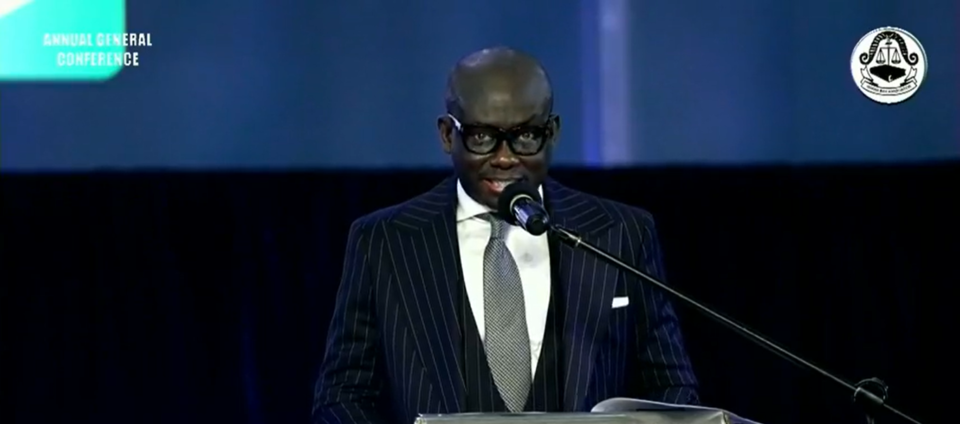

I am particularly delighted to speak to you on the first morning of this truly unique forum, the 39th Cambridge Symposium on Economic Crime. My sincere thanks go to the University of Cambridge, in particular, the founder, the Co-Chairman of the Symposium, and sometime Fellow of Jesus College, Cambridge, Prof. Barry Rider, for inviting me.

I salute his extraordinary efforts in sustaining this remarkable activity over the past forty (40) years. This is my second appearance here – the first in 2017, in my previous capacity as Deputy Attorney-General and Deputy Minister for Justice of Ghana. I have found the organisation of this forum simply amazing.

Recording at least 2000 participants from over 100 countries annually since 1982 and drawing leading personalities in law enforcement, politics and government all over the world, the Cambridge Symposium on Economic Crime has provided a platform for analysis and examination of the never-ending and ever-evolving threats facing the global financial system as a result of criminal and other nefarious activity.

It is correct to say that the Cambridge symposium has established itself as not just a talk shop but has earned the enviable track record of being a global platform that delivers practical solutions to economically motivated crime and misconduct worldwide.

The breadth of topics to be discussed at this year’s symposium covers the complexity of the criminal and subversive activity, which exposes the global financial sector to grave danger. Issues like reinforcing corporate integrity, breaches of trust, asset recovery, international cooperation, irregular immigration, corporate criminal responsibility, non-conviction-based forfeiture, and the role of banks in the control and interdiction of corruption reflect the multi-dimensions of economic crime.

A discussion of them will reinforce the reputation of this forum for unravelling and getting to the bottom of the intricate and sophisticated schemes deployed to commit or facilitate improper conduct in the global financial space.

The theme for this year’s forum “Selling status – insider crime and abuse”, addresses a very practical reality in the financial world today.

Recent phenomenon of economic crime in Ghana

As Ghana’s Attorney-General and Minister for Justice, I am constitutionally responsible for the initiation and conduct of all prosecutions of criminal offences in the Republic. I superintend agencies of state involvement in the fight against economic crime and corruption and collaborate with Cabinet colleagues in this regard. Since the last time I was here, in 2017, Ghana has had its fair share of threats to the financial sector.

There has been a banking sector crisis which shook the foundations of the financial system in Ghana. Between August 2017 and January 2020, Ghana was hit by a severe banking crisis that affected several indigenous banks, as a result of which the central bank ordered the take-over of some of the banks by another indigenous Ghanaian bank, the Ghana Commercial Bank. The central bank cited the insolvency of the banks in question as the major reason for the revocation of the operating licences of the affected banks. In addition to the take-over of some banks, five indigenous banks were consolidated to form a new bank called the Consolidated Bank Ghana Limited.

