Audio By Carbonatix

In a bold move to reshape the energy sector and alleviate debt burdens while ensuring a steady power supply for industries, the government has initiated a series of measures, including quarterly tariff increments.

To align with the IMF’s revenue mobilization objectives, Ghana unveiled a comprehensive Medium-Term Revenue Strategy in September 2023.

This strategic framework focuses on crucial tax policies and revenue administration measures essential for achieving both Ghana's domestic goals and the IMF's program revenue objectives.

Watch video: JoyNews' Isaac Kofi Agyei explains why Government of Ghana is introducing a 15% VAT of electricity

Ghana has already taken significant strides towards enhancing revenue generation, implementing measures such as quarterly adjustments to electricity tariffs, raising the VAT rate from 12.5% to 15%, restructuring the E-levy, and eliminating discounts on customs benchmark values.

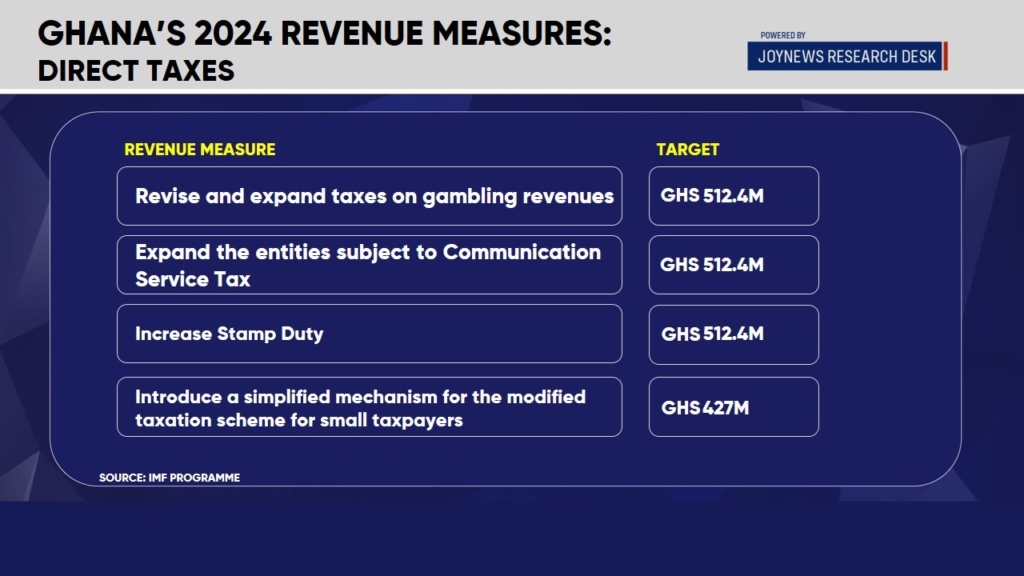

Looking ahead to 2024, the government plans to introduce additional measures, encompassing 12 tax reforms and the implementation of new tax mechanisms.

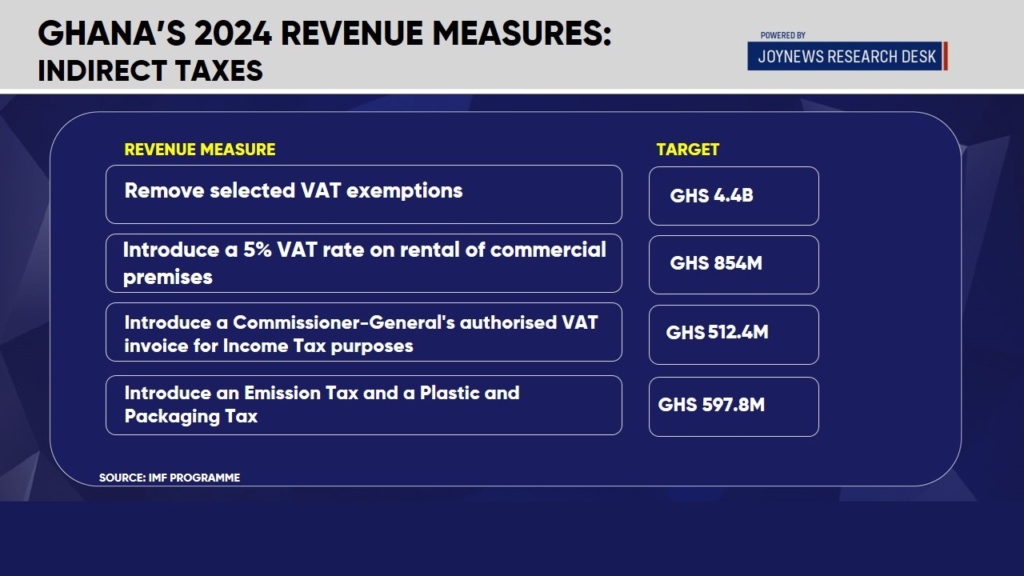

One of the pivotal strategies involves the removal of selected VAT exemptions, amounting to approximately GHS4.4 billion this year.

