Despite projections that the policy rate of the Bank of Ghana will go down by the end of the first half of this year to ease cost of borrowing, it does not look so because of some perceived risks in the economy.

This is coming at a time that the Monetary Policy Committee begins its 100th quarterly meeting, from today 26th May, 2020 to review the state of the Ghanaian economy.

Prior to the end of the year, there were high expectations that the policy rate – the rate at which commercial banks borrow from the Bank of Ghana - will fall to lower the borrowing costs of household and business consumers.

Fitch Solutions and Moody’s Analytics have all projected about 1.0 percentage point drop in the policy rate by May this year. Their forecast were based on expected lower inflation and improve growth rate in the first quarter of this year.

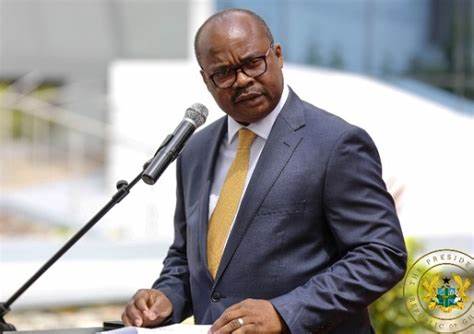

However, the large financing gap and debt which possess some threat to the economy could compel the MPC of the Bank of Ghana chaired by Governor Dr. Ernest Addison to maintain the policy rate at 14.5% for the 7th consecutive time since March last year.

Banking Consultant Dr. Richmond Atuahene told Joy Business that the policy rate will remain unchanged because of developments within the economy in the last couple of months, which does not support a reduction in the base lending rate.

“Looking at the various things that have happened over the last few months, including the announcement of taxes and taxes on fuel and others, and also looking at crude oil prices rising up to US$68 per barrel and other exigencies in the economy, I don’t think the policy rate can come down just in the near future. It has to stay there for some time.”

“And don’t forget that the policy rate level will also have something to do with interest rate, so we are in a dichotomy; we either keep the policy rate where it is and let the private sector not get access to cheap credit to expand the economy”, he further said.

The MPC will also assess the Bank of Ghana’s Composite Index of Economic Activity, the Business and Consumer Confidence indicator and make forecast for inflation and exchange rate, as well as proffer advise to the central government on measures to tackle the nation’s rising debt.

Latest Stories

-

We don’t operate investment platform – GNPC

1 min -

Ghana Fact-checking Coalition condemns disinformation on voting by Wontumi FM broadcaster

3 mins -

IFRS 17 will augment and accelerate NIC’s efforts to implement risk-based capital – Deloitte

5 mins -

IFRS 17 is one of biggest changes to financial reporting standards in insurance industry – Deloitte

19 mins -

Enimil Ashon: Whose polls do you believe: ‘Global Info or Prof Sarpong?

21 mins -

Ghana Climate Innovation Centre welcomes 25 businesses into Cohort 10

26 mins -

ADB will continue to enhance customer value and service experience – Managing Director

28 mins -

Colour Cure Exhibition highlights art’s role in healing and advocacy

30 mins -

GPL 2024/25: Aduana FC sack coach Yaw Acheampong after poor run

33 mins -

John Dumelo pays ¢10,400 in outstanding fees for visually impaired law student facing deferral

34 mins -

CHRAJ clears Rev. Kusi Boateng of conflict of interest, says he doesn’t own 2 passports with different names

37 mins -

We’ll restore hope by cutting down taxes and avoiding unreasonable borrowing – Ato Forson

42 mins -

14th Edition of Tech in Ghana Conference launched in Accra

42 mins -

Manifesto clash: NPP, NDC spar over water, hygiene, sanitation and climate change

49 mins -

Ellembelle MP constructs new health facility at Santaso to serve several communities

53 mins