In our previous article, "Economic Evolution - Can a 24-Hour Economy Be the Solution to Our Structural Challenges?" published in Business and Financial Times and myjoyonline.com on October 8th, 2024 earlier this year, we explored the potential of a 24-hour economy as a transformative solution to some of the persistent structural challenges faced by Ghana. The idea of a 24-hour economy is not new, but its relevance has gained new momentum, particularly as countries worldwide continue to adopt innovative solutions to foster growth. As we approach 2025, the landscape of global trade, finance, and economic interaction is changing rapidly, driven by digital technology. One such innovation that is altering the economic framework is the rapid adoption of digital currencies.

The convergence of a 24-hour economy and the adoption of digital currencies provides a compelling opportunity for Ghana to reshape its economic future. The 24-hour economy, where businesses and economic activities operate beyond the typical nine-to-five cycle, offers the potential to tap into untapped revenue streams, optimize productivity, and create jobs. Crucially, the widespread use of digital currencies could further accelerate this transformation. Cryptocurrencies, in particular, have emerged as one of the most dynamic components of this new economic landscape. In enabling faster, borderless, and more secure transactions, digital currencies are not only enhancing financial inclusion but also creating a robust mechanism to fuel continuous, global economic engagement.

Globally, the shift toward digital currencies is not just theoretical; it's already happening. Transactions involving cryptocurrencies have surged, with estimates showing that more than $10 trillion in digital assets were traded in 2021 alone (Blockchain.com). However, a significant portion of these transactions occurs without tax compliance, leading to substantial losses for governments worldwide. In many jurisdictions, including Ghana, the tax revenue from this booming market remains largely untapped, posing a major opportunity cost. According to the International Monetary Fund (IMF), digital currencies present an opportunity to enhance tax collection by bringing previously unreported transactions into the formal economy.

Ethiopia, for instance, has successfully capitalized on cryptocurrency mining, generating a staggering $55 million in 2022 (Africa News). This success highlights the revenue-generating potential of digital currencies, which could significantly bolster Ghana’s economy, especially considering the country’s challenges with energy supply. Meanwhile, Nigeria has made strides with its e-Naira initiative, the first digital currency issued by a central bank in Africa, while Ghana is actively developing its own digital currency, the e-Cedi, under the leadership of the Bank of Ghana. This push aligns with the Bank of Ghana’s ongoing solicitation for recommendations on the adoption and testing of digital assets, as the country aims to keep pace with the growing demand for digital financial services.

Furthermore, the BRICS economic bloc, consisting of Brazil, Russia, India, China, and South Africa, is nearing the completion of its plans to implement a digital currency, marking a monumental shift in the global financial system. As the BRICS nations prepare to adopt digital assets, the ripple effect could significantly alter the global balance of power in terms of currency usage, trade agreements, and economic alliances. The momentum behind digital currency adoption is undeniable, and it is critical for Ghana to embrace these advancements to harness the potential benefits.

However, as Ghana embarks on this transformative journey, it faces a daunting challenge: its energy deficit and rising national debt. With Ghana’s total public debt surpassing 100% of its GDP (Bank of Ghana), the country has limited fiscal space to fund extensive infrastructure projects or subsidize energy production. Despite these financial constraints, the integration of digital currencies into the economy can create new revenue streams, providing an innovative solution to the fiscal challenges. This, in turn, could support the expansion of a 24-hour economy, fueling economic growth and job creation even as the country contends with its energy and debt-related issues.

The path forward for Ghana involves harnessing the power of digital currencies to overcome these limitations. In tapping into this emerging market, Ghana can unlock new economic opportunities, attract foreign investment, and drive technological innovation. However, for the country to thrive in this new digital economy, it must prioritize the development of robust energy solutions, regulatory frameworks, and policies that facilitate the seamless integration of digital currencies into the national economy. The next step is to examine how Ghana can benefit from embracing both the 24-hour economy and digital currencies in greater detail.

Understanding the 24-Hour Economy

A 24-hour economy refers to a system where business and economic activities are not confined to a typical 9-to-5 working day but continue around the clock, allowing for the uninterrupted flow of goods, services, and financial transactions. Through extending operational hours across various sectors, a 24-hour economy enables a more competitive and efficient use of resources, fostering innovation and boosting overall productivity. The key sectors that benefit from this model include retail, financial services, transportation, entertainment, and, increasingly, digital infrastructure, all of which can operate continuously, allowing businesses to serve customers across different time zones and markets.

