The Atwima Kwanwoma Rural Bank has posted a 40 per cent profit after tax for the 2020 financial year, despite the impact of the Covid-19 on businesses.

The Bank grew its profit from 3,031, 095 cedis in 2019 to 3,841,061 cedis at the end of 2020. This represents an increase in rate of 26.72 per cent.

Chief Executive, Dr Sarfo Kantanka says the bank’s strategic plans show a more impressive performance by the end of 2021.

Deposits at the Atwima Kwanwoma Rural Bank in the 2020 financial year increased by 40.1 percent from the 2019 figure. It stood at 205,389,993 Ghana cedis as against 146,582,226 Ghana cedis in the previous year.

Amidst the uncertainty of the COVID-19 pandemic, the bank gave out loans of over 39 million cedis which is a 12 percent increase from the 2019 figure of 34 million cedis.

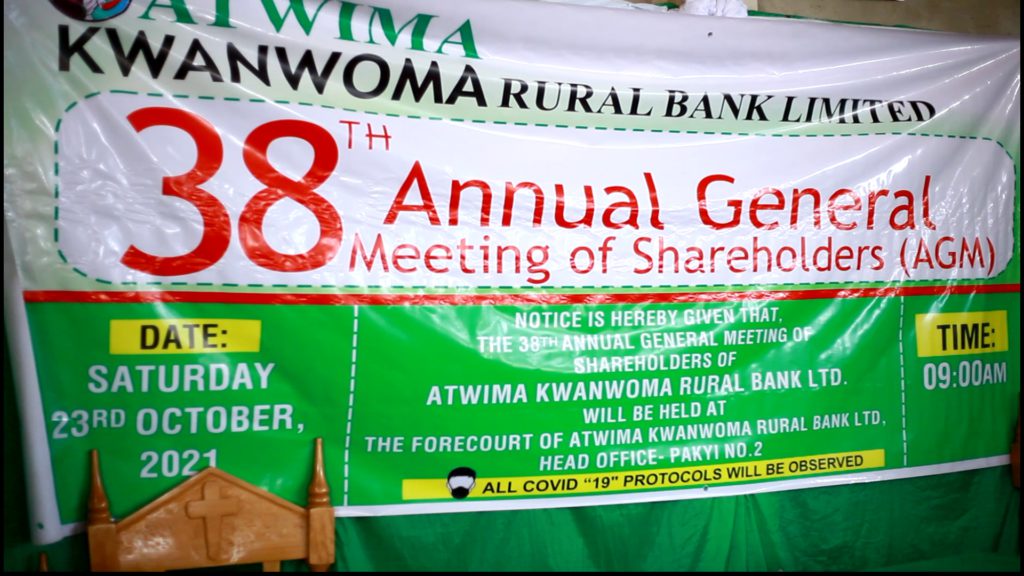

At the 38th Annual General Meeting held at Pakyi Number Two in the Ashanti Region; Dr Kantanka revealed the bank has put in measures to sustain the gains made in 2020.

Financial Performance

Investment portfolio also grew from 126,490, 164 Ghana cedis in the year 2019 to 179,956,837 Ghana cedis in the year 2020 representing an increase of 42.26 percent

The bank’s total loan portfolio stood at 39,109,169 cedis in the year under review as against 34, 919,716 Ghana cedis in 2019 an increase of 12 percent was recorded

Again, an increase was recorded in the Bank’s total asset from 188,723,038 Ghana cedis in 2019 to 252,545,551 cedis in 2020, representing a growth of 33.81 percent

At the end of the year 2020, the bank’s stated capital stood at 3,354,008 Ghana cedis.

As a requirement by the Bank of Ghana, all Rural and Community banks are to meet a minimum stated capital of 1million Ghana cedis and AKRB has it in excess of 200 percent.

“However, we wish to appeal to you to buy more shares since Bank of Ghana may very soon increase the minimum requirement”.

The bank recorded an increase in its equity from 37,575,423 cedis in 2019 to 41,454,279 cedis in 2020 representing 10.32 percent growth.

The board did not recommend payment for the 2020 financial year based on the Bank of Ghana directive dated 12th April, 2021. In line with a Bank of Ghana directive, the Atwima Kwanwoma Rural Bank is now a Public Limited Company.

Board Chairman, Patrick Owusu, explains the move is critical to enhancing the operations of the business.

Meanwhile, long-serving officials and other deserving members of the bank were recognized and awarded for their contribution to the bank’s growth.

Future Outlook

The economic outlook is good in the short to medium term, contingent on an increase in demand for Ghana’s export improved business confidence and successful implementation of the Ghana COVID-19 Alleviation and Revitalization of Enterprise Support Program.

Growth is projected to increase to 4 percent in 2021 according to the African Development Bank. The Rural Banking sector remains well-positioned to continue with the core objective of financial intermediation to support the rural and urban poor communities in Ghana.

The bank operated under an extremely difficult situation in the year under review and your bank was no exception. Regardless of the challenging global economy in the financial year, your bank put up an impressive performance for the year under review in comparison to 2019 financial year.

Latest Stories

-

Ghana’s Democracy: Choices, not elections will drive change – Benjamin Offei-Addo

3 mins -

PRESEC-Legon marks 86 years with launch of groundbreaking AI lab on November 30

6 mins -

Limited citizen participation threatens Ghana’s democracy – Prof. Kwesi Aning

16 mins -

Contractor storms basic school to drive out students from classroom, claiming government owes him

35 mins -

The quest for peaceful election: religious and traditional leaders should be part of election observers

41 mins -

NDC has better policies to boost economy through agricultural, oil sectors – Ato Forson

44 mins -

Yaw Ampofo Ankrah calls for Kurt Okraku and Executive Council to resign over AFCON failure

54 mins -

Coalition of teachers to boycott December election over unpaid salary arrears

58 mins -

Uphold ethics in fight against fraud – First National Bank CEO

1 hour -

CHRAJ recommends forensic audit of National Cathedral project

1 hour -

I cried every three days at the beginning of my career – Gyakie

1 hour -

#ChoosePeaceGh Campaign: JoyNews partners Catholic Relief Services beyond 2024 December 7 Elections

1 hour -

CHRAJ report scratched the surface on “the double identity” of Rev. Kusi Boateng – Ablakwa

2 hours -

Elections: Akufo-Addo calls for unified front to combat political instability

2 hours -

Alidu Seidu ruled out for the season after suffering raptured ACL

2 hours