A deeper examination of the banking sector crisis that rocked the financial environment in Ghana showed that poor corporate governance, non-performing loans, breach of directors’ fiduciary obligations, credit risk and regulatory lapses were responsible for the vulnerabilities the banks were exposed to. Internal auditors who were required to superintend proper accounting practices had become complicit in illicit practices and heavily immersed in cover-ups for executive directors. All this led to insolvency and under capitalisation of the banks.

The recent Ghanaian banking sector crisis held ramifications for the entire economy of Ghana. It was the most severe economic crisis to affect Ghana since its independence in 1957. The COVID-19 pandemic dealt a further devastating blow to the economy. The crisis was a vivid manifestation of the devastation that can be unleashed on an economy by a poorly regulated financial system.

To deter a reoccurrence of the situation, 20 individuals and companies have been put on trial for offences bordering on stealing, fraudulent breach of trust, money laundering, dishonestly receiving and wilfully causing financial loss to the state.

Another phenomenon that afflicted the financial sector of Ghana between 2018 and 2020 was the emergence of many unlicensed entities operating illegally. The leaders of such entities often lived a lavish lifestyle on the proceeds of their illicit activities.

Prominent among such entities was an amorphous organisation operating a microfinance institution under the guise of – guess what - gold trading and illegally using the name of a bank. It called itself Menzbank. Apparently, Menzgold, as it was also called, had been dealing in the purchase and deposit of gold collectibles from the public and issuing contracts with guaranteed returns to clients without a licence from the relevant authorities.

Against caution from the Central Bank, tens of thousands of individuals got hooked on the scheme devised by the company. Following the close down by the Securities and Exchange Commission, the customers could not retrieve their funds. The company relied on the greed and ignorance of thousands of otherwise hardworking Ghanaians who were prepared to pay their life savings to the suspects in the case, resulting in losses worth millions of dollars.

The situation caused misery and distress to many homes and unleashed a social crisis as riots and demonstrations broke out on the streets of Accra and other parts of the country. In real terms, people lost their homes, and some marriages have even broken up as a result of the Menzgold saga. Indeed, one lawyer suggested that the story of Menzgold could cause a civil war in Ghana in a manner akin to the civil war in Albania in 1997 caused by aggrieved customers of a Ponzi scheme.

By the Grace of God, Ghana was saved from such a situation as a result of the prompt action taken by authorities at the helm of the financial system. I am happy to state that after painstaking investigations, dockets on that financial crime are almost ready for prosecution to commence in earnest.

The Office of the Attorney-General is prosecuting other high-profile cases involving the offences of wilfully causing financial loss to the State, stealing, corruption, fraud, procurement breaches, and money laundering. These cases have as their sole object the principle of holding public officers to account and involve sums of over $850 million.

Important Ghanaian legislation to combat economic crimes

The current Government led by Nana Addo Dankwa Akufo-Addo recognises that the most enduring way to fight corruption and protect the financial sector is by strengthening the regime for so doing. In this regard, with a clear understanding that corruption thrives in an atmosphere conducive to its concealment and that access to information is a vital tool in the fight against corruption, the Government ensured the passage of the Right to Information Act 2019 (Act 989).

Other bold legislations introduced by the Government to curb official wrongdoing in the public sector are:

the Witness Protection Act, 2018 (Act 975)

Anti-Money Laundering Act, 2020 (Act 1044),

Corporate Restructuring and Insolvency Act, 2020 (Act 1015),

Companies Act, 2019 (Act 992),

Revenue Administration (Amendment) Act, 2020 (Act 1029),

State Interests and Governance Authority Act, 2019 (Act 990), and

Real Estate Agency Act, 2020 (Act 1047).

