On 2nd December 2022, Ghana announced to its domestic creditors that it intends to default on its debt. The creditors, mostly bondholders, were given a deadline of December 19, to turn in their current bonds and, in their place, be issued with a new series of four bonds of considerably lower value.

Default or No Default?

Though the authorities strongly abhor the word "default", preferring to refer to the ongoing exercise as an "exchange", every variation of loan terms to the detriment of the creditor is technically a default.

Domestic creditors currently hold more than 60 types of bonds that were, on average, meant to mature in a little over three years. These will now be replaced with four bonds with an average life of almost 11 years. They will thus have to wait for much longer to get their full investment plus return back.

On top of that, while their current bonds yield average interest of more than 20% a year, the new ones will yield on average less than 10% interest.

That is not all, investors will have to forgo interest for the whole of 2023 and make do with only 5% in 2024, before the 10% interest rate kicks in from 2025, conveniently after the Ghanaian elections in December 2024.

Haircuts or No Haircuts?

Taken together, analysts see losses for affected domestic investors averaging more than 60%. Curiously, the government insists on an official narrative that “there have been no principal haircuts”.

This is, of course, not technically correct as for that to be true the government would have had to increase coupons (interest payments) in later years to offset the losses (technically called NPV – “net present value” – haircuts) due to interest reduction and time extension. Because the principal value of a bond is calculated based on its net present value, an NPV loss amounts to a principal haircut. This is basic finance.

A Game of Power

Not surprisingly, local creditors are resisting the terms. In predictable Ghanaian fashion, it is those creditors with political backing that have been most vocal.

Though pension funds are usually assumed to have the best shock absorbers for investment losses of this kind (because of their long-term orientation), they have been the first to organize against the planned moves. They have cleverly enlisted the labour unions to make the whole issue about “worker pensions”. The government has been flat out told to exempt pension funds or forget about union acquiescence to any restructuring.

Anticipating the politics of the whole thing, the Ghanaian government took steps to avoid backlash of this nature. It is exempting individual bondholders, read “voters”, from the exercise. They can keep their old bonds and enjoy the original benefits. By so doing, it has averted potential wildcat litigation and class actions by peeved citizens.

Institutional investors do not deserve the same kind of mollycoddling. Not only are they few in number, and their client base predominantly middle-class, the government also wields massive regulatory power over banks and funds and expects them to do as they are told. That is why it never bothered to take their views into account in formulating the debt exchange proposal. Even though it created a committee of eminent bankers to engage the financial industry, the committee met only once with industry players. The chairperson was out of town, so his deputy went through the motions. In the end, nothing the industry said made any difference.

The Power of Game Theory

As the 19th December deadline approaches, it is clear that the government, partial shrewdness notwithstanding, miscalculated. It did not take into account the fact that once the politically-linked investors rejected the offer the others would be emboldened to do same.

As I write, local investors holding nearly 80% of domestic bonds have signaled that they won’t meet the deadline. It is likely that using state-owned or controleld banks and insurance companies, the government will break the front of the coalition. But it needs at least 80% to 90% participation rate for the program to be viable because of the “game theory” at play here.

If, say, 40% of bondholders refuse, the government has an option to default on their holdings or continue to honour the terms. A default on bonds owned by pension funds and insurance firms is simply not possible because they will in turn collectively disown the liabilities they have towards workers and ordinary citizens. This is a very credible counter-threat. But if the government cannot default on a large enough portion of the holdout investors, then it will be reckless to default on any others because a court will take a very dim view of such discrimination.

And if the government cannot default on any holdouts that also include pensions and insurance funds, then the more beholden investors like banks and securities dealers are best advised to simply wait and see. Rushing to accept major losses when others in the industry are holding out will signal to your shareholders and even customers that you are reckless, worsening redemption or withdrawal risks.

Even more so when some banks earn up to 70% of all their income from the same bonds that the government intends to pay no interest on in 2023, and when most banks earn between 35% and 50% of their income from such government securities.

