The resilience of the Ghanaian economy had not been tested until the inception of Covid-19 in Ghana in March 2020. Following 3 weeks of lockdown, the economy failed to show resilience and there was no option but to open for business to go on as usual.

The macro fundamentals now have taken a nose-dive and are impacting individuals and businesses. Public sentiments as a result of the impact of the failing economy have intensified this year.

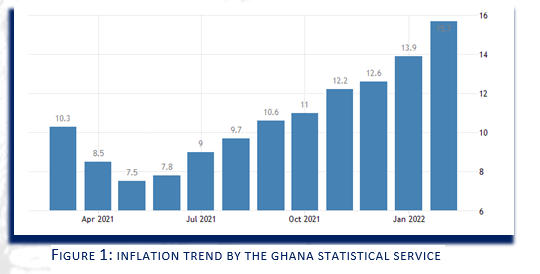

General price levels have escalated significantly, with inflation for February hitting 15.7%, the highest in 6 years, and compared to January’s 13.9%.

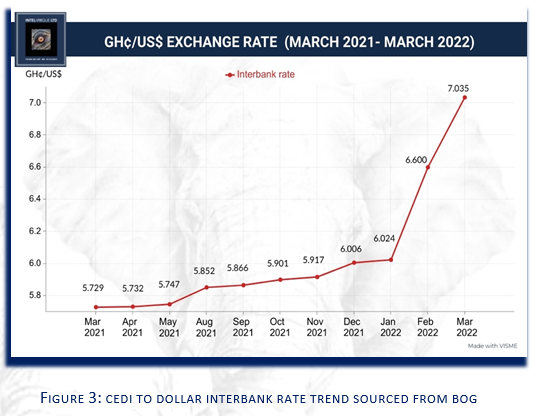

Following persistently high inflation, the Monetary Policy Committee of the Bank of Ghana had to increase the policy rate to 17% from 15.5% implying high average lending rates which will ultimately crowd out the private sector. The exchange rate recorded this year is the worst among Africa’s top currencies given a depreciation rate of approximately 14%.

Consequently, the cost of doing business has increased with importers and freight forwarders taking the biggest hit. At the end of 2021, debt stock had increased to GH¢351.8bn (80.1% of GDP), compared to GH¢218.2 bn (61.2% of GDP) recorded in December 2020. The figures highlight a worrying situation which required measures to be taken. A successful cabinet retreat for the 1st quarter-2022 focused on the economy leading to some outlined measures to ease hardship and bring the economy back to a sound footing.

GOVERNMENT ACTIONS & IMPLICATIONS ON BUSINESSES

2.1 Expenditure Cutting Measures

The government has approved 12 expenditure measures aimed at saving the country GH¢ 3.5bn and reducing the projected 7.4% fiscal deficit. Some of the key savings include:

- Fuel coupons that cost the state GH¢124m will be reduced to GH¢62m, equating to 50% savings.

- Meetings and conferences will save the country GH¢200m from the original budget of GH¢400m as stated by the Finance Minister, Ken Ofori-Atta.

Inferring from the 2022 Budget Statement and Economic Policy document, the total budgeted expenditure amounted to GH¢135.6bn. A planned reduction in government expenditure will dampen inflationary pressures because money in circulation needed by individuals to make demands will reduce thereby ensuring stable prices on the market. Consumers/individuals will have their cost of living stabilized for this period and standards of living improved as a result.

On the contrary, the reduction in government expenditure will in the long term reduce aggregate demand. Pumping of money into the economy will slow down, creating a ripple effect: income growth will slow down, businesses would not be able to expand as expected and hence leading to a slowdown in employment.

The depreciation of the cedi will be checked in the short term with the government’s plan to inject $2bn into the economy. This money will be borrowed from the external market. Although the approach by the government is unsustainable, it will bring some respite to the business environment. It is expected that this intervention will stabilize the forex market.

Unfortunately, borrowing to fund this intervention could be counterproductive as it will increase the high debt stock. This measure also reinforces the fiscal measure above (cutting down government expenditure) in checking rising inflation. It is worth noting that the depreciation of the cedi is partly to blame for the rising inflation experienced in the last few months. As the cedi depreciates importation becomes, consequently increasing the burden on consumers (high prices of goods and services).

2.2 Fuel Price Mitigation

Fuel prices at the pumps will see a 15pesewas reduction per litre at pumps by reducing margins. The reduction could have been more than what is being considered. The average price of fuel this year has reached $100 per barrel as compared to the government’s projected value-$60 per barrel.

