On 30 July 2021, Ghana’s Energy Minister sent a memo to Parliament explaining that two sister Norwegian affiliated companies — Aker Energy Ghana Limited (“Aker Energy”) and AGM Petroleum Ghana Limited (“AGM”) —seek to dilute their interests in the Deepwater Tano Cape Three Points and South Deepwater Tano blocks located offshore Ghana. Aker Energy was founded in February 2018 as a 50-50 joint venture between Aker ASA (listed on the Norwegian Stock Exchange) and TRG AS, a company controlled by Norwegian billionaire Kjell Inge Røkke. TRG AS also owns AGM Petroleum Ghana Limited.

Aker Energy/AGM proposes in the said transaction, and the Minister requests, that GNPC acquires a significant stake in the concessions above. Accordingly, Parliament has been invited to consider and approve the following:

- “Acquisition by GNPC, through GNPC Explorco, of the following stakes:

- 37% interest in Deep Water Tano/Cape Three Points (DWT/CTP) operated by Aker Energy Ghana Limited; and

- 70% stake in the South Deep Water Tano (SDWT) operated by AGM Petroleum Ghana Limited.

- Establishment of a joint operating company between Aker Energy and AGM, and GNPC Explorco;

- Mandate the Minister for Energy and the Minister for Finance to agree on a purchase price with Aker Energy/AGM;

- Provision of a loan not exceeding US$1.65 billion to finance the acquisition at a price to be negotiated which might not exceed $1.3 billion and GNPC Explorco share of capital expenditure (CAPEX) to Pecan Phase 1 First Oil of $350 million.”

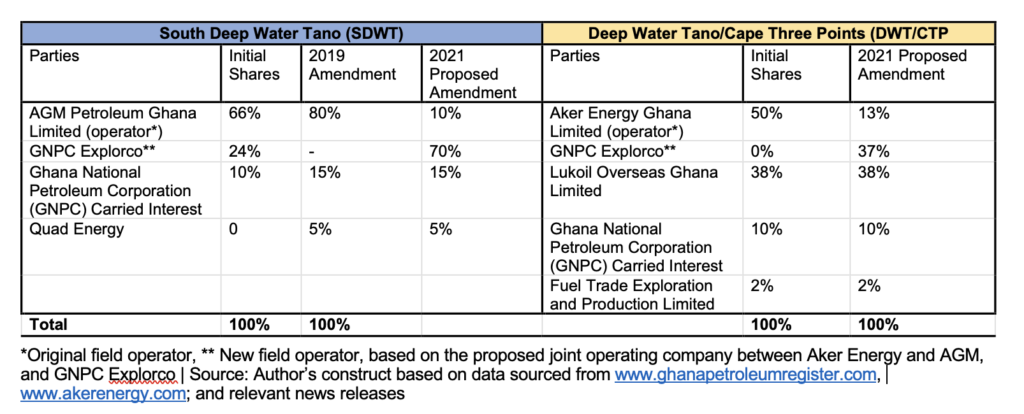

The proposed transaction will result in the following shareholding structure shown in the table below for the two oilfields if approved by Parliament.

In order to appreciate the nature of the issues at stake, I must provide some context of Ghana’s upstream oil and gas industry. Since the early 2000s, Ghana has signed petroleum agreements (PAs) with various IOCs and their local partners, including Tullow Oil, Kosmos Energy, Hess Corporation, Lukoil, Afren, ENI and Vitol, among others, to explore offshore hydrocarbon resources. Ghana has signed eighteen 18 such PAs out of which three are producing fields, and four with discoveries pending appraisal and or development.

The blocks with discoveries include the DWT/CTP operated by Aker Energy; SDWT operated by AGM; Cape Three Points (CTP) Block 4 operated by ENI Ghana Exploration & Production Limited; and West Cape Three Points (WCTP) Block 2 operated by indigenous company Springfield E&P Limited.

In recent times, Ghana’s oil industry has faced significant headwinds, such as the 2014 to 2017 oil price slump, which led to a drop in exploration activity. In addition, the maritime boundary dispute with Côte d’Ivoire also stalled offshore activity. Furthermore, the coronavirus pandemic, a further slump in oil prices in 2020 and the looming energy transition pose challenges to the country’s ability to fully maximise the economic recovery of its hydrocarbon resources.