Countries that have successfully embraced the 24-hour economy include Japan, where technology and a culture of hard work contribute to round-the-clock industrial and service activity. Similarly, South Korea has leveraged this approach in sectors like logistics, e-commerce, and digital finance, which operate non-stop, creating a global competitive edge. These economies highlight the profound impact of extended business hours on national GDP, enabling them to remain connected to the world’s largest markets and respond dynamically to global economic shifts.

For Ghana, shifting towards a 24-hour economy would bring significant economic benefits, but it requires overcoming key challenges such as erratic energy supply and inadequate infrastructure. Ghana’s energy sector is facing persistent deficits, with electricity outages and power surges hindering the continuous operation of businesses. To fully capitalize on a 24-hour economy, Ghana would need to invest in renewable energy, enhance grid capacity, and secure more stable power sources to support industries that depend on uninterrupted operations, such as manufacturing and digital services.

The energy challenge is particularly critical as Ghana moves towards integrating more digital services. In a 24-hour economy, the continued operation of digital payment systems, e-commerce platforms, and financial services is paramount. Digital currencies, like the e-Cedi and cryptocurrencies, can act as key enablers of this transformation by facilitating seamless transactions that operate beyond traditional banking hours. Cryptocurrencies and digital assets allow businesses to engage in cross-border transactions and access global capital without being constrained by time zones or operating hours, making them essential for Ghana’s economic shift.

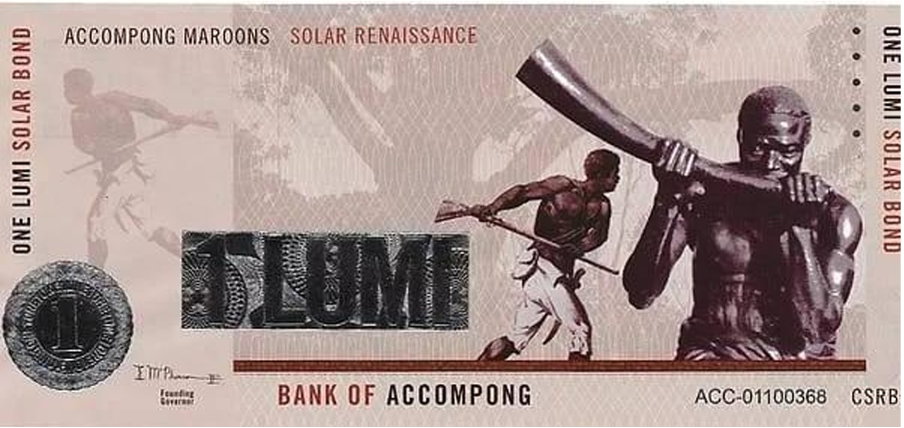

Globally, the increasing use of digital currencies, including Bitcoin, Ethereum, and emerging assets like Africa Kingdoms Lumi (AKL), highlights the growing importance of digital assets in a globalized economy. In 2022, Ethiopia raised $55 million through cryptocurrency mining, demonstrating how African nations can tap into digital currencies as a revenue-generating tool (Africa News). Nigeria’s adoption of the e-Naira and Ghana’s ongoing efforts with the e-Cedi further illustrate the growing interest in central bank digital currencies (CBDCs) and the recognition of their potential to modernize economies.

For Ghana, embracing a 24-hour economy integrated with digital currencies could be a game-changer. It would not only open new channels for revenue generation but also offer a solution to the country’s fiscal constraints, exacerbated by high energy debts, recurring public servant salaries, and maturing government bonds. The current state of Ghana’s debt—which has reached over 100% of GDP—along with the financial obligations tied to international loans, makes it difficult for the country to operate within its fiscal space. As the IMF and World Bank continue to provide limited solutions, Ghana must look beyond traditional methods and explore innovative financial strategies, such as leveraging digital currencies, to stimulate economic growth.