Partially anticipating this, the government has offered some carrots to the banks. It will relax various regulatory rules and risk the potential moral hazards of lower compliance with prudential regulations. It will set up a stability fund of about a billion dollars to support banks with liquidity should confidence plummet and people try to get their money out of the financial system. The government is hoping the World Bank and rich western countries will put up these funds.

Making such overtures to one class of creditors naturally inspires others to demand their fair share of the concessions. So, now insurance companies are also asking the government to set up a fund to assume some of their risks. Corporate treasurers are too fragmented a group to make coordinated demands but they are refracting their pressure through the securities dealers and brokers.

A truly messy and convoluted affair. And it can endanger the timeline of the government’s much vaunted IMF program since the Fund insists on some serious success with the debt restructuring program before it can send the much hailed staff agreement announced on 13th December to the IMF board for ratification.

Could Ghana have handled all this much better? With more “style” so to speak? To answer that question, we have to start at the beginning.

How did Ghana get here?

Was it international investor bias?

Some leading African commentators like to argue that the debt stress presently being witnessed across Africa is entirely an offshoot of an unjust and biased geo-financial system.

In this framing, the global ratings system comes up for very harsh scrutiny, which I have addressed in the past. In particular, I responded to economist Hippolyte Fofack’s assertions about skewed risk perceptions of Africa by providing data that shows a reasonable, even if not perfect, alignment between risk and ratings.

There is a variation of this debate that is very relevant to this essay. Did Ghana get into trouble simply because international investors have biased views of risk in Africa and therefore charged extortionate rates for Ghana’s debt leading to excessive debt servicing costs, fiscal stress, and, then, eventually, bad ratings, which have now shut Ghana’s access to international capital markets and led to the current default?

The Issue of Debt Servicing

It is true that Africa, including Ghana, faces a “Debt Servicing” more than a “Debt” crisis per se. African countries are spending too much of their meagre revenues paying interest and repaying principal.

The United States, for instance, has a public debt to GDP ratio of 134%. Japan’s figure is 254%. In the Euro area, the ratio of public debt to GDP is nearly 100%. The comparative figure in Africa is less than 60%.

Yet, Africa’s major economies can spend as much as 70% of all domestically generated tax revenues paying debt. Ghana is at that threshold already. Nigeria will get there next year. Angola spends 60% of all government revenue servicing external debt alone. Both Chad and Zambia would be spending 40%-plus of revenues in the same fashion had they not defaulted at the start of the pandemic.

By way of comparison, Japan has a debt service to revenue ratio of 7.8%; the US gets by with 9%; and the EU’s most debt-stressed nation, Greece, has servicing costs of 5.6% of revenue now.

This is where many African analysts often leave the inquiry. But it is not a complete picture.

There is a history to this

Excessive debt servicing is by no means an African phenomenon, or one precipitated primarily by bias.

Economic historiography has established a very robust relationship between general institutional decline and increasing debt servicing as a ratio of government income.

Take for instance the case of the famous Philip II of Castile (the principal region of Spain during the Renaissance). Yes, he of the armada.

Researchers Alvarez-Nogal and Prados de la Escosura in their “Decline of Spain” show (page 352 onwards) that in the Philippian era of the late 16th Century, whilst Castile’s debt to GDP ratio only exceeded 50% by a bit, debt servicing as a ratio of government revenue was a high 50% too.

