The 2024 KPMG Customer Experience Survey has revealed that the Ghanaian investment landscape reflects a cautious approach to investments with interests in both low and medium risk opportunities as individuals navigate economic challenges in pursuit of financial security and independence.

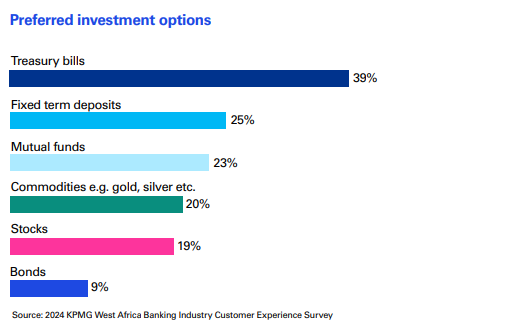

According to the report, the recent insights reveal that treasury bills remain the most preferred investment option, with 39% of respondents opting for these low-risk instruments.

Fixed or term deposits closely follow at 25%, further reinforcing the cautious approach among many Ghanaians, who prioritise stability and guaranteed returns amidst economic uncertainty.

However, the report said there are signs of gradual diversification in investment choices.

Mutual funds, selected by 23% of respondents, are gaining traction as a medium-risk option offering balanced returns.

Additionally, commodities such as precious metals and agriculture products, accounted for 20%, which demonstrated a growing appetite for alternative investments as a hedge against inflation and economic instability.

Expectedly, higher-risk instruments such as stocks (19%) and bonds (9%) remain underutilised, pointing to limited confidence.

The report added that the hesitancy of Ghanaians to adopt these investment options highlights the need for banks to provide education and solutions to bridge knowledge gaps and demystify complex financial products.

Despite these trends, the survey also revealed that 34% of respondents are willing to take risks with their investments, signalling an underlying desire for wealth creation and financial independence.

Despite these challenges, the survey also highlighted how Ghanaians are channelling resources toward personal growth, financial security and family welfare.

24% Ghanaians Invest in Skills Acquisition, Businesses

When asked about their top three priorities, approximately 24% of respondents are investing in skill acquisition and business ventures reflecting a desire for career advancement and financial independence.

Family obligations remained a central priority, with 24% dedicating funds to education, healthcare and general welfare.

Similarly, wealth generation through investments and property sales also gained traction, with 22% of respondents pursuing these strategies.

Latest Stories

-

GRA set to introduce modified taxation programme

15 minutes -

Israeli Ambassador writes: Why Iran’s nuclear ambition could no longer be Ignored

33 minutes -

Ecobank–JoyNews Habitat Fair Day 2: A visual tour of Ghana’s premier home‑ownership event

36 minutes -

“I’m so angry at myself” – Nicolas Jackson apologises after red card in Chelsea’s defeat to Flamengo

49 minutes -

Israel-Iran Conflict: Geopolitical implications and what it means for Ghana

53 minutes -

Ghana Boundary Commission assesses border security amid concerns over unapproved routes

57 minutes -

Accra: Queenmother killed at naming ceremony in Gbawe

1 hour -

Security agencies donate GH¢1m to MahamaCares

1 hour -

NPP urged to prioritise reforms over early primaries – CDD Fellow cautions

1 hour -

Electric Cars: DriveEVGH showcases next‑gen EVs at Ecobank-JOYNEWS Habitat Fair at Achimota Mall

2 hours -

NPP Race: The party needs deep reflection on the path it intends to pursue – Prof. Bokpin

2 hours -

NPP Race: No counter motion on early primaries at NEC meeting – Haruna Mohammed

2 hours -

Day 2 of the Ecobank-JOYNEWS Habitat Fair at Achimota Mall has the BEST DEALS to get you home!

2 hours -

Cargill provide Agro-Processing Equipment to Women in Cocoa-growing Communities

2 hours -

Cabinet approves Mahama Cares Bill

2 hours