Asset management company, Tesah Capital, has described as bold and necessary for debt sustainability, government's plan to raise ¢100.5 billion in total revenue for the 2022 fiscal year.

Tesah Capital notes the projected revenue which represents a 42.9 percentage points increment (¢30.5 billion) on the 2021 revenue outturn of ¢70.34 billion will increase the revenue generation capacity of the country.

The projected revenue increment, the company believes, is necessary given that the country has long suffered from narrow revenue mobilisation due to the existence of a large informal sector.

“The country depends largely on indirect taxes and import income from few primary commodities; though direct taxes as a share of total taxes witnessed some improvement from 42 per cent in 2017 to 50 per cent in 2020. Revenue targets have been missed for most of the years, from 2017 to 2020, highlighting the weakness in revenue forecasting capacity,” Tesah Capital noted in its review of the 2022 budget.

The projected 42.9 per cent revenue increment is expected to be achieved by government through the introduction of the electronic transaction levy, the 15 per cent increment in government services, reintroduction of the 3 per cent Flat Levy, property rates and government’s new resolve to pass the tax exemptions bill in 2022 to check revenue leakages as the immediate steps to increase revenues.

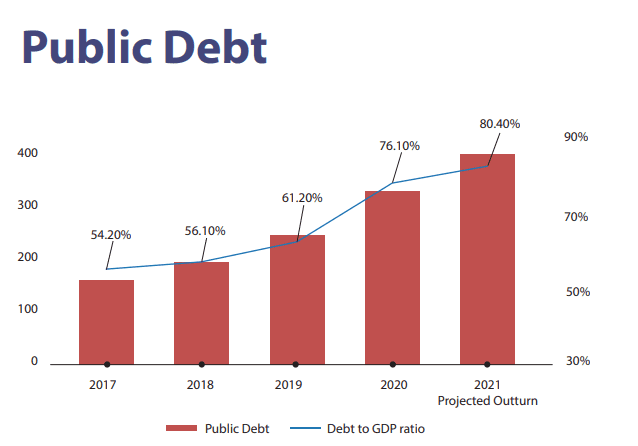

At the moment, Ghana's public debt is unsustainable and pegged at 77.8 per cent of Gross Domestic Product (GH₵341.8 billion) and is further projected to continue on an elevated path.

According to Tesah Capital, public debt as a ratio of GDP is expected to hit 80.4 percent by the end of 2021.

Of the total debt, domestic debt will amount to ¢185 billion representing 52.3 percent of GDP with external debt also amounting to ¢169 billion representing 47.7 percent of GDP.

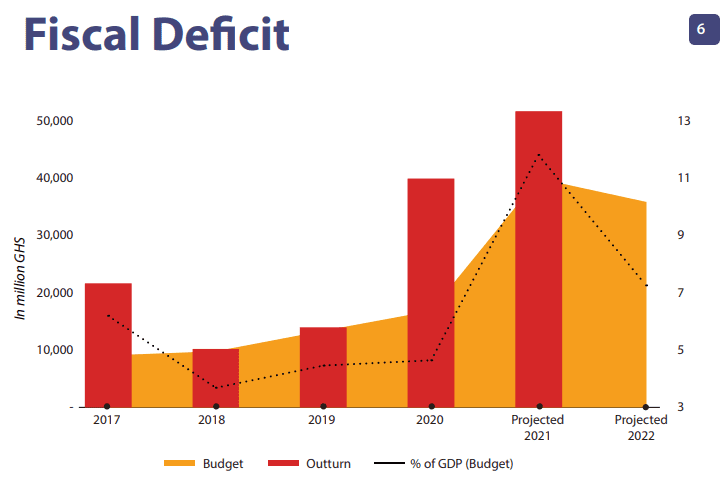

Tesah Capital adds that the projected 7.4 percent fiscal deficit (¢35.11 billion) for 2022 will increase the public debt to ¢395.81 billion.

"The expected fiscal deficit of cedis 35.11 billion cedis will increase the public debt to cedis ¢395.81 billion. The rising inflationary risk in advanced economies implies that the government will face an increased cost of financing the debt through international debt markets.