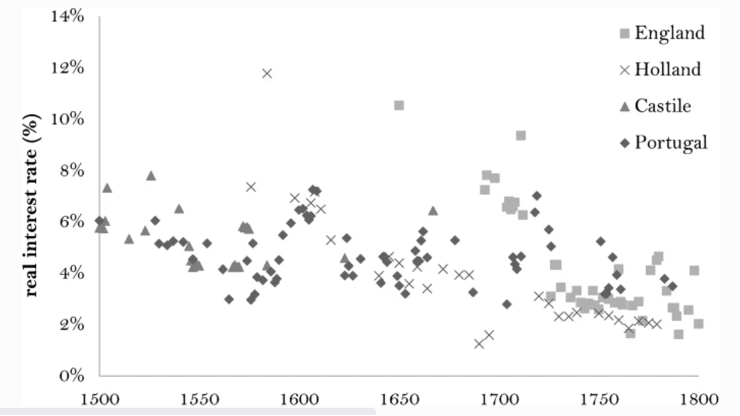

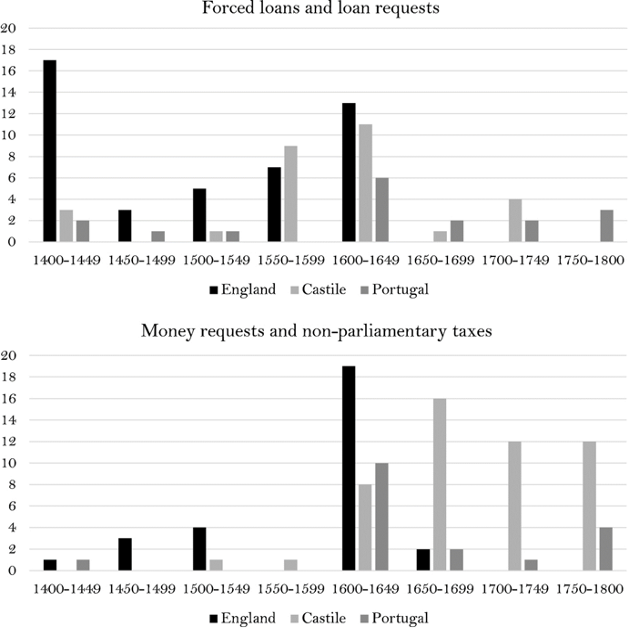

Antonio Henriques and Nuno Palma reinforce this view by more quantitatively demonstrating the synchronous relationship between worsening institutional quality and Spain’s debt servicing woes.

In their own words:

“Hence, interest rates paid by rulers are an indicator of their commitment to contracts and of the security of property rights. Hence, interest rates paid by rulers are an indicator of their commitment to contracts and of the security of property rights. Private lenders demand high interest rates when they perceive that the sovereign is prone to use the state’s discretionary powers, as in seventeenth-century France, or that the political system is too unstable for credible commitment. The differences between countries are thus visible in the interest rates charged to the sovereigns.”

And the evidence supports their claim. As England improved its institutional environment and rulers respected restraints on their power, consulted more, stopped treating investors and creditors like muck, and provided assurances of contract sanctity, interest rates dropped. As Spain/Castile and Portugal declined on these factors (such as degree of parliamentary oversight of government borrowing and arbitrary debt default practices), their sovereign borrowing costs surged.

Don’t Sink your Sinking Fund

We do not only seek to establish the fact that these factors apply to Europe as much as to Africa, we also want to point to how the evolution of this trend can be seen in Africa’s own economic history too.

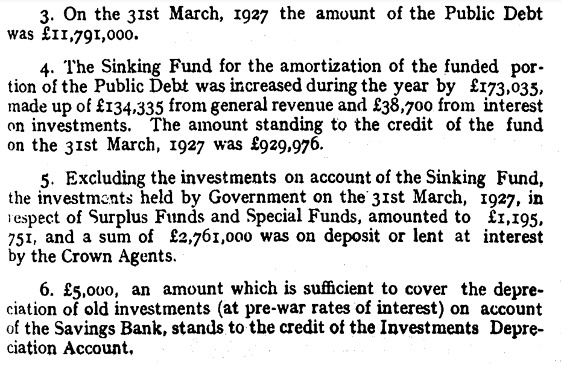

Here is an extract from the colonial report on Ghana in 1927.

