Seventy-two percent of firms in Ghana perceived the country's business environment as lagging behind its peers, the UK Ghana Chamber of Commerce (UKGCC) 2023 Ghana Business Environment and Competitiveness Survey has revealed.

The report stated that the firms believed Ghana's business environment slumped in 2023, compared to 47% that said the same in 2022.

This is in addition to a general view that other countries in the sub-region are not struggling as much as Ghana in the aftermath of COVID-19, the Russian-Ukraine war, and the supply chain disruptions it spawned.

Again, a staggering 75% of the respondents perceived corruption as a continuing bane to business operations, even though trends showed a decline in corruption compared to 2022.

It was also perceived that cost of labour—unskilled and skilled—remains affordable to most businesses.

Additionally, the government’s support of international trade and the availability of good quality transport infrastructure—two business components critical to the countries’ economic partnership and international trade and investment goals—ranked second and third, respectively, on the worst business components list.

The survey also assessed the most deteriorated business components over the years, as well as the most expensive business costs.

A third of respondents flagged cost of capital as the most deteriorated business component over the last five years, with cost of land being the most expensive business cost.

Over a third of respondents reported though that they are not exploiting the opportunity platform inherent in the African Continental Free Trade Area (AfCFTA) despite having the requisite capacity.

Respondents suggested reforms such as the government’s lowering of perceptions of corruption and improving transparency, as well as assuring the safety and security of investments, tax cuts, accessible infrastructure, and government incentives would promote ease of doing business in Ghana.

Regarding favourable business components assessed, the respondents favourably highlighted the availability of telecom facilities as one of the advantageous aspects of the Ghanaian business environment. It was the perception that telecom facilities and advanced technology have persistently seen the greatest improvements. It was also perceived that cost of labour—unskilled and skilled—remains affordable to most businesses that participated in the 2023 survey.

Report presents clear roadmap for action - UKGCC

Anthony Pile MBE, UKGCC Executive Council Chairman, remarked that “this report presents a clear roadmap for action. Lowering corruption, prioritising infrastructure upgrades, addressing regulatory burdens, and investing in skills development are not just numbers on a page – they are the keys to unlocking a brighter future for Ghanaian businesses”.

He urged “the government to embrace these reforms and work hand-in-hand with the private sector to build a competitive and prosperous nation."

Commenting on the report, Vish Ashiagbor, Country Senior Partner of PwC, a UKGCC Platinum member company and consultants/advisors for the report, noted that “Ghana is in a difficult place. Over the past three years, our economy has been buffeted by events, some of which are external and beyond the control of Government and businesses alike—COVID-19, global financial crisis, and the Russian-Ukraine war which spawned global supply chain hiccups that amplified the economic and business difficulties already triggered by the global financial crisis.

There is no doubt that Government is aware of the role that business plays in its quest to bring about socio-economic development. Indeed, the introduction of the Mutual Prosperity Dialogue is testament to this awareness and acknowledgement. We hope that, in the spirit of transparency, this report is considered objectively by Government, and working with UKGCC, considers what interventions can be implemented in the medium-to-long term to help improve the business environment.”

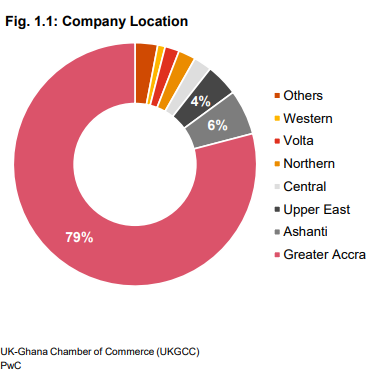

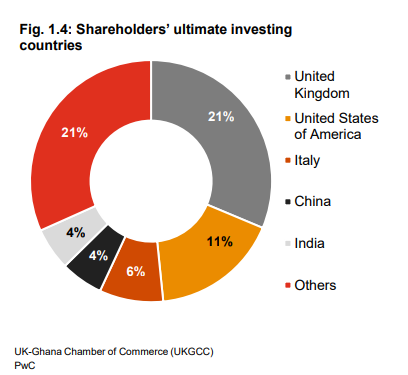

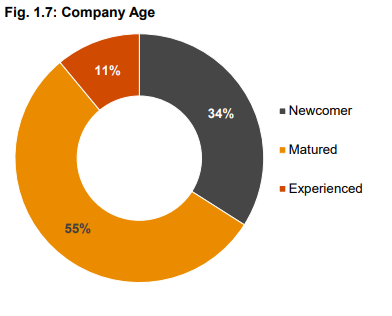

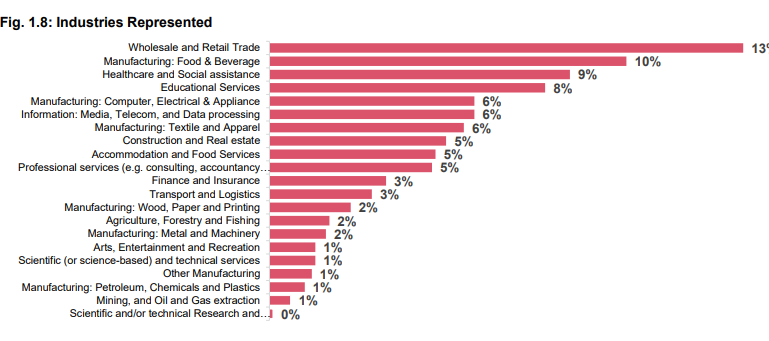

Over 690 businesses, including UK Ghana Chamber of Commerce members and non-member companies from 16 industries, ranging from small to large companies, participated in the survey.

Latest Stories

-

Businesses still battling power outages despite government assurances – PEF Boss

2 hours -

Few banks in Ghana facing larger capital gaps – IMF

2 hours -

Ghana’s macroeconomic outlook remains broadly stable

3 hours -

Ghana’s public debt sustainable but still at high-risk of debt distress – IMF

3 hours -

CleanVibeGhana partners with Buzzstop Boys to ignite sanitation revolution through clean-up exercise

4 hours -

Energy Minister engages stakeholders ahead of ENI shutdown

4 hours -

Ghana hosts 4th International Maritime Defense Conference to tackle piracy and transnational crimes

4 hours -

IMF endorses ECG privatisation

5 hours -

Ablekuma North rerun: A win was expected because we worked hard – Ewurabena Aubynn

5 hours -

Finance Minister to deliver mid-year budget review on July 24

6 hours -

Rotary renews pledge to fight polio, expand its impact footprint across Ghana

6 hours -

Minority blasts government appointees for ‘celebrating violence’ in Ablekuma North

6 hours -

NDC’s Ewurabena Aubynn wins Ablekuma North seat in crucial rerun

6 hours -

Ayawaso West Municipal Assembly announces two-month ultimatum for developers to regularise building permit

7 hours -

Asantehene assures Kumasi Zoo won’t be relocated

7 hours