The trend suggests the price will hover around $100 per barrel till the end of the year. The government will be making a windfall profit which will be more than enough to meet the projected tax revenue imposed on fuel. It would have been more prudent to further reduce some of the taxes on fuel to bring more relief to Ghanaians.

Persistent increases in the price of fuel since the turn of the year have led to a 15% rise in transport fares and subsequently affected other sectors of the economy. Businesses have had their cost of production increase significantly. Coupled with the efforts to ensure stability in the forex market, the short to medium term is expected to see the cost of doing business stabilized and consequently stability in the prices of goods on the market.

2.3 Revenue Measures

The fiscal measures were not one-sided. Government also laid down measures to drive revenue mobilization. On the overall economy, the fiscal deficit is expected to be better than the 7.4% projected by the government by end of 2022.

A potential area of taxation that has remained underexplored, property tax, will be efficiently capitalized to boost total revenue. The implementation and collection of the revised property rate will commence by end of April 2022.

Tax compliance is expected to be enhanced provided improvements to Ghana's personal and property tax systems and customs will be taken seriously. The implication to individuals is that rent charges will go up as a result. Already, prices of building materials are escalating by the day.

A few measures have also been introduced to ensure efficiency in mobilizing revenue by the Ghana Revenue Authority (GRA) and the Customs Division of the GRA. Digitalisation will be reinforced to remove human interference in revenue mobilisation. Over the years, taxpayers experience a manual and arduous process to file their taxes. A simplified tax-filing mobile app for all eligible taxpayers will be rolled out by July 2022.

Also, E-VAT/E-Commerce/E-Gaming initiatives are set to be implemented by end of April 2022. Lastly, a “No Duty – No Exit” policy will be enforced at the MPS Terminal at the Tema Port to improve revenue collection.

The Revenue Assurance, Compliance, and Enforcement (RACE) Programme by the Ghana Revenue Authority will be rolled out to plug revenue leakages, especially at the ports and the infamous fuel bunkering and small-scale mining exporters cabal.

The controversial passing of the e-levy will see citizens pay the new rate of 1.5%. The bill which has been assented to by the President will make electronic payments and settlements expensive to consumers and businesses. There is the likelihood that individuals and businesses may drift away from significant gains of online payment platforms resulting in a return to cash-based transactions which present greater associated security risks.

Also, government businesses will be fast-tracked to ensure that the Tax Exemptions Bill, and Fees and Charges Bill which have been in parliament since 2019 are passed soon. With these, some respite given to businesses will be reversed or drastically reduced. The mining sector especially will be hard hit once they are passed. It Is worth noting that Ghana loses GH¢5bn through tax exemptions. Lastly, the government will partner with the private sector to introduce digital systems to monitor quarrying, sand winning and salt winning to get more revenues from our natural resources.

3.0 CONCLUSION

The measures put in place by the government are laudable and a glimmer of hope for Ghanaians in the short term. But there are doubts amongst a section of Ghanaians when it comes to the implementation of these measures. The doubts emanate from the mismanagement that went on during the Covid-19 era. Ghanaians can only hope that these measures will be strictly enforced, with a proper monitoring system in place to gauge progress at points in time to have a full impact on the economy.

Latest Stories

-

IFRS 17 is one of biggest changes to financial reporting standards in insurance industry – Deloitte

5 seconds -

Enimil Ashon: Whose polls do you believe: ‘Global Info or Prof Sarpong?

3 mins -

Ghana Climate Innovation Centre welcomes 25 businesses into Cohort 10

8 mins -

ADB will continue to enhance customer value and service experience – Managing Director

10 mins -

Colour Cure Exhibition highlights art’s role in healing and advocacy

11 mins -

GPL 2024/25: Aduana FC sack coach Yaw Acheampong after poor run

14 mins -

John Dumelo pays ¢10,400 in outstanding fees for visually impaired law student facing deferral

16 mins -

CHRAJ clears Rev. Kusi Boateng of conflict of interest, says he doesn’t own 2 passports with different names

19 mins -

We’ll restore hope by cutting down taxes and avoiding unreasonable borrowing – Ato Forson

23 mins -

14th Edition of Tech in Ghana Conference launched in Accra

24 mins -

Manifesto clash: NPP, NDC spar over water, hygiene, sanitation and climate change

30 mins -

Ellembelle MP constructs new health facility at Santaso to serve several communities

35 mins -

Kwasi Appiah wanted to axe Ayew brothers and Wakaso from Black Stars – Ernest Thompson reveals

42 mins -

AngloGold Ashanti empowers PWDs in Obuasi East to harness 10-year socio-economic development plan

45 mins -

‘Dumsor’ won’t go anytime soon, we need 2 years to stabilize- IES

51 mins