Against this background, GNPC seeks to grow and develop its reserves and asset base by acquiring extra stakes in the fields above, thereby playing increasingly, a more direct developmental role in Ghana’s oil and gas industry.

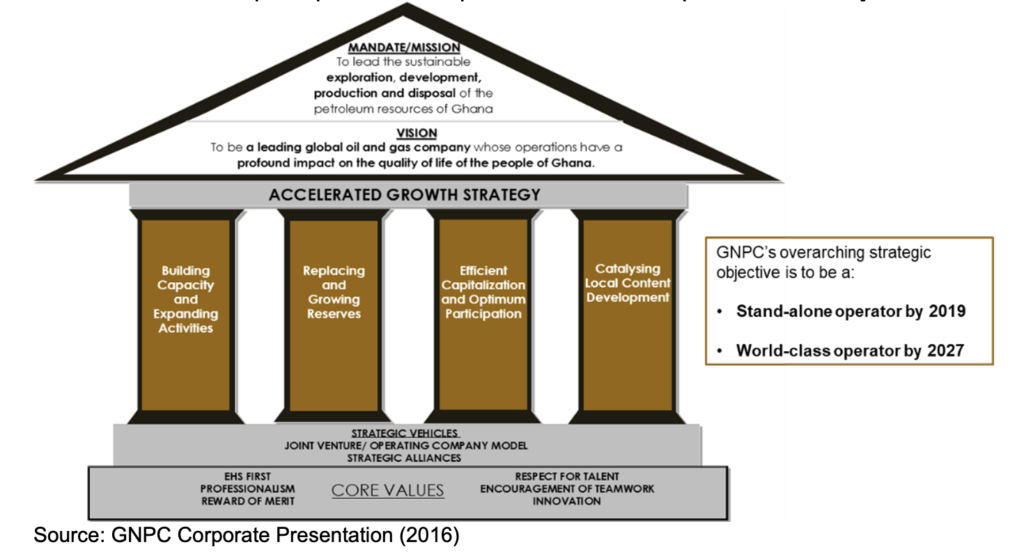

However, the core of this strategic intent by GNPC to grow reserves and specifically become an operator is not new – it goes back over ten years. Therefore, persons attempting to make this look like something new are instead, in my view, deliberating obfuscating matters. In fact, as far back as 2016, GNPC launched a new strategic vision – the accelerated growth strategy – based on the following (see also figure below):

- Building capacity and expanding activities - Investing systematically and prudently in building operating capability to manage a wider portfolio of producing assets.

- Replacing and growing reserves - Investing in high impact initiatives for the replacement and growth of reserves.

- Efficient capitalisation and optimum participation - Securing capital at the lowest possible cost to maintain an optimum level of participation in petroleum operations.

- Catalysing local content development - Expediting the creation of an appropriate environment for Ghanaian participation in the upstream sector of the petroleum industry.

I have stated that I agree in principle with GNPC wanting to increase its reserves and production, for example, by using its commercial arm GNPC Explorco to take on more exploration risk but with more significant potential commercial upside. Some other civic organisations also share this view.

Nevertheless, there are some major issues with the proposed Aker Energy/AGM deal, such as the valuation, which needs to be carefully looked at, as in my view, it does not inure to the public interest.

The primary issue on the table is not about whether GNPC can increase its reserves and production. Instead, it is the ‘how or mechanics’ of the acquisition that warrants appropriate public scrutiny. Thus, it is about the finer details of the proposed Aker Energy/AGM transaction on public interest grounds.

Two important considerations in any valuation exercise are (1) estimating the proved oil and gas reserves that can be economically recovered, and (3) estimating the related future net cash flows, which is the difference between revenues or cash inflows and costs or cash outflows. Proved reserves must be economically extractable from a given date based on current economic conditions, including the prices and costs. Also, estimating cash flows requires some economic assumptions, such as current and future costs, future production rates, oil prices, and a discount factor that reflects the minimum rate of return or opportunity cost of capital.