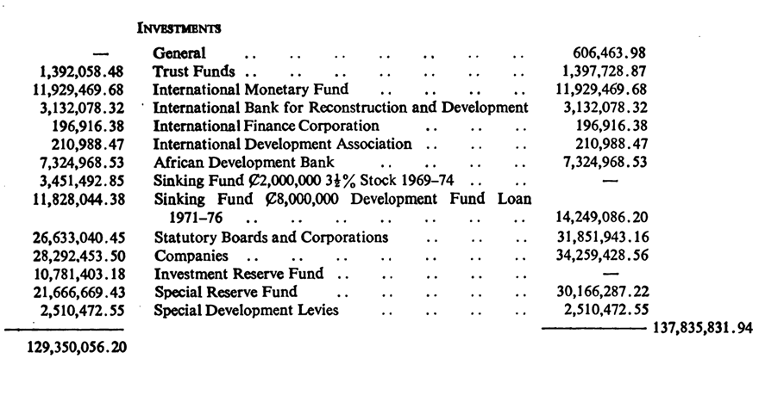

Pay attention to the size of the sinking fund relative to the overall public debt, i.e. nearly 8% of the total. Note also a growth of sinking fund value by nearly 23% on a year-by-year basis. A sinking fund is the prudential measure a government takes to put money away to service debt when it can afford to do so in relatively good times.

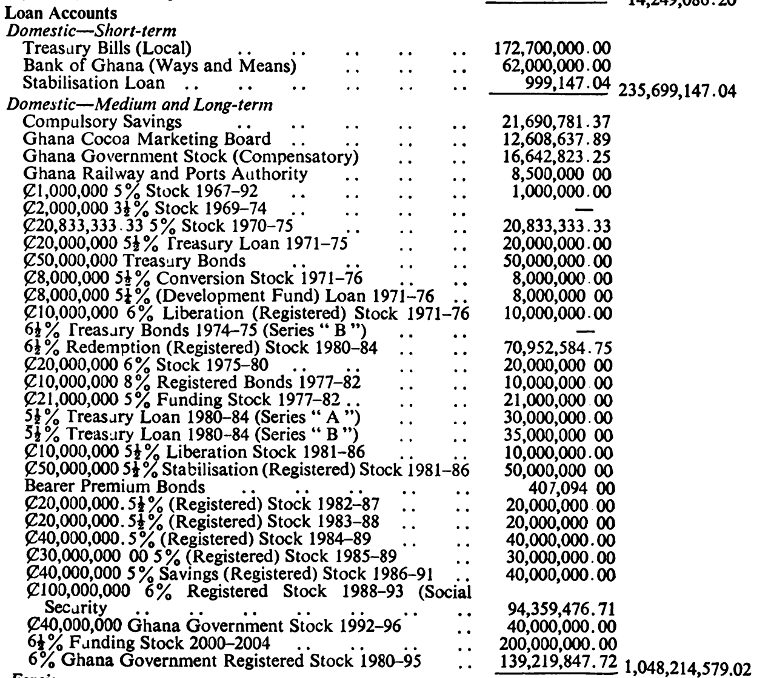

By the time we hit 1976, in Ghana’s turbulent 70s, the public debt accounts of Ghana now look something like the below.

That is to say, the Sinking Fund had declined to about 1.3% of outstanding public debt

Today, Ghana’s sinking fund has become a fiscal slush fund, to be raided for quick relief. Some years, the government pays nothing into it, and it refuses to publish balances.

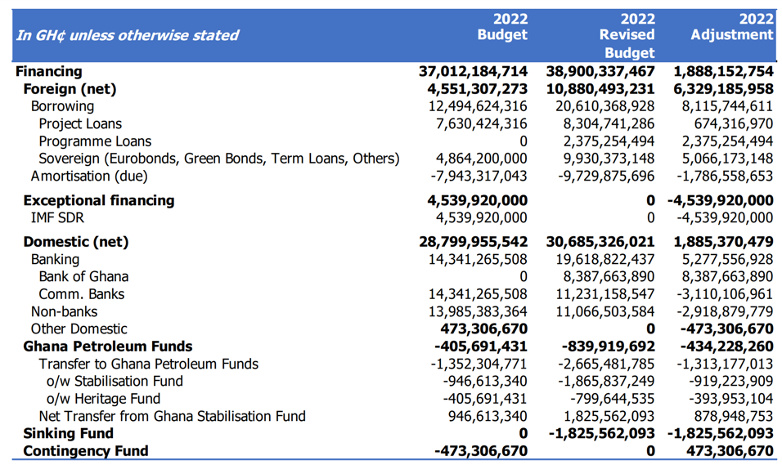

In 2020, the Ghanaian authorities lowered the cap on the Stabilization Fund above which funds must be sent to the Sinking Fund to deal with debt, from $300 million to $100 million despite raising a record amount of roughly $7 billion in external finance. Despite repeated warnings by the political Opposition to restore the Sinking Fund to its status as a debt risk management tool, such practices have only intensified.