The new Companies Act, in particular, represented a giant step in the quest for sound corporate governance in Ghana.

By virtue of a variety of measures introduced by the Companies Act to ensure the verification of information entered on the Companies Register, the duty to provide particulars of beneficial owners under the Act, among others, the recently established Office of the Registrar of Companies has become a legitimate partner of the government in its effort to stamp out corruption and financial indiscipline.

Mr. Chairman, the complexity of modern-day economic crimes has necessitated the introduction of more non-custodial sentences and, in appropriate cases, non-conviction-based punishments. As Attorney-General, I have sought to introduce legislation which, if properly applied, can speed up the administration of justice and ease congestion in our courts. A few weeks ago, Parliament enacted an amendment to the Criminal Procedure Act of Ghana to introduce plea bargaining into Ghana’s criminal jurisprudence.

To the extent that economic crimes are not exempted from an application of plea bargaining procedures, the nation stands to avoid long and costly trials which have no guarantee of compensation and restitution for victims of the offences, through a sound application of those procedures.

International effort and cooperation to tackle economic crimes

I will conclude by suggesting that the multiple manifestations of economic crime show that there is no single structure under which wrongdoers operate. Wrongdoers exploit differences between countries to further their objectives, enriching their organisations, expanding their power and avoiding detection or apprehension. They gain influence in government, politics and commerce through corrupt and illegitimate means. The need for states to cooperate in combating the threat of economic crimes is, therefore, more than imperative.

In Africa, the launch of the Africa Continental Free Trade Area (AfCTA), whilst presenting Africa with its greatest opportunity to show to the world the strength of its potential and the entrepreneurial spirit of the people, has unleashed a new set of issues of concern to law enforcement authorities. These take the form of migratory problems, social integration challenges, the good old phenomenon of corruption, money laundering and environmental challenges.

Economic crimes threaten the prosperity of nations and weaken public confidence in the government of every nation. They can, not only undermine the values we hold dear as a society but also prop up the kind of authoritarian regimes that wreak havoc in the world. We are acutely aware of the knock-on effect of corruption on human rights internationally and on our efforts to combat environmental damage.

Human rights and nature are the casualties of this system of profiteering, which, in reality, is war by other means.

The punishment of corruption requires the establishment of a fair, honest and efficient justice system. Thus, the need to strengthen criminal justice must sit right at the top of our developmental agenda. Criminals ought to be deprived of their assets in order to reduce the impact of their actions and the inspiration they serve to others on the continent. Crime must not be rewarding.

I wish you a fruitful week as we listen to the rich insight of distinguished and accomplished speakers from around the world gathered here.

Thank you. God bless us all!!!

Latest Stories

-

Afenyo-Markin still suffering from the massive defeat – Fifi Kwetey

2 minutes -

Retain Afenyo-Markin as NPP leader, he has experience – Deputy Speaker

13 minutes -

Kufuor didn’t leave behind a strong economy – Fifi Kwetey

17 minutes -

It won’t be business as usual, remain humble – Fifi Kwetey to party members

1 hour -

Ebenezer Ahumah Djietror appointed as new Clerk to Parliament

2 hours -

Actress Benyiwaa of ‘Efiewura’ TV series dead

2 hours -

Ashanti Regional Chief Imam dies at age 74

3 hours -

Africa Arts Network calls for tax reform to save Ghana’s theatre industry

3 hours -

SSTN Ghana Chapter reaffirms commitment to economic growth under new leadership

3 hours -

Inlaks strengthens leadership team with key appointments to drive growth across sub-Saharan Africa

4 hours -

Green Financing: What Ghana’s Eco-startups need to know

4 hours -

CHAN Qualifiers: Amoah confident of beating Nigeria

4 hours -

Governments deprioritising health spending – WHO

4 hours -

Lordina Foundation brings Christmas joy to orphans

4 hours -

Yvonne Chaka Chaka to headline ‘The African Festival’ this December

4 hours