Below, are some questions on the proposed transaction which warrants further scrutiny:

Independent valuation of the reserves and contingent resources of the DWT/CTP and SDWT blocks

- Were the reserves and resources in both the DWT/CTP and SDWT blocks independently certified in line with, for example, The Society of Petroleum Engineers (SPE) Petroleum Resources Management System (PRMS)? In other words, at what point was an independent valuation of the oil and gas reserves and resources in both the DWT/CTP and SDWT blocks conducted before the commencement of negotiations? The standard industry practice is that reserve evaluators such as Gaffney, Cline & Associates, DeGolyer and MacNaughton, and Ryder Scott independently evaluate such reserves and contingent resources, which serves as an input into the cash flow models and eventual valuation. Thus, the so-called valuations, with financial calculations based on Aker Energy/AGM projections or even GNPC’s, are meaningless without any certification of reserves.

- What is the commerciality of the Nyankom-1X discovery? Nyankom-1X is currently a contingent resource, based on Aker Energy’s two well (Kyenkyen-1X and Nyankom-1X) campaign on SDWT. My reading of relevant regulatory filings by Aker in Norway and Ghana indicates that there is currently no technical and economical solution at the extreme water depths to commercially exploit the Nyankom discovery, which raises material questions on the true commerciality of Nyankom. It makes little sense for GNPC, in its plan to become “an operator”, to take up a 70% stake in the block in deepest water offshore Ghana with a relatively small unappraised discovery and simply assert that this has value. No technical account is provided about how the development of that field will proceed, the technology they will use, among others. Any overstatement in these contingent resources has a significant impact on the valuation

What was the basis for some of these optimistic oil price forecasts in the valuation reports, which again has a major impact on the underlying net asset value? Several of the independent valuations, such as the one jointly commissioned by GNPC and Aker Energy from Lambert Energy Advisors, have a rather unrealistically high long-term price estimate of US$65/bbl (in real terms) for the valuation, which is then escalated at 2% per annum on cost and commodity price. Most long-term price forecasts that I have seen from several leading investment banks (Citigroup, Credit Suisse, among others), research and analytical agencies (such as Wood Mackenzie, Fitch Solutions, among others), oil majors, and international organisations such as the IEA are in the US$50/bbl to US$60/bbl range. In my view, there is significant over-valuation on account of these over-optimistic oil prices.

Other public policy issues

- Only two years ago, in April 2019, Ghana’s government kowtowed to Aker’s interests by amending the petroleum laws and agreement to favour the latter, including reducing Explorco’s 24% paid interest in SDWT to zero. This was the first-ever amendment of a petroleum agreement in Ghana. Interestingly, AGM, the operator, discovered oil in the Nyankom-1X well in July 2019 (three months down the line) with reported initially estimated volumes of about 127 million barrels. This is the same block that AGM is now seeking to divest a purported 70% back to GNPC. This begs the question: if this block was so valuable to AGM only two years, indicated by the extent to which it went in negotiating with the Ghanaian government to increase its equity from 66% to 80%, then what has changed? Could it be that there are major issues around the commerciality of the discovery and or that the company is struggling to raise funds to finance its commitment to developing the field going forward, hence this attempt at a ‘forced’ backdoor divestment to GNPC?

- Will the proceeds from the farm-down be used to fund the sellers’ portion of the now reduced or minimal stakes in the two blocks? In other words, does the seller want to eat their cake and still have it by subsequently entering into a joint operating company model, whereby Aker Energy/AGM sister companies stand to benefit from supply chain contracts such as FPSO leases and other equipment and services?

- Why has this transaction just been narrowed down to a GNPC-Ministry of Energy-Aker/AGM debate when The Petroleum Commission, the upstream regulator, has a more fundamental role to play? Section 3 of the Petroleum Commission Act, 2011. Act 821 cloaks it with the power to advise on such M&A deals. The Commission advised against the PoD that Aker Energy previously submitted for the Pecan field on the DWT/CTP block, giving sound reasons for their position. Now, without the new PoD being submitted by Aker, the planned share acquisition by GNPC, supported by the Ministers of Finance and Energy, would effectively mean a pre-approval of a PoD which is yet to be submitted. What possible justification can there be for this rush to spend US$1.65 billion in blocks, some of which have reserves and contingent resources that have not been sufficiently de-risked or independently verified? Why is the regulatory body not even being given a chance to review what is due to be submitted by the end of the year and give advice as they are supposed to do?

