Ghana’s Finance Minister says it will take sacrifice and “burden-sharing as a people with one language” to transform the country’s economy.

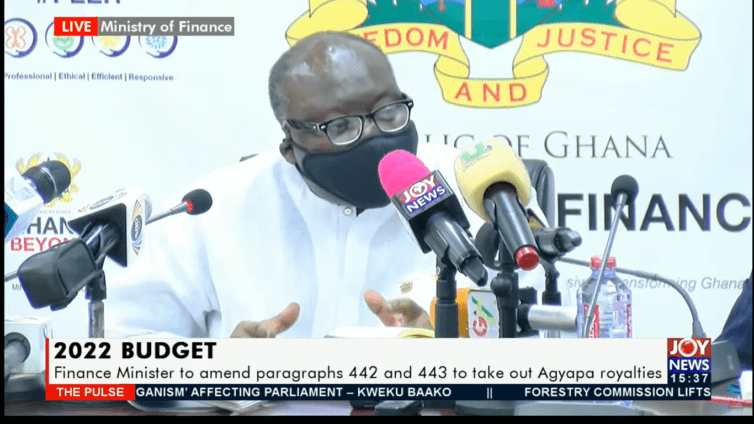

Ken Ofori-Atta who was speaking at a press briefing to, among others, court support for the recently introduced electronic transaction levy, popularly known as e-levy, said the initiative will help to widen the country’s tax base and generate revenue.

According to him, “out of about 18 million potential income taxpayers, only 2.4million persons, approximately 8% of the total population, are registered as personal income taxpayers as of August, 2021", hence the need to widen the tax base so as to be able to service the country’s debt and curb unemployment.

“Only 45,109 entities are registered as corporate taxpayers while 54,364 persons are registered as self-employed taxpayers at the Ghana Revenue Authority; and there are about 17 million registered voters and about 19 million active mobile money accounts.

“In using the 17 million registered voters or the 19 million mobile money accounts as a proxy for Ghanaians that are of adult age and economically active, and comparing it to the 2.4 million Ghanaians who pay income tax, we are confronted with the stark reality that the structure of our economy is quite informal, unlike the western economies, and as such, the traditional tax handles, like the personal income tax, also known as PAYE, may not be as effective in raising the required revenue” the Finance Minister explained.

Again, Mr. Ofori-Atta stressed that Ghana’s GDP of 12.2% is lower than other African countries and must therefore be addressed. He emphasized that the development is a poor reflection on the country and called for a change in the narrative.

"As I mentioned in my Budget Speech, recent economic data suggests that the overall tax to GDP ratio for SSA in 2018 was 16.5%. The tax to GDP ratio for Ghana in 2019 was estimated to be 12.2%. Our tax-to-GDP ratio is lower than our peer countries in West Africa and significantly lower than many developed nations. (South Africa - 26.7%, Senegal - 16.4%, SSA average-16.5%, Ghana-12.2% in 2019).

"These statistics are a poor reflection on the country and highlight the need to change the narrative."

Government introduces Electronic Transaction Levy

Government has decided to place a levy on all electronic transactions to widen the tax net and rope in the informal sector.

The Electronic Transaction Levy or E-Levy covers electronic transactions, including mobile money payments, bank transfers, merchant payments and inward remittances.

1.75% to be charged will be borne by the sender except inward remittances, which will be borne by the recipient.

According to the Finance Minister, to safeguard efforts being made to enhance financial inclusion and protect the vulnerable, “all transactions that add up to ¢100 or less per day (which is approximately ¢3000 per month) will be exempted from this levy.”

The levy, which is supposed to take effect January next year, will be used to support entrepreneurship, youth employment, cyber security, digital and road infrastructure among others.

But this initiative has been widely criticised for being insensitive to the plights of Ghanaians amidst the Covid-19 pandemic and its impact.

Latest Stories

-

Bawumia joins thousands in Kumasi for burial prayers for Ashanti Regional Imam

41 minutes -

Blue Gold Bogoso Prestea Limited challenges government actions in court

1 hour -

Patrick Atangana Fouda: ‘A hero of the fight against HIV leaves us’

2 hours -

Trinity Oil MD Gabriel Kumi elected Board Chairman of Chamber of Oil Marketing Companies

2 hours -

ORAL campaign key to NDC’s election victory – North America Dema Naa

3 hours -

US Supreme Court to hear TikTok challenge to potential ban

3 hours -

Amazon faces US strike threat ahead of Christmas

3 hours -

Jaguar Land Rover electric car whistleblower sacked

3 hours -

US makes third interest rate cut despite inflation risk

4 hours -

Fish processors call for intervention against illegal trawling activities

4 hours -

Ghana will take time to recover – Akorfa Edjeani

4 hours -

Boakye Agyarko urges reforms to revitalise NPP after election defeat

5 hours -

Finance Minister skips mini-budget presentation for third time

5 hours -

‘ORAL’ team to work gratis – Ablakwa

5 hours -

Affirmative Action Coalition condemns lack of gender quotas in Transition, anti-corruption teams

5 hours