This paradigm shift would also help alleviate the financial burden on the government by enabling tax collection from digital transactions that are currently outside the formal tax system. With platforms like Binance and Hanypay facilitating trillions of dollars in annual cryptocurrency transactions, a significant portion of these funds could be brought into the taxable ecosystem, reducing the tax gap and increasing revenue streams (Blockchain.com). Moreover, adopting digital currencies would position Ghana as a leader in the African digital economy, providing the groundwork for the integration of various sectors into the 24-hour operational model.

As Ghana continues its path toward integrating digital currencies, the pressing issue of energy deficits remains. A robust and sustainable energy infrastructure must be built to ensure that businesses can operate smoothly around the clock, supporting the digital economy. Without this, the full potential of a 24-hour economy cannot be realized. Furthermore, the incoming government must take radical steps to reform fiscal policy, including addressing the energy challenge, restructuring the debt, and adopting innovative digital financial solutions to reset the economy. In the face of looming economic challenges, Ghana cannot afford to rely solely on traditional financial institutions like the IMF or World Bank. The fiscal pressures from servicing debt, paying public sector salaries, and other statutory payments demand a creative and urgent response. A digital currency-powered 24-hour economy could help break this cycle, providing a platform for long-term economic sustainability and growth.

The Role of Africa Kingdoms Lumi (AKL) in Shaping the Future

Africa Kingdoms Lumi (AKL) represents a pivotal moment in the development of digital currencies, particularly for the African continent. Unlike many traditional cryptocurrencies, AKL is backed by solar energy and gold, providing it with inherent stability and a secure foundation. Pegged at $15.96 per AKL for the next four decades, this fixed value ensures long-term predictability and security, making it an ideal asset for long-term investment. This feature, alongside its connection to sustainable energy sources, positions AKL as a reliable tool for both investors and nations looking to modernize and diversify their economies, especially in the face of challenges such as inflation and unstable global markets.

AKL’s creation is closely linked to the Eco-6 initiative, established under the Abuja Treaty in August 2019. This initiative aims to foster economic integration across African nations, streamlining trade and financial transactions while promoting technological advancement. Through AKL, Eco-6 offers African nations a digital currency that facilitates intra-Africa trade and enhances global financial inclusion. AKL serves as both a tool for economic growth and a symbol of Africa’s ability to innovate and integrate into the global digital economy.

One of the most impactful projects connected to AKL is the $9 billion IPADA Africa initiative, which includes the construction of six luxury cruise ships to be used in Africa and the Caribbean. Of these, four will be built in Nigeria, and two in the Caribbean, requiring over 1.5 million metric tons of steel. This massive project is expected to significantly boost the tourism sector, generating employment, attracting investment, and stimulating regional economic growth. In utilizing AKL as the primary currency for these transactions, this initiative integrates digital currency into high-impact, real-world projects, demonstrating AKL’s practical applications and potential.

In addition to tourism, the IPADA framework also focuses on the development of Geo-terminal energy projects in Rwanda and Vanuatu, aimed at harnessing volcanic eruptions to generate sustainable energy. These projects are designed to make Rwanda and Vanuatu major energy exporters, leveraging their natural geothermal resources. The financing of these energy projects, as well as the cruise ship initiative, is being facilitated through the AKL Stimulus Act by Eco-6. These projects not only contribute to sustainable energy generation but also enhance economic resilience, positioning Rwanda and Vanuatu as global leaders in renewable energy. These projects are part of the broader efforts to create a more sustainable and diversified economy under the IPADA framework, demonstrating the potential of AKL in driving infrastructure development and economic growth.

The AI training program in Rwanda is another key component of the IPADA Africa initiative. In December 2023, an MoU was signed at the La Campagne Tropicana Beach Resort in Lagos between Rwanda, Vanuatu, and the African Diaspora Central Bank. The MoU outlined plans for a 3 million-person AI training program to begin in 2025, aimed at equipping Africans with the skills necessary to thrive in the digital age. This program is part of a broader effort to develop the continent’s technological capabilities and prepare its workforce for the 4th Industrial Revolution. Rwanda, known for its abundance of gorillas, also offers unique opportunities for tourism development, making it a prime location for integrating AI and sustainable tourism as part of the larger economic strategy.

