Twitter on Thursday announced its financial results for the first quarter 2022.

First quarter 2022 operational and financial highlights

Except as otherwise stated, all financial results discussed below are presented in accordance with generally accepted accounting principles in the United States of America, or GAAP.

As supplemental information, we have provided certain non-GAAP financial measures in this press release's supplemental tables, and such supplemental tables include a reconciliation of these non-GAAP measures to our GAAP results.

The sum of individual metrics may not always equal total amounts indicated due to rounding.

- Q1 revenue totaled $1.20 billion, an increase of 16% year-over-year, or 19% on a constant currency basis, reflecting headwinds associated with the war in Ukraine. When excluding MoPub and MoPub Acquire, year-over-year growth was 22%.1

- Advertising revenue totaled $1.11 billion, an increase of 23%, or 26% on a constant currency basis.

- Subscription and other revenue totaled $94 million, a decrease of 31% year-over-year, or a decrease of 5% year-over-year when excluding MoPub from the year ago period.

- Costs and expenses totaled $1.33 billion, an increase of 35% year-over-year. This resulted in an operating loss of $128 million and -11% operating margin, compared to an operating income of $52 million or 5% operating margin in the same period of the previous year.

- Stock-based compensation (SBC) expense grew 60% year-over-year to $177 million and was approximately 15% of total revenue.

- Net income was $513 million, representing a net margin of 43% and diluted EPS of $0.61.

- Net income of $513 million includes a pre-tax gain of $970 million from the sale of MoPub for $1.05 billion and income taxes related to the gain of $331 million. This compares to net income of $68 million, a net margin of 7% and diluted EPS of $0.08 in the same period of the previous year.

- Net cash provided by operating activities in the quarter was $126 million, compared to $390 million in the same period last year. Capital expenditures totaled $161 million, compared to $179 million in the same period last year.

- Average monetizable daily active usage (mDAU)[2] was 229.0 million for Q1, up 15.9% compared to Q1 of the prior year.

- Average US mDAU was 39.6 million for Q1, up 6.4% compared to Q1 of the prior year.

- Average international mDAU was 189.4 million for Q1, up 18.1% compared to Q1 of the prior year.

In December 2021, we completed the wind down of MoPub Acquire and on January 1, 2022, we closed the sale of MoPub to AppLovin. As a reminder, MoPub revenue was previously reported in Subscription and Other Revenue, and MoPub Acquire revenue was previously reported in Advertising Revenue.

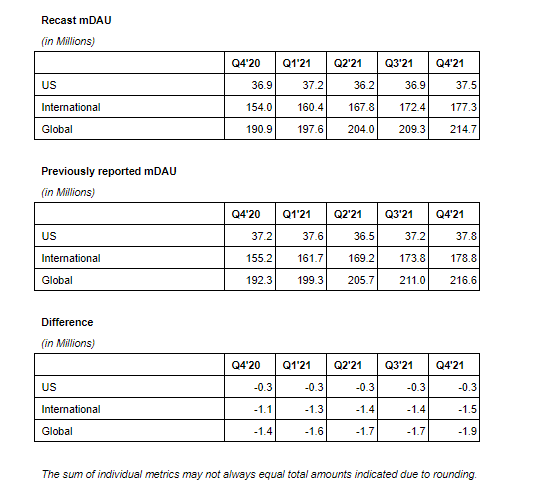

An error introduced in March of 2019 resulted in an overstatement of mDAU from Q1'19 through Q4'21. See the section in this document titled "mDAU recast" for the full description.

In February 2022, we announced that our board of directors authorized a share repurchase of up to $4.0 billion of our common stock, replacing our previously authorized $2.0 billion share repurchase program from 2020. As part of the new program, we entered into a $2.0 billion accelerated share repurchase in February 2022.

Given the pending acquisition of Twitter by Elon Musk, we will not be providing any forward looking guidance, and are withdrawing all previously provided goals and outlook.mDAU Recast

In March of 2019, we launched a feature that allowed people to link multiple separate accounts together in order to conveniently switch between accounts. An error was made at that time, such that actions taken via the primary account resulted in all linked accounts being counted as mDAU.

This resulted in an overstatement of mDAU from Q1'19 through Q4'21. The table below provides updated values for mDAU from Q4'20 to Q4'21 alongside historical reported values for those same time periods.

We are including one decimal place for both the absolute values and growth rates to give more detail around the magnitude of the changes.

Note that recast data is not available prior to Q4'20 due to data retention policies, but our estimates suggest the prior period adjustments are not likely to be greater than those in Q4'20.

For more information regarding the non-GAAP financial measures discussed in this press release, please see "Non-GAAP Financial Measures" and the reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP below.

Elon Musk Transaction

As announced on April 25, 2022, we entered into a definitive agreement to be acquired by an entity wholly owned by Elon Musk, for $54.20 per share in cash. Upon completion of the transaction, Twitter will become a privately held company.

The transaction is subject to customary closing conditions and completion of regulatory review and Twitter's stockholder approval.

The transaction, which is expected to close in 2022, has been approved by the board of directors of Twitter.

First Quarter 2022 Webcast and Conference Call Details

In light of the proposed transaction with Mr. Musk, as is customary during the pendency of an acquisition, Twitter will not be hosting a conference call, issuing a shareholder letter, or providing financial guidance in conjunction with its first quarter 2022 earnings release.

For further detail and discussion of our financial performance please refer to our upcoming quarterly report on Form 10-Q for the quarter ended March 31, 2022.

Latest Stories

-

GFA set to launch Girls for Goals campaign in Keta

26 seconds -

Siisi Baidoo wins Male Vocalist at 2024 Praise Achievement Awards

5 mins -

Perez Musik celebrates marriage with breathtaking photos

32 mins -

I am not ready to sign any artiste to my record label – Kuami Eugene

59 mins -

Gov’t spokesperson on governance & security calls for probe into ballot paper errors

1 hour -

Free dialysis treatment to be available in 40 facilities from December 1 – NHIA CEO

1 hour -

NHIA will need GHC57 million annually to fund free dialysis treatment – NHIA CEO

1 hour -

MELPWU signs first-ever Collective Agreement with government

2 hours -

I’ve not been evicted from my home – Tema Central MP refutes ‘unfounded’ reports

2 hours -

After Free SHS, what next? – Alan quizzes and pledges review to empower graduates

2 hours -

Wontumi FM’s Oheneba Asiedu granted bail

2 hours -

Alan promises to amend the Constitution to limit presidential powers

3 hours -

Ghana to face liquidity pressures in 2025, 2026 despite restructuring most of its debt – Fitch

3 hours -

NPP’s record of delivering on promises is unmatched – Bawumia

3 hours -

Mahama: It’s time to dismiss the incompetent NPP government

3 hours