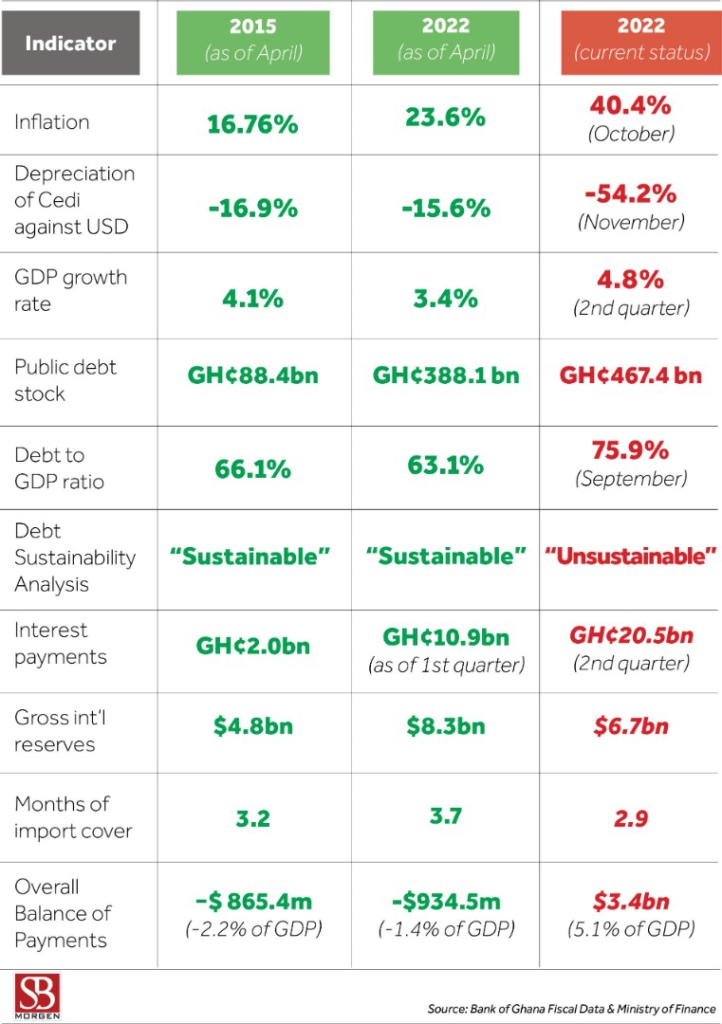

While delivering the much anticipated 2023 budget, Ghana’s Finance Minister, Ken Ofori-Atta, unmasked the nature of Ghana’s debt portfolio, saying the country is finding it difficult to carry a debt burden worth $48.9 billion as of September 2022.

Debt restructuring is the only gateway to access the projected $3 billion IMF bailout package. Barely five days after Ofori-Atta confirmed the debt operation exercise, international credit rating agency Moody’s dropped Ghana’s long-term sovereign bonds ratings.

On 4 December 2022, the government finally announced a debt operation exercise called “Domestic Debt Exchange”, which outlined the nature of debt restructuring for domestic creditors. The Finance Minister indicated that domestic bondholders would be asked to exchange their instruments for new ones under the programme. However, the impact of the domestic debt exchange on investors holding government bonds, particularly small investors, individuals, and other vulnerable groups, will be minimised; hence treasury bill holders will be paid the full value of their investments on maturity.

20 years after Ghana received a total relief of approximately US$3.7 billion, equivalent to US$ 2.2 billion in Net Present Value terms, from all its creditors, it is back in the IMF ‘programmes market’ hoping to shop for another bailout packet worth $3 billion. According to the fund, “in cases where a country’s debt is assessed as unsustainable, the IMF is precluded from providing financing unless the member takes steps to restore debt sustainability, including by seeking a debt restructuring from its creditors.” Like the country’s 16th IMF programme in 2015, the government has decided to freeze public-sector employment next year to reduce expenditure. The monetary policy rate has also been hiked from 24.5% to a record 27% to deal with the over 40% inflation rate.

As Ghana walks the path to its 17th IMF bailout, precipitated by a debt sustainability problem, the country will experience the immediate impact, such as losses to investors, shaking of the financial industry, potential bank collapses and stifling of production due to how expensive it will be to procure financing. Added to these is the long-term effect of losing confidence in the Ghanaian government’s security. It will be hard for a government that has defaulted on domestic debt in the currency it prints to convince investors to buy its securities in international currencies that it does not control. This will take at least a decade to restore.

Latest Stories

-

Government is “suppressing information” about power sector challenges – IES Director

3 mins -

Majority of our debts caused by forex shortfall – ECG Boss

29 mins -

Pan-African Savings and Loans supports Ghana Blind Union with boreholes

58 mins -

Bole-Bamboi MP Yussif Sulemana donates to artisans and Bole SHS

1 hour -

Top up your credit to avoid potential disruption – ECG to Nuri meter customers

1 hour -

We’ll cut down imports and boost consumption of local rice and other products – Mahama

4 hours -

Prof Opoku-Agyemang donates to Tamale orphanage to mark her birthday

5 hours -

Don’t call re-painted old schools brand new infrastructure – Prof Opoku-Agyemang tells gov’t

6 hours -

Sunon Asogli plant will be back on stream in a few weeks – ECG

6 hours -

ECOWAS deploys observers for Dec. 7 election

6 hours -

73 officers commissioned into Ghana Armed Forces

6 hours -

Impending shutdown of three power plants won’t happen – ECG MD

6 hours -

Ghana shouldn’t have experienced any ‘dumsor’ after 2017 – IES Boss

7 hours -

Lamens flouted some food safety laws in re-bagging rice – Former FDA Boss Alhaji Hudu Mogtari

7 hours -

Afcon exit: Our issue is administrative failure and mismanagement, not lack of talent – Saddick Adams

8 hours