For Ghana, similar projects under the IPADA framework could provide a pathway for economic growth without straining public debt. The country could leverage its own natural resources, such as the potential for sustainable energy projects and tourism development, to stimulate job creation, economic diversification, and infrastructure growth. These projects, if financed through initiatives like AKL, would not only reduce the reliance on traditional debt mechanisms but also provide a more sustainable, long-term solution to the country’s economic challenges.

The synergy between the cruise ship initiative, energy projects, and AI training programs showcases the far-reaching potential of AKL. In supporting these projects, AKL offers an innovative way to drive economic growth and technological advancement while ensuring that the benefits are widely distributed. Through these strategic partnerships, Eco-6 and the African Diaspora Central Bank are helping to shape a new era of digital economy growth, creating jobs, improving infrastructure, and fostering a sustainable future for Africa

The Current Digital Currency Landscape and Its Economic Impact

The rise of digital currencies is fundamentally transforming the global financial landscape. Cryptocurrencies, central bank digital currencies (CBDCs), and emerging digital assets are rapidly reshaping how value is exchanged and stored. In particular, digital currencies have the potential to revolutionize economies by enabling faster, more secure transactions, reducing costs, and increasing financial inclusion. However, the most significant impact is seen in the ability to facilitate cross-border trade and investment without the limitations of traditional banking systems or the restrictions imposed by local currencies.

As of 2023, over $10 trillion in digital assets were transacted globally, with cryptocurrencies accounting for a substantial portion of this value (Blockchain.com). Despite the impressive growth in the digital asset market, a major concern remains the lack of tax compliance and regulation in many jurisdictions, especially in Africa. The unreported transactions on platforms like Binance, for example, have resulted in significant revenue losses for governments worldwide. For countries like Ghana, this represents a major opportunity to tap into a growing market that is largely untaxed, thus creating an avenue for increased government revenue. In adopting digital currencies and integrating them into the national financial system, Ghana can secure these untapped revenues and enhance its fiscal capacity.

The impact of digital currencies is already being felt in countries like Ethiopia, which raised $55 million in 2022 through cryptocurrency mining, showing the potential for African nations to generate substantial income through digital assets (Africa News). Furthermore, Nigeria’s e-Naira and Ghana’s e-cedi are both examples of central bank digital currencies (CBDCs) aimed at modernizing the financial systems of their respective countries. These initiatives are designed to increase the efficiency of financial transactions and reduce the dependency on cash, while also addressing issues such as inflation and financial exclusion. Ghana, under the leadership of the Bank of Ghana, is actively testing and promoting the e-cedi, making strides toward adopting a fully digital currency system that could drive the country's economic transformation.

However, the rise of digital currencies, including those backed by government institutions like the e-cedi, does not come without its challenges. Many African countries, including Ghana, face energy deficits that can impede the smooth operation of a 24-hour economy powered by digital technologies. The energy crisis in Ghana, compounded by rising national debt, makes it increasingly difficult to provide the necessary infrastructure for digital financial systems to thrive. Digital currency systems require reliable energy sources to function continuously, as they depend on secure, always-on servers and blockchain technologies to process transactions.

At the same time, BRICS countries—Brazil, Russia, India, China, and South Africa—are moving closer to completing their digital currency adoption plans, further emphasizing the global trend towards digital assets. The shift toward digital currencies by BRICS will likely have a profound impact on global finance, potentially diminishing the dominance of the US dollar in international trade. As digital assets grow in importance, nations that adopt these technologies early, like Ghana, stand to gain both economically and strategically by integrating digital currencies into their economies.

Moreover, digital currencies can help countries like Ghana avoid over-reliance on traditional financial institutions like the International Monetary Fund (IMF) or the World Bank. These institutions often impose stringent conditions on loans, which can exacerbate existing financial pressures. With Ghana’s debt levels reaching critical thresholds, innovative strategies such as leveraging digital currencies and decentralized finance could offer an alternative path to economic revitalization. By adopting digital currencies like the e-Cedi and AKL, Ghana can avoid the burden of new loans while gaining access to a growing pool of international capital, enabling it to finance critical infrastructure projects without exacerbating its debt issues.