Drilling Down the Colonial Contrast Point

We must be quick to clarify that we are not in any way trying to suggest that colonial rule was always prudent and modern public financial management in Africa is always bad.

Like today, the experience was quite varied. In the Cape Colony (part of modern-day South Africa), for instance, debt servicing, strongly linked to public works, used to consume more than 70% of government revenue from the 1870s onwards. The equivalent figure in South Africa today is below 10%.

Using colonial reformer Lord Malcolm Hailey’s widely referenced “African Survey”, we can construct a basic comparison across African colonies in the late colonial period from 1936 to 1938. Nyasaland (today’s Malawi) spent 15.8% of government’s revenue on debt servicing. Northern Rhodesia (Zambia today) spent 16.2%. Nigeria spent 21.4%.

And, of course, today, we have African countries like Cote D’Ivoire where debt servicing as a share of government revenue is projected to remain below 18% for the next ten years and even fall to 14.3% in 2027. The corresponding figure for Senegal today is a less reassuring but still modest 24%.

More relevant to the economic historiographical point canvassed earlier in this section about the impact of prudential debt management practices like sinking fund maintenance is the case of the Gold Coast. The Gold Coast (now Ghana) spent just 3.7% on debt servicing in the 1937 to 1938 period. It is even more remarkable to note that this moderation followed a period of fiscal stress due to massive commercial infrastructure investments by the government in the port city of Takoradi. The increase in national productivity induced by these ports and railways however defused the crisis as can be seen in the low debt servicing figures.

In the Belgian Congo, where colonial administration was tragically bad most of the time, it is not surprising that debt servicing costs hit 50% by 1938.

Liquidity & Sustainability Fund

The above discussion is very pertinent to global policy discussions about how to address the sovereign debt stress in Africa, especially the proposal to build a Liquidity & Sustainability Fund (LSF) to boost the secondary market for African government bonds.

If, as has often been argued, the foundation of such schemes is bias-correction, then they are flawed.

In the Ghana case, and increasingly also in Kenya and Nigeria, domestic debt has proven to be the key trigger for government insolvency. In Ghana, the government’s short-term borrowing cost locally is now more than 35%. The weighted borrowing cost over current stock of domestic debt is more than 20% showing that this is not just a recent phenomenon. Domestic debt servicing costs now exceeds 75% of total debt service costs. Clearly, these are not the doings of biased external investors.

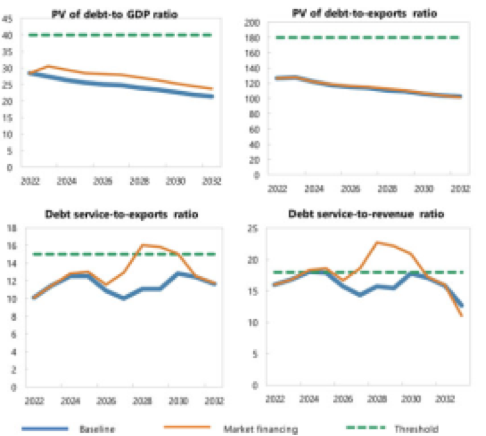

Therefore, anchoring a fund to any notion of perception correction would fail since there is a high risk of the LSF repo mechanism seizing up when most needed due to fundamentals-driven shifts forcing the LSF to regularly push up margins. A development that would defeat the whole liquidity idea.

So now what?

African countries need to recognise the fundamental link of macroeconomic prudence to debt servicing costs. Focusing on managing investor perception as Ghana has for so long done is bound to fail, eventually.

Boring old practices like sinking fund discipline, avoiding spending on infrastructure projects with poor returns (like Ghana’s $450 million plus cathedral and bible museum), enhancing revenue management, and checking the mispricing of state commercial activity are the only real safeguards, not the elaborate financial engineering championed by some proponents of innovations like the LSF.

