The Swiss watch industry has survived lickings before, but Rolex, Omega and Cartier now face a combination of economic punches putting them back on their heels.

The industry was just adapting to the downturn from political protests in its largest market, Hong Kong when the coronavirus outbreak hit. Now China’s economic slowdown threatens to engulf the rest of the world. Meanwhile, the strong Swiss franc, surging gold prices, and store closures are set to saddle companies like Swatch Group AG and Richemont with higher costs.

Rolex shut down all its plants in Switzerland for at least 10 days starting Tuesday. Richemont has been offering price cuts of as much as 49% for secondhand Cartier timepieces in a one-week special offer on its vintage resale site, Watchfinder. Watch fairs in Basel and Geneva have been cancelled. Swatch will put as much as 70% of its Swiss production staff on reduced working hours by the end of the week.

The first half will probably be the worst ever for the modern luxury-goods industry, Sanford C. Bernstein’s Luca Solca said. That threatens employment in Swiss watchmaking, which supports 59,000 people and accounts for almost a tenth of the country’s exports. To make matters worse, the industry depends heavily on workers living across the border in France, and many of those are staying home in containment efforts or because border crossings have closed.

“This scenario is worse than in 2008, as there doesn’t seem to be any offset -- other than possibly a quantum of solace from online,” Solca wrote.