In this context, the adoption of digital currencies offers not only a financial solution but also an opportunity for economic sovereignty. The potential benefits extend beyond revenue generation and fiscal management; the shift toward digital currencies also aligns with broader global trends towards decentralization, economic diversification, and sustainability. In a world where traditional financial systems are increasingly being challenged by new technologies, countries that embrace digital currencies will likely be better positioned to participate in the global economy of the future

BRICS Nations and the Digital Currency Revolution

The BRICS bloc, composed of Brazil, Russia, India, China, and South Africa, is playing a pivotal role in the global shift toward digital currencies. These emerging economies are leading the way in adopting digital currencies, driven by the desire to reduce their dependency on the US dollar, enhance financial inclusion, and create more efficient monetary systems. As the BRICS nations move closer to completing their digital currency adoption plans, their influence on the global financial system is becoming more pronounced, signalling a monumental shift in how currencies are used in international trade and investment.

The digital currency initiatives within BRICS are not just about adopting cryptocurrencies like Bitcoin or Ethereum. Rather, the focus is on developing Central Bank Digital Currencies (CBDCs)—government-backed digital assets that can be used for everyday transactions, cross-border trade, and financial inclusion. China, for instance, has been a frontrunner in this regard, with its Digital Yuan already in circulation in select regions. Russia and India are also advancing their CBDC programs, with pilot projects underway, while Brazil and South Africa are exploring the potential benefits of digital currencies in their economies.

The implications of BRICS countries fully implementing digital currencies are profound. As the bloc collectively reduces its reliance on the US dollar, it could challenge the dollar’s dominance in global trade. This shift has the potential to reshape the global financial order, providing new opportunities for countries to engage in trade and investment without being subject to the fluctuations and restrictions of a single dominant currency. For African nations like Ghana, this presents a unique opportunity to diversify their foreign exchange reserves and become part of a more multipolar currency system, one that could provide greater economic stability and flexibility.

For Ghana, the adoption of digital currencies, particularly AKL, could position the country as a key player in this new global financial order. As BRICS countries embrace digital assets and create alternative financial systems, Ghana can use its membership in the Eco-6 initiative to integrate digital currencies into its economy, leveraging them for trade, investment, and economic diversification. By embracing AKL as a regional currency, Ghana could tap into the growing digital economy and access new markets while avoiding the volatility of traditional cryptocurrencies.

Moreover, the rise of BRICS digital currencies highlights the importance of blockchain technology and decentralized finance (DeFi) in creating more efficient, transparent, and secure financial systems. These technologies have the potential to revolutionize banking, payments, and trade, reducing costs and eliminating inefficiencies that have long plagued traditional financial systems. For Ghana, investing in digital infrastructure and blockchain technology could unlock significant opportunities for growth, innovation, and financial inclusion.

The adoption of digital currencies within BRICS is also an indication of the broader global trend towards greater digitization and decentralization of financial systems. As more countries explore the potential of digital currencies and CBDCs, Ghana must remain proactive in adopting these technologies to ensure it is not left behind. The introduction of AKL as a regional digital currency offers an ideal opportunity for Ghana to stay ahead of the curve, attracting investment and fostering economic growth in the process.

The potential benefits of digital currencies go beyond economic growth. By embracing these technologies, countries like Ghana can also improve financial inclusion, providing access to banking services for the unbanked and underbanked populations. With over 50% of Africa’s population still without access to formal banking services, the adoption of digital currencies could be a game-changer in bridging this gap and fostering inclusive economic development.

The Bank of Ghana’s Progress on Digital Currency Adoption

The Bank of Ghana (BoG) has been making significant strides toward the adoption of digital currencies, particularly the e-Cedi, as part of its broader vision to modernize Ghana’s financial system. Recognizing the transformative potential of digital currencies, the BoG has been actively exploring and testing innovative solutions to enhance financial transaction efficiency, security, and accessibility. These efforts aim not only to position Ghana as a leader in Africa’s digital economy but also to ensure that the country is well-prepared for the future of global finance.

On February 1, 2024, theEco-6 West Africa Secretariat, led by its trading partner, the Vanuatu Trade Commissioner to Ghana, paid a courtesy call to the President of Ghana to discuss the integration of the AKL digital currency into the central bank’s financial framework. This landmark meeting underscored the strategic importance of digital currencies for Ghana’s economic transformation. Following these discussions, the President directed the Ministry of Finance to work with relevant agencies, including the BoG, to develop a robust implementation plan for integrating digital currencies into the financial system.

