country.

Not to be left behind, the extortionists are said to be asking for ransom in the new currency, never mind that people cannot get hold it.

Many Nigerians are in danger of losing their savings altogether.

A large number of the 774 local governments in Nigeria do not have bank branches and even in the present era of electronic monetary transactions, such services are not commonly available in rural areas.

Of course it tends to be in rural areas where there is the peculiar practice of people keeping money in mattresses or under their beds.

Mr Emefiele has blamed this hoarding for the currency crunch. But in reality it is not the average Nigerian that is to blame for the bulk of the stockpiling.

Analysts say this tends to become an issue before elections when politicians are accused of using cash to buy favours.

During the 2019 election, social media had pictures and a video of a bullion van supposedly full of cash going into the residence of a senior political influencer.

His aides denied accusations that it was for vote-buying.

But the practice of giving voters money to cast their ballot for a particular candidate is not uncommon here.

The currency change may be well-intentioned, to level the political playing field before the 25 February vote, yet the timing of it all is causing concern.

The senate has asked for the switchover period to be extended but the CBN is sticking to its guns.

To make matters worse, Governor Emefiele has disappeared. He has been out of the country for weeks, facing various accusations of mismanagement, which some argue may be politically motivated.

Nonetheless it means the chances of completing the exchange by 31 January look slim.

President Muhammadu Buhari will be stepping down in May to handover to his successor after completing two terms in office as a democratically elected leader.

Yet for some it brings to mind the currency change that took place in the 1980s when Mr Buhari was the military head of state. It was a time when well-off private business people lost fortunes.

Latest Stories

-

Academic City granted Presidential Charter

5 minutes -

Suspected ‘witchdoctors’ arrested over attempt to ‘bewitch’ Zambia’s president

10 minutes -

Gambaga ‘Witches’ Camp women laud Lordina Foundation for lifesaving support

15 minutes -

Dusty dry air: EPA issues red alert; recommends nose mask wearing, less outdoor activities

22 minutes -

Economy to remain on recovery path but growth projected at 3.6% in 2025 – Databank

27 minutes -

BoG outlines draft open banking directive for regulated financial institutions

27 minutes -

Deloitte lists mining, financial services, 3 other sectors to watchout in 2025

31 minutes -

People voted because promises weren’t fulfilled – Egyapa Mercer on voter discontent

32 minutes -

Deloitte forecasts average inflation of 11.9% for Ghana in 2025

32 minutes -

T-bills: Government’s target fell short by GH¢58.11m; interest rates surged

36 minutes -

‘Ghana’s education sector is in crisis’ – President-Elect Mahama calls for national forum

42 minutes -

Ghanaian movies released in 2024

47 minutes -

Another deadly crush in Nigeria at event offering free food

54 minutes -

Cyclone Chido kills 94 people in Mozambique

1 hour -

How tactless NDC exonerated the Electoral Commission

1 hour