"This suggests that the government is likely to continue with the trend of using the domestic debt market to finance a larger portion of the public debt. Increased borrowing in the local debt market could lead to an increase in interest rates and crowd out the private sector from the loan market," the AMC notes.

Interest payments and employee compensation to decline

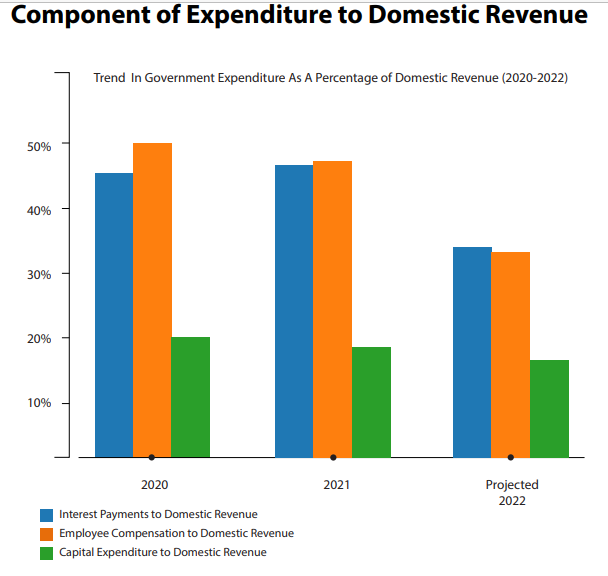

Interest payments, employee compensation and capital expenditure as components of domestic revenue Tesah Capital asserts are expected to marginally decline in 2022.

According to Tesah Capital, interest payments, employee compensation and capital expenditure over the last three years have been a major drainer of domestic revenue averaging 43 percent, 45 percent and 19 percent respectively.

"However, their component of domestic revenue is expected to decline from 47 percent, 48 percent and 18 percent in 2021 to 38 percent, 36 percent and 16 percent in 2022 respectively," Tesah Capital notes.

The marginal decline in the components of government's expenditure, Tesah Capital states, is as a result of the relatively higher projected growth in domestic revenue (30.5 percent) compared to projected growth in Interest payments (13.1 percent), employee compensation (7.9 percent) and capital expenditure (22.3 percent).

Projected total expenditure for the 2022 fiscal year (including payments for the clearance of arrears) is ¢137.5 billion, equivalent to 27.4 percent of GDP.

The expenditure estimate for the 2022 fiscal year represents a growth of 23.2 percent above the projected outturn of ¢111.6 billion, equivalent to 25.3 percent of GDP for 2021.

Key drivers of expenditure growth include capital expenditure, funding of key government flagship programmes, wage bill and interest payments.

Latest Stories

-

Shamima Muslim urges youth to lead Ghana’s renewal at 18Plus4NDC anniversary

50 minutes -

Akufo-Addo condemns post-election violence, blames NDC

58 minutes -

DAMC, Free Food Company, to distribute 10,000 packs of food to street kids

2 hours -

Kwame Boafo Akuffo: Court ruling on re-collation flawed

3 hours -

Samuel Yaw Adusei: The strategist behind NDC’s electoral security in Ashanti region

3 hours -

I’m confident posterity will judge my performance well – Akufo-Addo

3 hours -

Syria’s minorities seek security as country charts new future

3 hours -

Prof. Nana Aba Appiah Amfo re-appointed as Vice-Chancellor of the University of Ghana

4 hours -

German police probe market attack security and warnings

4 hours -

Grief and anger in Magdeburg after Christmas market attack

4 hours -

Baltasar Coin becomes first Ghanaian meme coin to hit DEX Screener at $100K market cap

4 hours -

EC blames re-collation of disputed results on widespread lawlessness by party supporters

5 hours -

Top 20 Ghanaian songs released in 2024

5 hours -

Beating Messi’s Inter Miami to MLS Cup feels amazing – Joseph Paintsil

5 hours -

NDC administration will reverse all ‘last-minute’ gov’t employee promotions – Asiedu Nketiah

5 hours