Building on this momentum, on July 31, 2024, the Eco-6 Chairman visited Ghana and paid a courtesy call to the Deputy Minister of Finance. During this meeting, all necessary documentation to support the integration and implementation of digital currencies was officially submitted. This marked a crucial step toward operationalizing digital currencies within Ghana’s financial ecosystem, laying the groundwork for a seamless rollout.

The e-Cedi, as Ghana’s central bank digital currency (CBDC), is designed to operate alongside physical cash, offering a secure, scalable, and efficient payment solution. It represents a critical tool for enhancing financial inclusion, particularly for underserved populations in rural areas. Despite progress in mobile money services, a significant portion of Ghana’s population remains outside the formal banking sector. In introducing the e-Cedi, the BoG aims to bridge this gap, allowing more individuals to access secure, low-cost financial services and participate in economic activities.

The e-Cedi is also set to enhance the efficiency of Ghana’s payments system. Digital currencies reduce transaction costs, enable faster settlement times, and offer greater security compared to traditional payment methods. This real-time accessibility is particularly beneficial for the 24-hour economy, where businesses and individuals require around-the-clock access to financial services. Through facilitating instant, secure transactions, the e-Cedi will support continuous economic activity, enabling businesses to operate without the constraints of traditional banking hours.

Moreover, the e-Cedi is poised to simplify cross-border trade by eliminating the high costs and complexities associated with traditional payment systems. As Ghana strengthens its integration into the global economy, the e-cedi will provide a more efficient means of conducting international transactions, making Ghana a more competitive player in global trade.

While the BoG has made commendable progress, more work is needed to amend and expand the regulatory framework to fully integrate digital currencies. Existing laws, such as the Payment Systems and Services Act, 2019 (Act 987)and the Foreign Exchange Act, 2006 (Act 723), provide a foundational legal basis but require updates to address the complexities of modern digital currency operations. Additionally, the Regulatory Sandbox Framework, which allows businesses to test digital currency applications in a controlled environment, must be expanded to ensure broader industry adoption.

The proactive approach taken by the BoG, combined with the government’s high-level engagements with Eco-6 and Vanuatu’s Trade Commission, has positioned Ghana as a frontrunner in Africa’s digital currency adoption. However, challenges such as cybersecurity risks, limited public awareness, and energy constraints must be addressed to ensure the e-Cedi’s long-term success. Robust investments in digital infrastructure and energy solutions will be critical to supporting the continuous operation of digital currency systems.

The successful implementation of the e-Cedi represents a transformative opportunity for Ghana to modernize its economy, reduce reliance on cash, and strengthen its position in the global digital economy. Alongside digital currencies like AKL, the e-Cedi can enable Ghana to unlock new economic opportunities, facilitate seamless cross-border trade, and drive sustainable growth. With the right policies, partnerships, and infrastructure, Ghana is well-positioned to become a leader in the global digital transformation.

Practical Gains from Adopting Digital Currencies: Fueling the 24-Hour Economy

The adoption of digital currencies presents a multitude of practical benefits that are critical for Ghana’s economic transformation, particularly in fueling the vision of a 24-hour economy. From enhancing financial inclusion and reducing transaction costs to generating additional government revenue, digital currencies are uniquely positioned to provide the backbone for a thriving, round-the-clock economic model. The introduction of digital currencies like e-Cedi and AKL offers an unprecedented opportunity for Ghana to modernize its financial infrastructure, diversify its economic base, and unlock new revenue streams—all of which are essential for achieving the goals of the 24-hour economy policy.

A fundamental advantage of adopting digital currencies is the potential to significantly increase government revenue. Digital currencies provide a means of formalizing transactions that were previously outside the scope of the tax system. The global cryptocurrency market, valued at over $10 trillion in 2021, contains a vast amount of untaxed transactions, and Ghana stands to benefit by integrating these activities into the formal economy. In implementing a clear regulatory framework for digital currencies, Ghana can capture a share of this revenue, which could be used to finance critical infrastructure projects—key to the functioning of a 24-hour economy. These projects require significant funding for energy, transportation, logistics, and digital infrastructure—areas where digital currencies could provide the necessary financial resources.