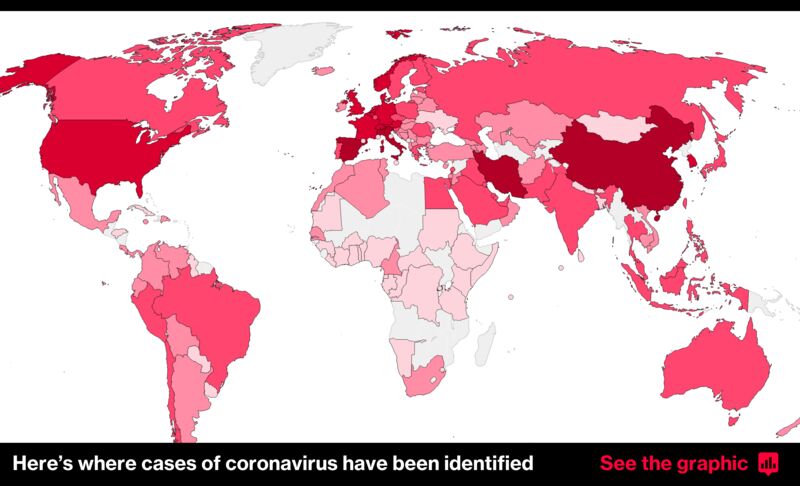

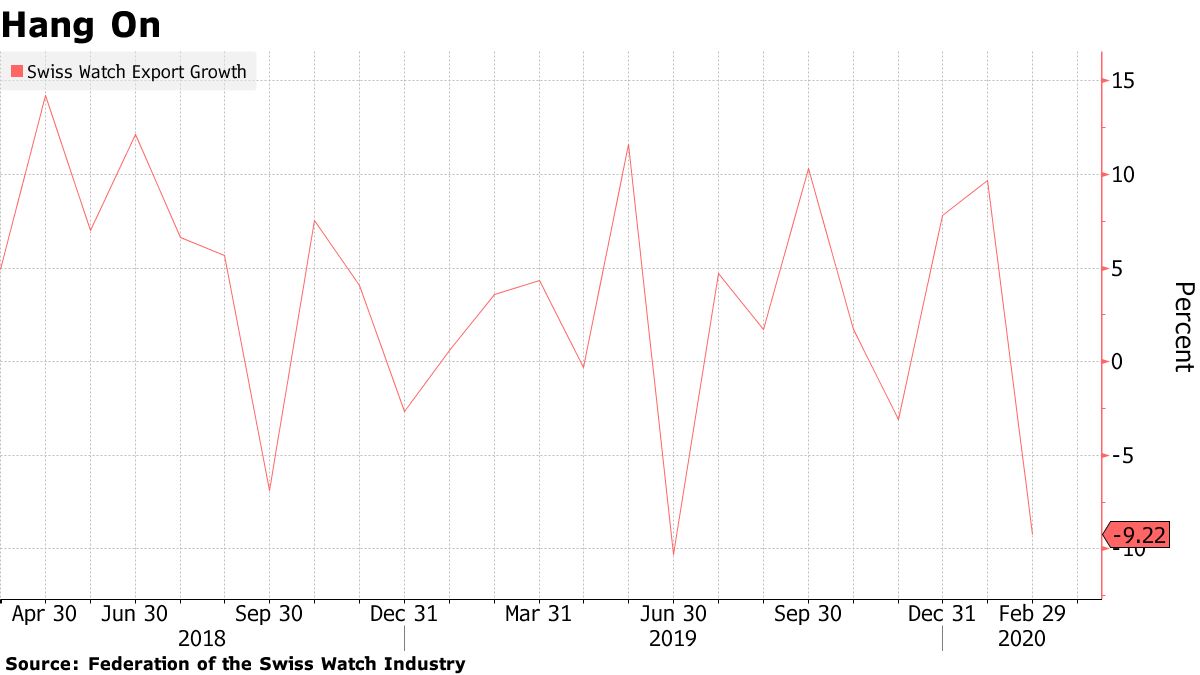

Swiss watch exports fell the most in eight months in February, with shipments to China and Hong Kong slumping 52% and 42% respectively, a report showed Thursday. The decline is set to worsen this month as the epicentre of the disease shifts to Europe, which now has more diagnosed cases than China.

Business is now more or less back to normal in Asia, though it will take a few months to return to normal consumption there, Swatch Chief Executive Officer Nick Hayek said at the company’s annual press conference Thursday, addressing journalists via the internet while sitting in front of 90 teddy bears who took the seats of the press.

Swatch, which makes Breguet and Longines, and Richemont, whose brands include Vacheron Constantin, have both lost about a third of their value this year. On Thursday, Swatch shares gained as much as 6.1% after Chairwoman Nayla Hayek indicated the company hasn’t lost hope.

Stay Positive

“2020 will certainly be a difficult year worldwide,” she said in the company’s annual report. “We will remain positive in our outlook despite all the obstacles.”

Swatch plans to spend as much as 500 million francs ($517 million) this year on research, new products, production capacities and the sales network despite the crisis, according to the annual report. Last year the company finished the 220 million-franc construction of a new headquarters in Biel, a giant honeycomb-like structure designed by Pritzker-prizewinning Japanese architect Shigeru Ban.

The luxury-goods industry’s first-quarter revenue will slump more than 30%, Rene Weber, an analyst at Bank Vontobel AG, estimated.

“Demand will suffer in a way we’ve never seen before,” he said. “The main question is how long it will last.”

Swatch’s Tissot brand unveiled its first smartwatch during the webcast Thursday, four years later than planned. Competition from Apple Inc. has decimated demand for low-end timepieces. Swatch’s plans to start selling the connected watch in Switzerland in June or July are now uncertain with the coronavirus outbreak in Europe. The watch is compatible with Huawei’s Harmony operating system.

A fund called Veraison recently invested 8 million francs in Swatch, and CEO Andreas Weigelt told Finanz und Wirtschaft earlier this month that a share buyback like the one announced in 2016 would be attractive. Hayek said there have been no discussions with them.

The crisis has already taken its toll on smaller companies. RJ Watches SA, an independent Swiss watchmaker known for timepieces featuring characters like Pac-Man, filed for bankruptcy last month.

“There are likely to be heavy losses, particularly for smaller players,” said Jon Cox, an analyst at Kepler Cheuvreux. “There will be casualties.”

Latest Stories

-

AngloGold Ashanti empowers PWDs in Obuasi East to harness 10-year socio-economic development plan

16 seconds -

‘Dumsor’ won’t go anytime soon, we need 2 years to stabilize- IES

6 mins -

Black Stars Management Committee does a good job – Ernest Thompson

9 mins -

GFA set to launch Girls for Goals campaign in Keta

12 mins -

Siisi Baidoo wins Male Vocalist at 2024 Praise Achievement Awards

16 mins -

Perez Musik celebrates marriage with breathtaking photos

43 mins -

I am not ready to sign any artiste to my record label – Kuami Eugene

1 hour -

Gov’t spokesperson on governance & security calls for probe into ballot paper errors

1 hour -

Free dialysis treatment to be available in 40 facilities from December 1 – NHIA CEO

1 hour -

NHIA will need GHC57 million annually to fund free dialysis treatment – NHIA CEO

2 hours -

MELPWU signs first-ever Collective Agreement with government

2 hours -

I’ve not been evicted from my home – Tema Central MP refutes ‘unfounded’ reports

2 hours -

After Free SHS, what next? – Alan quizzes and pledges review to empower graduates

3 hours -

Wontumi FM’s Oheneba Asiedu granted bail

3 hours -

Alan promises to amend the Constitution to limit presidential powers

3 hours