Also read: VAT on power consumption: From free electricity to taxing times

Additionally, there will be revisions to income-based taxes and a scrutiny of the headline rate of the Communication Services Tax (CST).

The Government of Ghana also aims to expand taxes on gambling revenues, heighten Stamp Duty, introduce a 5% VAT rate on the rental of commercial premises, and unveil new taxes, such as the Emission Tax and the Plastic and Packaging Tax.

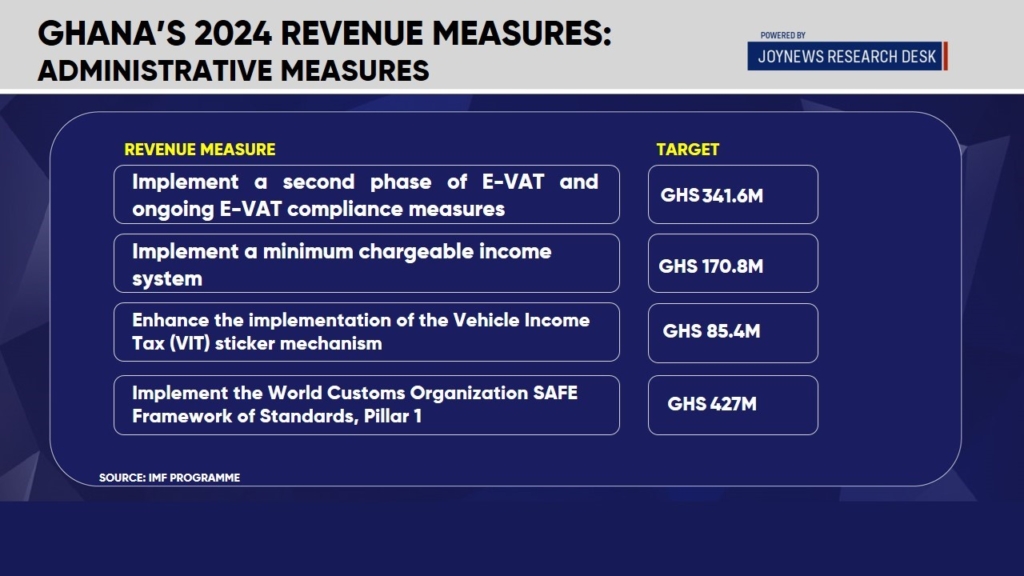

Adding more, the government is set to strengthen the implementation of the Vehicle Income Tax (VIT) sticker mechanism and embark on the reform of corporate income tax by gradually phasing out tax holidays and exemptions.

It is crucial to note that these measures are intrinsic to the government's independent revenue mobilization strategy and not dictated by the IMF.

As Ghana navigates these reforms, stakeholders and citizens alike will closely observe the impact on various sectors and the overall economic trajectory.

Latest Stories

-

None of NPP’s 5 flagbearer aspirants is credible – Abdulai Alhassan

11 minutes -

Police arrest suspect for unlawful possession and attempted sale of firearm

1 hour -

3 arrested in connection with Tema robberies

2 hours -

Your mouth on weed is nothing to smile about

2 hours -

25% university fees hike, what was the plan all along? — Kristy Sakyi queries

3 hours -

Some OMCs reduce fuel prices; petrol going for GH¢10.86, diesel GH¢11.96

4 hours -

Trump says health is ‘perfect’ amid ageing concerns

4 hours -

China’s BYD set to overtake Tesla as world’s top EV seller

4 hours -

Joy FM’s iconic 90’s Jam returns tonight: Bigger, better, and packed with nostalgia

5 hours -

Uproar as UG fees skyrocket by over 25% for 2025/2026 academic year

6 hours -

Japan PM joins fight for more female toilets in parliament

7 hours -

Ga Mantse declares war on fishing industry child labour

7 hours -

Adom FM’s ‘Strictly Highlife’ lights up La Palm with rhythm and nostalgia in unforgettable experience

8 hours -

OMCs slash fuel prices as cedi gains

9 hours -

Around 40 dead in Swiss ski resort bar fire, police say

10 hours