- How much has Aker Energy spent on the DWT/CTP block since it acquired. Hess’s take for US$100 million in February 2018, which would count as petroleum cost as per the PA? Also, how much has AGM spent on the SDWT block?

- Why does GNPC want to saddle itself with more debt at this particular time given it already has challenging financial commitments – such as take or pay gas contract obligations for Sankofa and post-foundation gas pricing for Jubilee and TEN, Karpowership guarantees, Tema LNG project - which continue to weigh down on its balance sheet?

Concluding remarks While the arguments of the energy transition and potentially stranded assets are widely known to many an industry analyst, it is not enough to use that as a basis to justify what is an otherwise rushed transaction. Details matter and this proposed Aker Energy-AGM transaction deserve to be scrutinised appropriately on its merit. Unfortunately, those throwing energy transition issues into the mix either do not understand the technicalities or are deliberately obfuscating the issues.

A careful analysis of the proposed deal reveals inconsistencies and deviations from industry-wide accepted valuation norms, among other issues, which if not addressed will leave GNPC, the national oil company, with overpriced assets on its balance sheet, some of which may never be commercialised. To put things into context, the proposed loan (which has now been purportedly reduced from US$1.65 billion to US$1.45 billion) amounts to 2.2% of Ghana’s GDP, 5.9% of Ghana’s external debt and 2.9% of Ghana’s total debt as of 2020.

Also, the Ghana Revenue Authority (GRA), together with GNPC and the Petroleum Commission, have an opportunity to audit and establish the cost base and value. Furthermore, any disposal of the assets may need to be assessed for applicable capital gains taxes by the GRA.

My reading of the situation so far indicates to me that the sellers (Aker Energy/AGM) perhaps require this transaction more than GNPC (the buyer). Hence, the government should not be under pressure to give away value. There should be no rush to conclude this deal. Aker Energy’s own statement on 11 May 2021 indicates them saying that they will submit a revised Plan of Development (PoD) for the DWT/CTP block by the end of this year. Therefore, why not wait for that since, without such a PoD or independent valuation of the reserves, there is little basis for the numbers thrown up in the various “valuation” reports. There is value in waiting, in my view.

******

Dr Theo Acheampong is a petroleum economist and political risk analyst with over 10 years of experience in natural resource governance and public financial management issues. He is an Associate Lecturer at The Centre for Energy, Petroleum and Mineral Law and Policy (CEPMLP), University of Dundee; and also, Associate Lecturer and Honorary Research Fellow at the University of Aberdeen. Theo is currently co-editing a Palgrave MacMillan book titled “Petroleum Resource Management in Africa: Lessons from Ghana”, which examines the challenges and opportunities from ten years of oil and gas production in Ghana.

Latest Stories

-

Mahama is a failed president; give Bawumia a chance – Akufo-Addo to Ghanaians

2 mins -

‘No child left behind in Free SHS’ – Akufo-Addo declares

14 mins -

MMDAs tasked to pay more attention to TB cases

16 mins -

2024/25 GPL: Defending champions Samartex suffer second consecutive loss as Basake Holy Stars wins 1-0

19 mins -

Government stands firm in Galamsey fight, says Akufo-Addo

24 mins -

National Peace Council assures public of violent free elections

28 mins -

Agenda 111 to be discontinued if NDC comes to power – Akufo-Addo

37 mins -

Mahama begins 3-day tour of the Western Region today

42 mins -

NCCE holds Parliamentary Candidates’ dialogue at Kumbungu

59 mins -

Akufo-Addo commissions new oil and gas services terminal

1 hour -

Bono East NIB seizes stolen SHS rice, arrests driver

1 hour -

Petroleum Commission gives $3.6bn contracts to indigenous companies

2 hours -

COP29 ends with $300bn annual deal to fight climate change

2 hours -

Singer absolutely terrified of Diddy, lawyer says

2 hours -

Texas schools can now teach Bible-based reading lessons

2 hours