But if, after all this, a country still has to default, it is important to mind the style as well as the substance.

First, don’t present investors with a fait accompli. Do what the Jamaicans did in 2010 and again in 2013 by setting up a proper local advisory committee filled with both investors and other social actors with a holistic national interest stance. Make all the key data available so that together all parties can come up with a strategy that feels fair.

To date, Ghana has studiously refused to publish the debt sustainability analysis guiding its actions. It has refused to engage any of the country’s sprawling civic factions, not even the hung parliament.

Second, show investors some upside. If they are to help you get things back on track, they need to see signs of future reward. Come up with some instruments that increase their stake in an upturn beyond a general “we are all going to benefit from better times” claim.

In Greece, Grenada and Argentina, they have used various “warrants” or “options” to achieve this. Sometimes these instruments are tied to future macroeconomic performance, such as GDP growth. It is a maxim of elementary finance that options are always valuable. Having a menu of legal and financial technologies tied to a variety of options suited to different classes of creditors increases counterparty appetite for creative thinking, and will more quicker get you to a “yes”.

Third, sometimes “credit enhancements” are impossible to avoid if a government is asking creditors to take steep losses. In Ghana’s case, not only is the government asking investors to forgo roughly 60% of the value of their principal, it has also set things up to make it easier for a future default.

Even local bonds (like the famous ESLA) that had English Law protection are to see those protections vanish. It is hard to win sympathy when you create the impression that you are outsmarting the other party. In 2020, to address a large pile of debt from unpaid subsidies in the energy sector, the government handed over ESLA and Bank of Ghana bonds worth more than half a billion dollars to banks and energy companies. Now, it seeks to impair these bonds, dragging out liabilities dating as far back as 2015 to as late as 2037.

Fourth, be coherent and consistent. Ghanaian leaders have said a bunch of things that have over time turned out to be untrue, like “no principal haircut”. Now, they are assuring people of their intention not to default on short-term securities like treasury bills. Yet, in the debt exchange agreement, the government clearly warns that they reserve the right to default on those too. Such conduct doesn’t breed confidence.

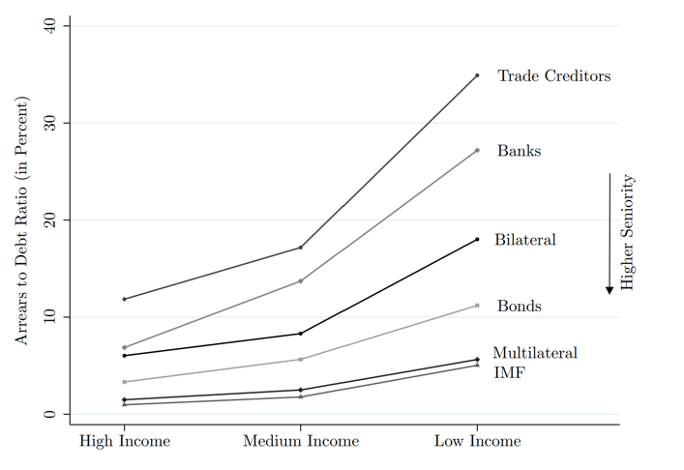

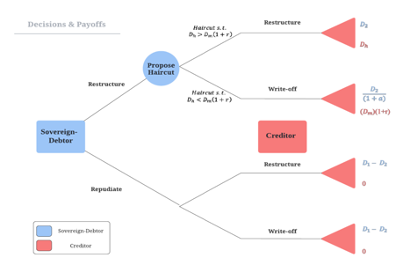

Furthermore, even though bonds are widely considered to be a senior form of debt, sitting just below multilateral finance from the likes of the IMF (see diagram below by Professor Christoph Trebesch of the Kiel Institute), the government appears to be privileging banks in Europe like Deutsche Bank and Chinese state-owned banks, like CDB and China Exim, apparently to preserve its strategic flexibility to keep funding mega-projects ahead of the 2024 elections. Such conduct must come with clear explanations to dispel cynical interpretation.

