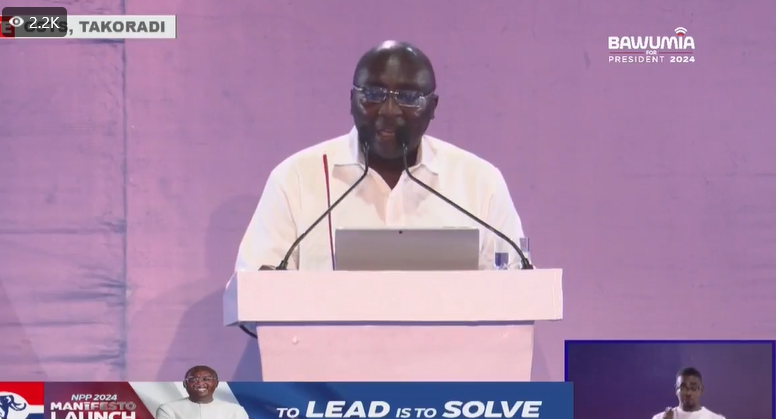

The New Patriotic Party (NPP)’s flagbearer, Dr Mahamudu Bawumia, has pledged to establish a more business-friendly environment if elected in the upcoming 2024 elections.

Unveiling the party’s 2024 manifesto, Dr Bawumia highlighted his unwavering commitment to boosting and expanding the private sector.

He outlined a comprehensive plan for a revamped tax regime under his administration, specifically tailored to accelerate business growth and spur economic development across the country.

Below are the plans he highlighted;

a. Offering Investment Tax Credits (ITC) to incentivise Ghanaian start-ups in strategic sectors during their first three years of operation.

b. Introducing a Flat Rate for all importers to bring predictability and stability to the pricing of imported goods.

c. Harmonizing port charges to align with those of competing regional ports, particularly in Togo, ensuring that duties at Ghanaian ports are the same or lower.

d. Utilizing the government’s purchasing power to stimulate industrial expansion and business growth by implementing a “Buy Ghana First” policy, where public sector procurement prioritizes locally produced goods and services.

e. Reforming electricity tariffs to establish a structure where commercial rates are equal to or lower than residential rates, ensuring affordable power for industries and businesses.

f. Establishing an SME Bank to address the specific financing needs of small and medium enterprises, which employ over 80% of Ghanaians.

g. Reforming the licensing regime for the small-scale mining sector, reducing the minerals export tax to 1% to curb gold smuggling, and establishing a Minerals Development Bank to finance viable local mineral projects, small-scale miners, and Ghanaian mining services firms.

h. Completing the digitalisation of land titling and registration, enabling property owners to use their assets as collateral to raise capital for business growth and expansion.

unapparelled luxury

i. Creating Special Economic Zones (Free Zones) in collaboration with the private sector at major border towns such as Aflao, Paga, Elubo, Sampa, and Tatale to enhance economic activity, increase exports, reduce smuggling, and create jobs.

Latest Stories

-

Trump and Musk enter bitter feud – and Washington buckles up

28 minutes -

Footballer jailed for £600k drugs smuggling plot

39 minutes -

Lamine Yamal shines as Spain beat France in nine-goal thriller

51 minutes -

Gauff battles past Keys to reach semi-finals

1 hour -

Gen Z aim to deny history-chasing Djokovic

1 hour -

Sabalenka takes out Swiatek to reach French Open final

1 hour -

Dumsor levy: Sulemana Braimah demands accountability for GH¢26bn fuel taxes paid in 2024

3 hours -

Dumsor Levy: Reset Ghana by ending waste, not taxing fuel, says Sulemana Braimah

3 hours -

$48m jute sack contract signed in Dec 2024 despite 110,000 unused bales – Acting Cocobod CEO

4 hours -

Acting CEO Randy Abbey says balancing the books will take time as Cocobod drowns in debt

4 hours -

‘We are chased every day’ – Cocobod boss paints bleak picture of mounting $33bn debt

5 hours -

Ken Ofori-Atta listed on INTERPOL Red Alert over “using public office for profit”

5 hours -

World Vision empowers health workers in Agortime Ziope with life-saving infection control training

5 hours -

Plan International Ghana launches She Leads Social Movement to sustain girls’ rights advocacy

5 hours -

Liverpool tell Barcelona Diaz is not for sale

5 hours