Ethiopia’s $55 million revenue from cryptocurrency mining in 2022 offers a compelling example of how digital assets can be harnessed as a revenue-generating tool for national development. With the right strategies, Ghana could replicate this success by fostering a local digital currency ecosystem, encouraging innovation, and attracting investments. This revenue could then be directed into financing 24-hour economy projects, such as expanding power grids, building data centres, and enhancing logistics infrastructure, ensuring that businesses can operate continuously.

Another significant benefit is financial inclusion, which is crucial for supporting the broader goals of the 24-hour economy. The World Bank reports that over 1.7 billion people worldwide remain unbanked, with a significant portion of that number residing in Africa. Digital currencies can provide access to financial services for these populations, allowing them to participate in economic activities that were previously out of reach. As more people engage in the digital economy, they can contribute to a thriving 24-hour economy, helping to drive consumption, investments, and job creation, all of which are essential for the model’s success. In enabling individuals to save, invest, and transact digitally, Ghana can unlock new economic activity, particularly in rural areas where traditional financial institutions are often absent.

In addition to improving financial inclusion, digital currencies also facilitate efficient cross-border transactions, reducing the costs and delays associated with traditional banking systems. The Bank for International Settlements (BIS) estimated that global remittance fees cost migrants approximately $600 billion annually—money that could otherwise be directed toward productive uses in their home economies. By enabling low-cost, instant transactions via digital currencies, Ghana can increase its engagement in global trade, attracting investment and creating business opportunities around the clock. This increased efficiency is crucial for sustaining a 24-hour economy, where businesses operate without the constraints of time zone differences or traditional banking hours.

The global blockchain and digital currency market is expected to grow from $1.6 billion in 2020 to $67.4 billion by 2026 (Market Research Future). In adopting e-Cedi and AKL, Ghana can position itself to capture a share of this rapidly expanding market, providing a stable digital currency that can fuel investment and trade around the clock. With the global economy becoming increasingly digitized, digital currencies can provide a reliable, scalable means to finance the 24-hour economy policy. For Ghana, this is not just an opportunity to modernize its financial system; it is an essential tool to drive the long-term success of the policy.

Moreover, the strategic adoption of digital currencies enables Ghana to harness their benefits to fuel the infrastructure required for a 24-hour economy. The funds generated from digital currency transactions can be reinvested into projects that directly contribute to the economy’s continuous operation. For example, AKL, as a stable digital asset backed by solar energy and gold, can serve as a foundation for financing energy infrastructure projects that are essential to powering businesses around the clock. Through investing in renewable energy sources, Ghana can address its energy deficit and ensure that businesses can operate 24/7 without interruption. Additionally, these funds could be used to enhance the country’s transportation and logistics sectors, ensuring that goods and services can move seamlessly at all hours of the day.

The combined impact of digital currencies on revenue generation, financial inclusion, and cross-border transactions will create a robust financial environment that supports a thriving 24-hour economy. With an integrated digital infrastructure, Ghana can ensure that businesses can operate continuously, generating income and creating employment around the clock. This will drive economic growth, attract investment, and contribute to the long-term sustainability of the country’s financial system.

For Ghana, the adoption of digital currencies is not just a progressive move—it is a vital step toward ensuring that the 24-hour economy policy succeeds. In providing a means to access global markets, streamline transactions, and generate new revenue streams, digital currencies will play a central role in the realization of a more dynamic and resilient economic system. Without this shift, Ghana risks falling behind as other nations embrace the digital economy and its many benefits. Therefore, the adoption of digital currencies is not merely an option—it is essential for the country's continued economic growth and stability.

Conclusion

The adoption of digital currencies, particularly the AKL and other digital assets, represents a critical opportunity for Ghana to transform its economy and lay the foundation for a successful 24-hour economy. The practical gains from digital currencies are immense, ranging from increased government revenue and improved financial inclusion to streamlined cross-border transactions and enhanced economic efficiency. In embracing these technologies, Ghana can position itself at the forefront of the digital economy, unlocking new revenue streams, improving infrastructure, and fostering innovation.

