Audio By Carbonatix

Government is considering the reintroduction of the Electronic Transaction Levy percentage charge from 1.75 % to 1.5%.

This comes after the Deputy Majority Leader, Alexander Afenyo-Markin revealed that the Finance Minister, Ken Ofori-Atta, will withdraw the controversial E-levy in Parliament and re-introduce same.

Mr Markin made this known whiles presenting the business statement for next week to the House.

He said the e-levy will be withdrawn by government on Tuesday February 15, 2022.

He also noted that it will further be reintroduced after it has been reviewed on Friday, February 18, 2022.

Members of Parliament were however encouraged to “participate fully in the consideration of the Bill for the passing of a good piece of legislation for the benefit of all.”

Earlier, government had hoped to get the buy-in of the NDC MPs for the Bill to be passed.

This was after telecommunication companies agreed to reduce their 1% charge on transactions by 0.25%.

If this was upheld, the rate would be reduced from 1.75% levy to 1.5%.

But it was rejected by the Minority.

About E-levy

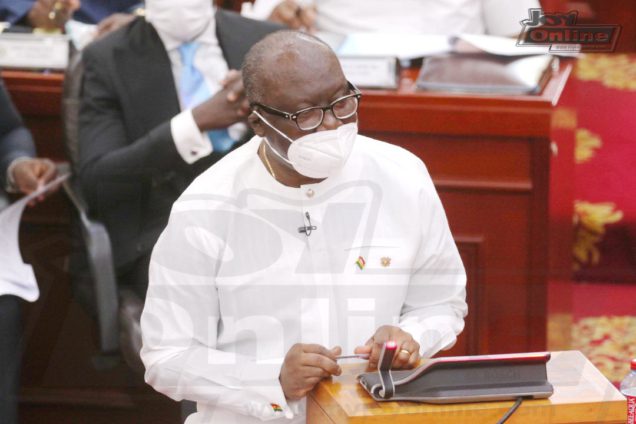

Finance Minister Ken Ofori-Atta, presenting the 2022 budget on Wednesday, November 17, announced that the government intends to introduce an Electronic Transaction Levy (e-levy).

The levy, he revealed, is being introduced to “widen the tax net and rope in the informal sector”. This followed a previous announcement that the government intends to halt the collection of road tolls.

The proposed levy, which was expected to come into effect in January, 2022, is a charge of 1.75% on the value of electronic transactions. It covers mobile money payments, bank transfers, merchant payments, and inward remittances. There is an exemption for transactions up to GH¢100 per day.

Explaining the government’s decision, the Finance Minister revealed that the total digital transactions for 2020 were estimated to be over GH¢500 billion (about $81 billion) compared to GH¢78 billion ($12.5 billion) in 2016. Thus, the need to widen the tax net to include the informal sector.

Although the government has argued that it is an innovative way to generate revenue, scores of citizens and stakeholders expressed varied sentiments on its appropriateness with many standing firmly against it.

Even though others have argued in support of the levy, a section of the populace believe that the 1.75% e-levy is an insensitive tax policy that will deepen the already prevailing hardship in the country.

Latest Stories

-

Ghana’s global image boosted by our world-acclaimed reset agenda – Mahama

3 minutes -

Full text: Mahama’s New Year message to the nation

4 minutes -

The foundation is laid; now we accelerate and expand in 2026 – Mahama

23 minutes -

There is no NPP, CPP nor NDC Ghana, only one Ghana – Mahama

25 minutes -

Eduwatch praises education financing gains but warns delays, teacher gaps could derail reforms

39 minutes -

Kusaal Wikimedians take local language online in 14-day digital campaign

1 hour -

Stop interfering in each other’s roles – Bole-Bamboi MP appeals to traditional rulers for peace

2 hours -

Playback: President Mahama addressed the nation in New Year message

2 hours -

Industrial and Commercial Workers’ Union call for strong work ethics, economic participation in 2026 new year message

4 hours -

Crossover Joy: Churches in Ghana welcome 2026 with fire and faith

4 hours -

Traffic chaos on Accra–Kumasi Highway leaves hundreds stranded as diversions gridlock

4 hours -

Luv FM Family Party in the Park: Hundreds of families flock to Luv FM family party as more join the queue in excitement

4 hours -

Failure to resolve galamsey menace could send gov’t to opposition – Dr Asah-Asante warns

4 hours -

Leadership Lunch & Learn December edition empowers women leaders with practical insights

4 hours -

12 of the best TV shows to watch this January

5 hours