Fitch Solutions has maintained that Ghana will reach a staff-level agreement with the International Monetary Fund (IMF) by the first quarter of 2023.

This will mean that the country could secure a programme from the Fund by the end of quarter 1, 2023 or the second quarter of 2023.

Some economists and experts were anticipating that the country could reach a staff-level agreement with the Fund before the end of 2022 to pave way for a programme by the first quarter of 2023.

But in its latest paper on “Division within Ghana's Ruling Party to Weigh on Political Stability”, the international research firm also said should the Finance Minister, Ken Ofori-Atta, be replaced, negotiations with the IMF would likely remain largely unaffected.

“While Ofori-Atta remained opposed to an IMF bailout – we believe that he would take a more accommodative approach towards negotiations with the Fund. As such, we believe that a change of finance minister would most likely not impact the timeline of IMF negations and we would retain our view that a staff-level agreement will be reached in Q123 [quarter 1, 2023]”, it explained.

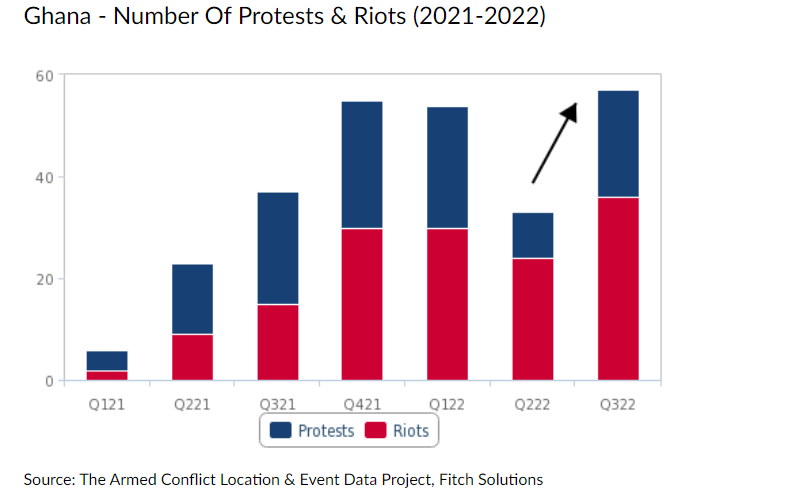

Government to face additional pressure from frequent protests

Furthermore, it said the government will face additional pressure from more frequent protests and industrial action.

“Worsening living standards amid rising consumer prices – inflation reached 40.4% year-on-year in October 2022, the highest reading since 2001 – and tighter monetary conditions have led to a 72.7% quarter-on-quarter increase in protests and riots across in quarter 3 2022. The country has also seen large industrial action in recent months, including a three-day retail strike in Accra in October [2022]".

Inflation to remain elevated, weighing on living standards

Fitch Solutions also expects inflation to remain elevated in the months ahead.

“Given that inflation is primarily driven by currency weakness, we expect price growth to remain elevated in the months ahead. Indeed, significant capital and financial account outflows caused by weakening investor sentiment will continue to weigh on the currency”.

“Our view is further informed by the fact that previous periods of significant exchange rate weakness in Ghana all lasted roughly 12-14 months, suggesting that the cedi will continue to depreciate into quarter 1, 2023 (the current sell-off started in January 2022). This will keep inflation high, weighing on living standards and eroding support for the government”.

Latest Stories

-

Mimmy Yeboah: Blending heritage with global sophistication, confidence redefined through couture

4 mins -

Akufo-Addo commissions 97-km Tema-Mpakadan railway line

32 mins -

Majority requests recall of Parliament

48 mins -

Kanzlsperger and Professor Quartey support WAFA with medical Donation

49 mins -

Gideon Boako donates 10 industrial sewing machines to Yamfo Technical Institute

1 hour -

‘Golden Boy’ Abdul Karim Razak honored at WAFU-B general assembly

1 hour -

Buipewura Jinapor secures Vice Presidential position in National House of Chiefs with record votes

2 hours -

2024 election: I want results to come out like ‘milk and honey’ – Toobu

2 hours -

Ghana’s Henry Bukari hands over chairmanship of ECOWAS Brown Card Council of Bureaux

2 hours -

Residents of Dome-Kwabenya on edge ahead of December elections

2 hours -

Moffy drops new single ‘Wo’, blending culture and modernity

2 hours -

Don’t bring soldiers to polling stations – Martin Kpebu

3 hours -

Ogyeahohuo Yaw Gyebi II retained as President of National House of Chiefs

3 hours -

Embrace ICT to fit in digital world – Ho NYA boss to youth

4 hours -

We don’t want armed soldiers at polling stations – Tanko-Computer

4 hours