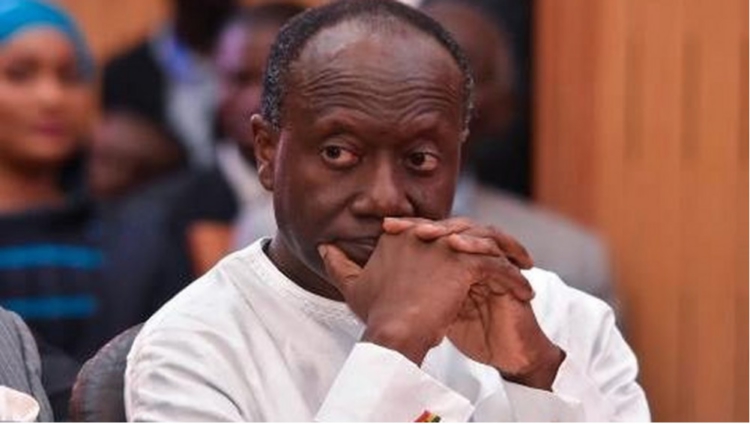

Finance Minister, Ken Ofori-Atta

Summary

- The timeline of 4 months to IPO is problematic, unless the Government has surreptitiously filed for listing. To ensure favourable pricing of the offered securities, the timeline for listing any MIIF SPV on any international exchange should be extended to at least April 2021. This should also allow additional scrutiny into the Agyapa transaction because, so far, it lacks the basic minimum of transparency and assurance of above-board dealing required of a sovereign transaction.

- The degree of information-hiding has been so intense that, per the official record, it took the Ministry of Finance more than a year to share the full set of agreements with the Government’s own Attorney General following an initial request for legal review in January 2019. Unsurprisingly, the final agreement ratified by Parliament defies many pieces of advice offered by the Attorney General, including a suggestion that the Investment Agreement be limited to a fixed term of 30 years.

- Raising short-term capital and building a solid company to invest Ghana’s royalties are not intertwined objectives and the selected vehicle for listing securities on the LSE Main Market is ineffective for achieving either strategy in a holistic way. The massive upfront costs of listing and sustaining a listing is equivalent to borrowing at over 10% per annum, far above Ghana’s current sovereign borrowing rate.

- There is a case to be made for diversifying the country’s sovereign wealth strategy and acquiring some geo-economic influence, but that should not be pursued at the high cost of valuing 75% of all of Ghana’s future royalties at 30% of their true value. The $1 billion valuation of these massive resource entitlements is unconscionable and amounts to undervaluing Ghana’s resources by over 65%.

- Less than 25% of future royalties should go for that amount of money in any such transaction. Our position is backed by a review of several such “royalty streaming” transactions around the world. A private market transaction would be superior to a public listing in this regard.

- The claim that dividends shall prove a seamless substitute for royalties in the future is abjectly wrong in view of typical dividend yields in the context under evaluation and the fact that the transactions expressly exclude dividend protections granted the government by the SIGA law.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Latest Stories

-

Maiden Women in Chemical Sciences conference opens with a call for empowerment

10 mins -

We’ll reclaim all Groupe Nduom stolen assets – Nduom declares

16 mins -

Center for Learning and Childhood Development Director Dr Kwame Sakyi honoured at Ghana Philanthropy Awards

9 hours -

Asantehene receives 28 looted artefacts

10 hours -

CAF WCL 2024: Ghana’s Thelma Baffour wins title with TP Mazembe

11 hours -

Benjamin Boakye slams politicisation of energy sector issues and ECG’s inefficiencies

11 hours -

Erastus Asare Donkor and Dr Neta Parsram win big at 10th Mining Industry Awards

11 hours -

Government is “suppressing information” about power sector challenges – IES Director

11 hours -

Majority of our debts caused by forex shortfall – ECG Boss

12 hours -

Pan-African Savings and Loans supports Ghana Blind Union with boreholes

12 hours -

Bole-Bamboi MP Yussif Sulemana donates to artisans and Bole SHS

13 hours -

Top up your credit to avoid potential disruption – ECG to Nuri meter customers

13 hours -

Dutch & Co wins 2024 Entrepreneur of the Year Award

13 hours -

We’ll cut down imports and boost consumption of local rice and other products – Mahama

15 hours -

Prof Opoku-Agyemang donates to Tamale orphanage to mark her birthday

16 hours