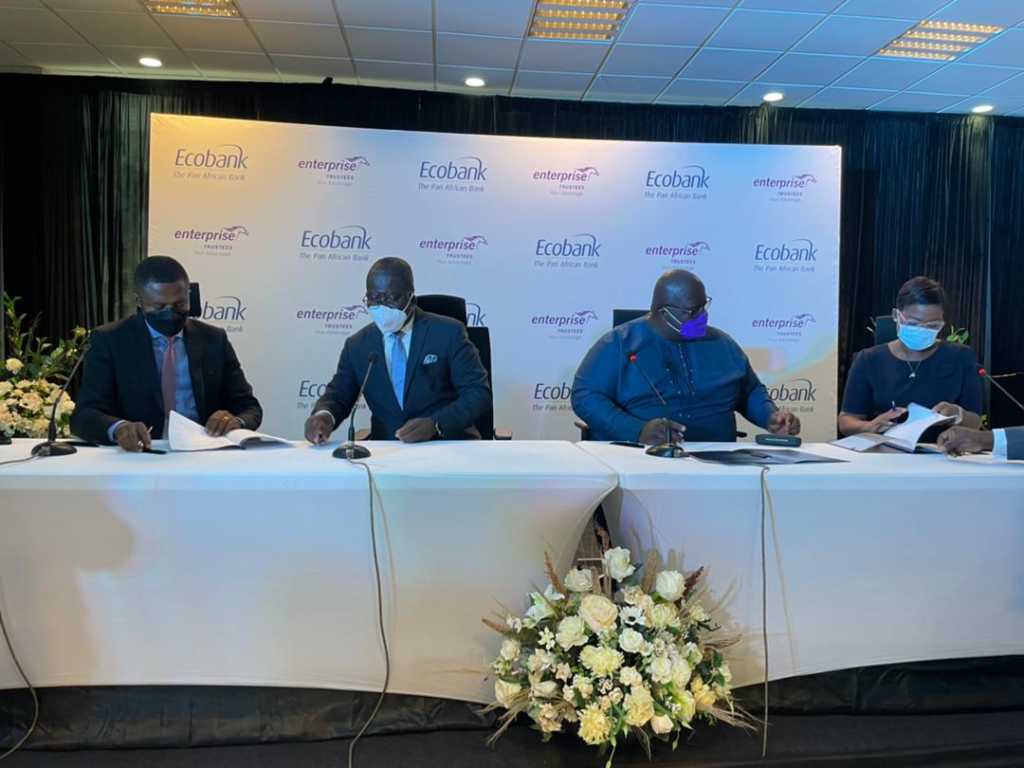

Ecobank Ghana and Enterprise Trustees have signed a partnership agreement to make meaningful contribution towards helping pension contributors acquire affordable homes.

The partnership also seeks to offer customers of both institutions a whole new experience with unending benefits.

Speaking at the signing ceremony, Managing Director of Ecobank Ghana, Dan Sackey said the partnership will enable Enterprise Trustees to make available to all workers, whose pension funds reside at Enterprise, a package that enables them to attract mortgages from Ecobank with zero down payments.

“Under this agreement, Enterprise Trustees will make available to all workers, whose pension funds reside at Enterprise, a package that enables them to attract mortgages from Ecobank with zero down payments. The bank will disburse the mortgage loan to the beneficiaries, who will pay monthly instalments over a 15-year period”, he noted.

He further added that, “this is a novelty for the Ghanaian financial services market, which should be embraced by workers. A regular mortgage will require the borrower to make available at least 20% down payment, but this innovative partnership offers a product that requires the borrower to make no deposit whatsoever. All that the borrower needs to do is to identify the house and Ecobank will provide the funding.”

“With this offer, there is really no excuse for Enterprise Trustees Tier 3 contributors not to own their own homes. There is also no excuse for not accessing the requisite funding for their various projects”, he pointed out.

On his part, Managing Director of Enterprise Trustees, Joseph Ampofo indicated that this new partnership will help workers build an enviable fund towards their retirement.

“It’s been 10 years of running schemes, enabling contributors to build up funds towards their future retirement. This is a collaboration between two industry giants Ecobank Ghana and Enterprise Trustees. We are optimistic that our shared value of Excellence will be our guiding principle as we work together for the betterment of Ghanaian workers to own homes through a unique mortgage solution”, he added.

Latest Stories

-

Betway Africa offers once-in-a-lifetime ‘Play-on-the-Pitch’ experience at Emirates Stadium

6 mins -

I coined the term ‘hype man’ in Ghana – Merqury Quaye

12 mins -

Vasseur questions ‘strange momentum’ of Formula One race director change

34 mins -

“I am disappointed in Kojo Manuel” – Merqury Quaye on “no tie” comment

34 mins -

Nana Kwame Bediako; The beacon of unity

36 mins -

Western Region: NDC youth wing embarks on phase 2 of ‘retail campaign’

1 hour -

Action Chapel International holds annual Impact Convention in November

1 hour -

Jana Foundation urges young women to take up leadership roles

1 hour -

All set for Joy FM Prayer Summit for Peace 2024

1 hour -

Managing Prediabetes with the Help of a Dietitian

2 hours -

Joy FM listeners criticise Achiase Commanding Officer’s election comment

2 hours -

Legal Aid Commission employees threaten strike over poor working conditions

2 hours -

Ghana ranked 7th globally as biggest beneficiary of World Bank funding

2 hours -

IMF board to disburse $360m to Ghana in December after third review

2 hours -

Former Bono Regional NPP organiser donates 13 motorbikes to 12 constituencies

2 hours