Fifth, know Game Theory. The government behaves and speaks as if the only option creditors, including external ones who hold local debt[i], have is to take its offer or brave the notoriously slow and sometimes unpredictable Ghanaian courts. But investors, especially the international ones, can also sell their holdings to vulture funds, which specialise in litigation. Likewise, investors can transfer large holdings to individuals (who have been exempted from the default) in complex trust arrangements creating complete confusion. In short, investors have more credible counter-threats than assumed.

[i] PS: In this essay we focus on the domestic debt situation in the Ghana case study both because the government is yet to formally announce its external debt restructuring plans and also because we seek to question the focus on external investor bias and misconduct. There are credible reports that the government intends to offer foreign bondholders a 30% principal haircut, 30% coupon haircut and a 3-year moratorium on paying coupons. Some analysts have stressed the fact that many investors holding Ghana’s international bonds presently bought them at a significant discount due to the ongoing distress. The inference then is that such investors will find a 30% haircut very easy to accept. That would have been more accurate if the government was undertaking a bond buy-back as part of the restructuring. In the current circumstances, there are some nuances. If the debt restructuring leads to further depression of secondary trading, then even those investors who got the bonds at a discount could still suffer considerable losses.

The diagram above is a simple decision tree from game theory created by a Harvard economics undergraduate, Alejandro Jimenez, who won a prize for his thesis on sovereign debt restructuring. In his analysis, he shows that there are situations where a creditor is indifferent to whether sovereign defaults or restructure due to options outside that narrow setup.

Sixth, the law is not always a hindrance. Ghana has decided to proceed with this unprecedented domestic debt default without any legislative process at all. Yet there are exemptions that it believes it is compelled to make that breach hallowed principles of insolvency norm, such as “pari passu”, the idea that all creditors holding the same class of debt deserve identical treatment. Most analysts believe that such twists to standard practice, even if unavoidable, require some legislative guardrails that might actually improve on predictability and make the entire exercise more palatable.

Because the development financing game is a strategic one, it is sensible for a government never to take investors for granted. A smart government’s winning style is always to master the art of the “win–win”.

PS:

[1] PS: In this essay we focus on the domestic debt situation in the Ghana case study both because the government is yet to formally announce its external debt restructuring plans and also because we seek to question the focus on external investor bias and misconduct. There are credible reports that the government intends to offer foreign bondholders a 30% principal haircut, 30% coupon haircut and a 3-year moratorium on paying coupons. Some analysts have stressed the fact that many investors holding Ghana’s international bonds presently bought them at a significant discount due to the ongoing distress. The inference then is that such investors will find a 30% haircut very easy to accept. That would have been more accurate if the government was undertaking a bond buy-back as part of the restructuring. In the current circumstances, there are some nuances. If the debt restructuring leads to further depression of secondary trading, then even those investors who got the bonds at a discount could still suffer considerable losses.

Latest Stories

-

Bawumia joins thousands in Kumasi for burial prayers for Ashanti Regional Imam

3 hours -

Blue Gold Bogoso Prestea Limited challenges government actions in court

3 hours -

Verdicts due for 51 men in Pelicot mass rape trial that shook France

3 hours -

Syria not a threat to world, rebel leader Ahmed al-Sharaa tells BBC

3 hours -

Patrick Atangana Fouda: ‘A hero of the fight against HIV leaves us’

4 hours -

Trinity Oil MD Gabriel Kumi elected Board Chairman of Chamber of Oil Marketing Companies

4 hours -

ORAL campaign key to NDC’s election victory – North America Dema Naa

5 hours -

US Supreme Court to hear TikTok challenge to potential ban

5 hours -

Amazon faces US strike threat ahead of Christmas

5 hours -

Jaguar Land Rover electric car whistleblower sacked

5 hours -

US makes third interest rate cut despite inflation risk

6 hours -

Fish processors call for intervention against illegal trawling activities

6 hours -

Ghana will take time to recover – Akorfa Edjeani

6 hours -

Boakye Agyarko urges reforms to revitalise NPP after election defeat

7 hours -

Finance Minister skips mini-budget presentation for third time

7 hours