The experiences of other countries that have adopted digital currencies, such as Ethiopia’s success in cryptocurrency mining and Nigeria’s adoption of e-Naira, provide valuable lessons for Ghana. These examples underscore the potential for digital currencies to generate substantial revenue, enhance financial inclusion, and stimulate economic growth. As the digital currency landscape continues to evolve, Ghana has the opportunity to leverage its unique position within the Eco-6 initiative and the broader African digital economy to drive growth and development.

However, for Ghana to fully realize these benefits, the country must move quickly to integrate digital currencies into its financial system. The Bank of Ghana must take the necessary steps to amend and expand its regulatory framework to ensure that it can effectively manage digital currencies, address emerging challenges such as cybersecurity, and foster a conducive environment for innovation. In doing so, Ghana can tap into the global digital economy and begin to reap the long-term rewards of embracing digital currencies.

As Ghana works towards achieving its 24-hour economy vision, digital currencies will be an essential tool in ensuring that the country can operate efficiently around the clock. In using digital currencies to fuel key projects in energy, infrastructure, and trade, Ghana can overcome its fiscal challenges, stimulate economic growth, and ensure long-term sustainability. The transition to a digital economy is not just an opportunity—it is crucial for Ghana’s future success.

In essence, Ghana stands at a crossroads. The adoption of digital currencies is not just a step towards modernization—it is a necessary move to secure the country’s economic future. In embracing digital currencies and integrating them into the 24-hour economy framework, Ghana can unlock new potential, drive growth, and position itself as a leader in Africa’s digital transformation. The time to act is now—failure to do so may result in missed opportunities and economic stagnation. The path forward is clear, and it will redefine Ghana’s place in the global economy.

*****

Dr. David King Boison, Senior Research Fellow at the Center for International Maritime Affairs Ghana (CIMAG), is a distinguished academic, consultant, and CEO of Knowledge Web Centre, specializing in Blue Economy, Maritime and Port Operations & Logistics, IT, supply chain management, and Artificial Intelligence. With dual PhDs in Port Operations and Business Administration and two MSc degrees with distinction from Coventry University, he is the Lead Consultant for the Ai Africa Project, which aims to train 11 million Africans in AI technologies. A Senior Visiting Lecturer at Wigwe University, Rivers State, Nigeria, he is also recognized for pioneering Ghana's e-port system (now the Paperless Port System). He has authored numerous peer-reviewed papers and white papers on the Blue Economy, maritime trade & Port Operations, AI, fintech, and digital currencies, and has written two books.

***

Albert Derrick Fiatui, is the Executive Director at the Centre for International Maritime Affairs, Ghana (CIMAG), an Advocacy, Research and Operational Policy Think- Tank, with focus on the Maritime Industry (Blue Economy) and general Ocean Governance. He is a Maritime Policy and Ocean Governance Expert

Latest Stories

-

Ghana and India to expand cooperation in trade, agriculture, energy – Mahama

1 hour -

Your visit reaffirms our collective commitment to global peace, prosperity – Mahama tells Narendra Modi

1 hour -

Israel: A divine and historical claim rooted in scripture and truth

1 hour -

Norway fight back to beat Euro 2025 host Switzerland

1 hour -

Anabel Rose unveiled as Fresh Finds Spotify cover for June

1 hour -

Stalled Winneba-Kasoa highway sparks concerns over unpaid contractor arrears

2 hours -

Sean ‘Diddy’ Combs loses bid for release on bail ahead of sentencing

2 hours -

Court discharges lecturer, 2 students over room, bed allocation scandal

2 hours -

Friday Club urges NPP presidential hopefuls to prioritise unity and issue-based campaigning

2 hours -

Court grants bail to TikToker over viral political claims

2 hours -

Youth urges State of Emergency declaration on galamsey at PNAfrica National Youth Mock Parliament

2 hours -

Burning of waste bins and indiscriminate dumping threaten sanitation management efforts – Zoomlion

2 hours -

NPP brutally injured, recovery will take time – Addai-Nimoh

3 hours -

Rastafarian student Oheneba Nkrabea graduates from GIS after Achimota saga

3 hours -

Gov’t heighten monitoring along Black Volta after drowning of Lawra SHS students

3 hours